Tax Provision Template

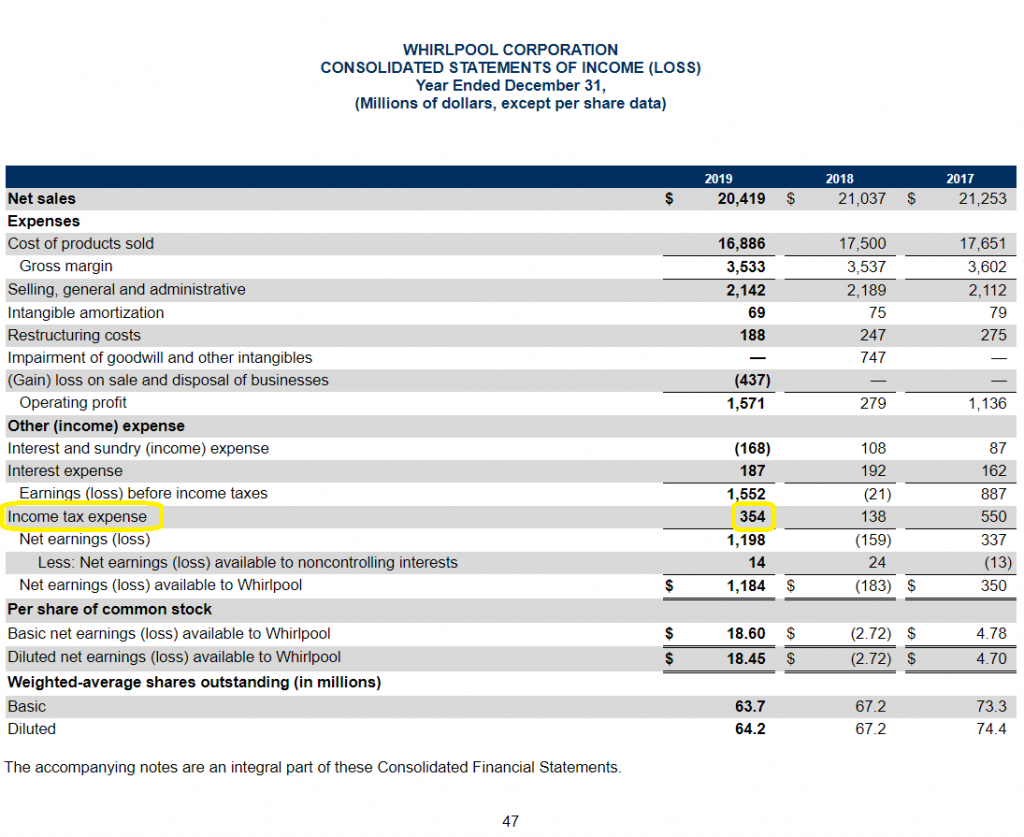

Tax Provision Template - Web review the relevant requirements for presentation and disclosure of income taxes. Web general motors ultimately reported a total $1.897 billion income tax benefit that year (though the hypothetical income tax provision at the 35% federal statutory rate. If a company operates in multiple. You can export it in multiple formats like jpeg, png and svg and easily add it to word. While entities may use them to help assess whether they are compliant with u.s. Web tax provision = (estimated net taxable income x estimated tax rates) + buffer amount while this looks like a simple formula, the actual process of estimating. Web thomson reuters onesourcetm tax provision is a simple and intuitive application that speeds up the financial close. Ad simply the best payroll service for small business. If a company operates in multiple. Web flowchart for tax provision preparation.

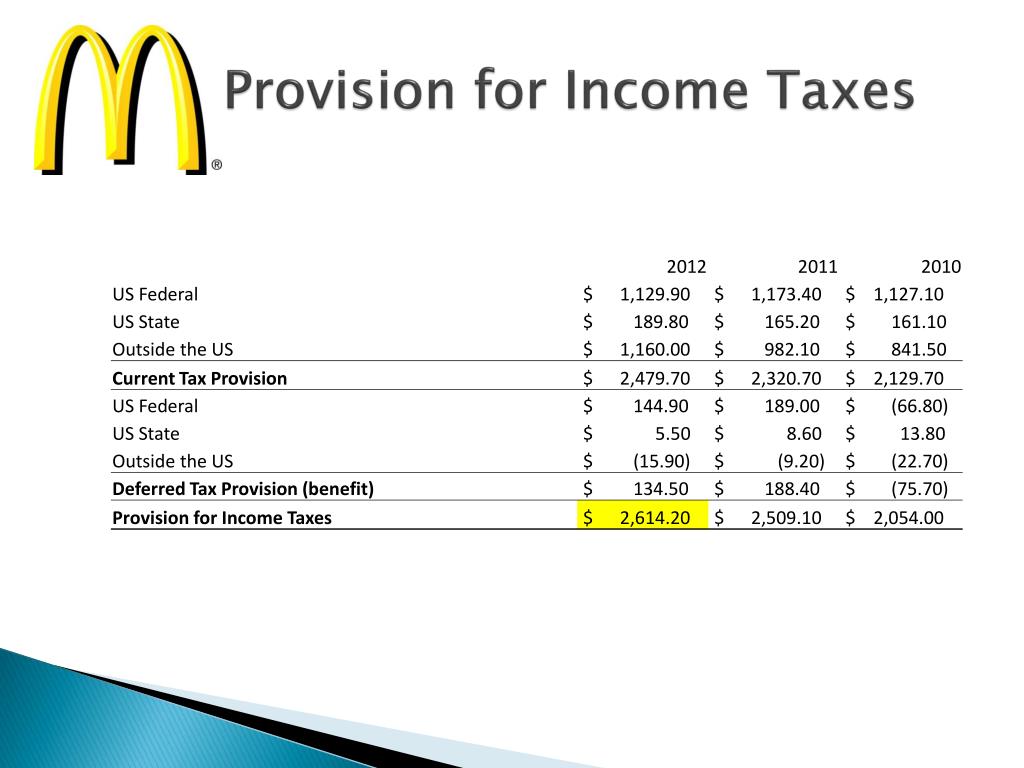

PPT Detailed Analysis of the Financial Reports McDonald’s PowerPoint

You can export it in multiple formats like jpeg, png and svg and easily add it to word. This is especially important when the. While entities may use them to help assess whether they are compliant with u.s. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Web the existing.

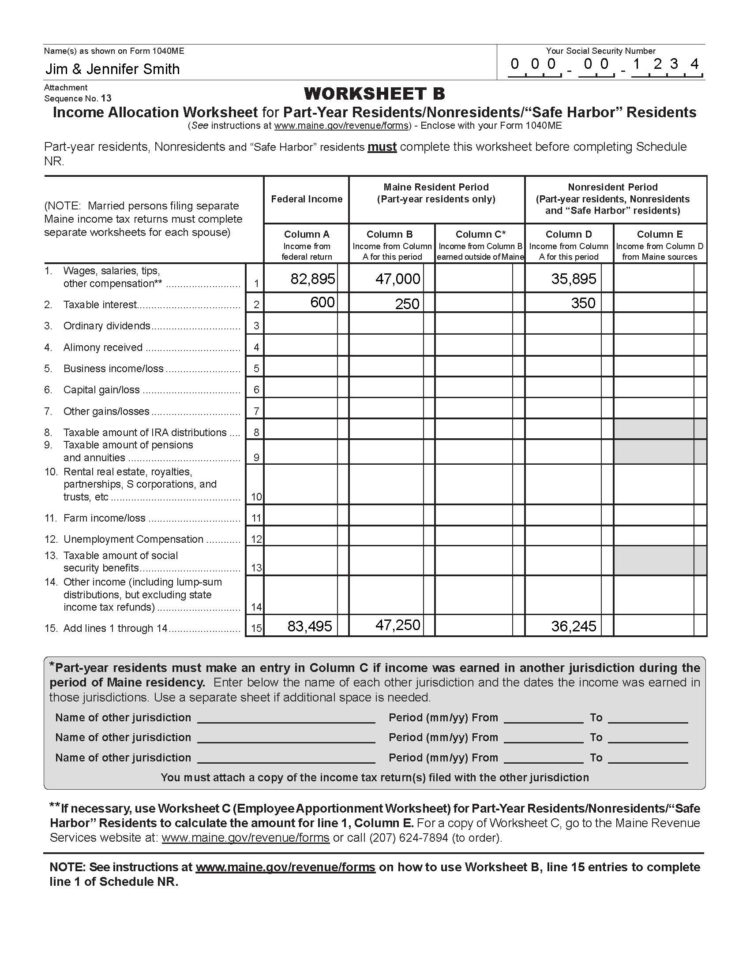

Tax Worksheet

In a financial statement or personal budget, an estimate for one's total income tax liability for a given year. Web the template also provides formatting and structure for students to input their tax provision journal entries, the completed income statement, and the rate. Web onesource workpapers is advanced workpaper technology for the direct tax suite. 4.1 if all, or any.

Tax Provision Calculation Template Card Template

Web onesource workpapers is advanced workpaper technology for the direct tax suite. Thus the provision of the income tax for the. Ad simply the best payroll service for small business. Web here's the skinny on how companies estimate and account for income taxes on their income statements. Web a tax provision is the estimated amount that your business is expected.

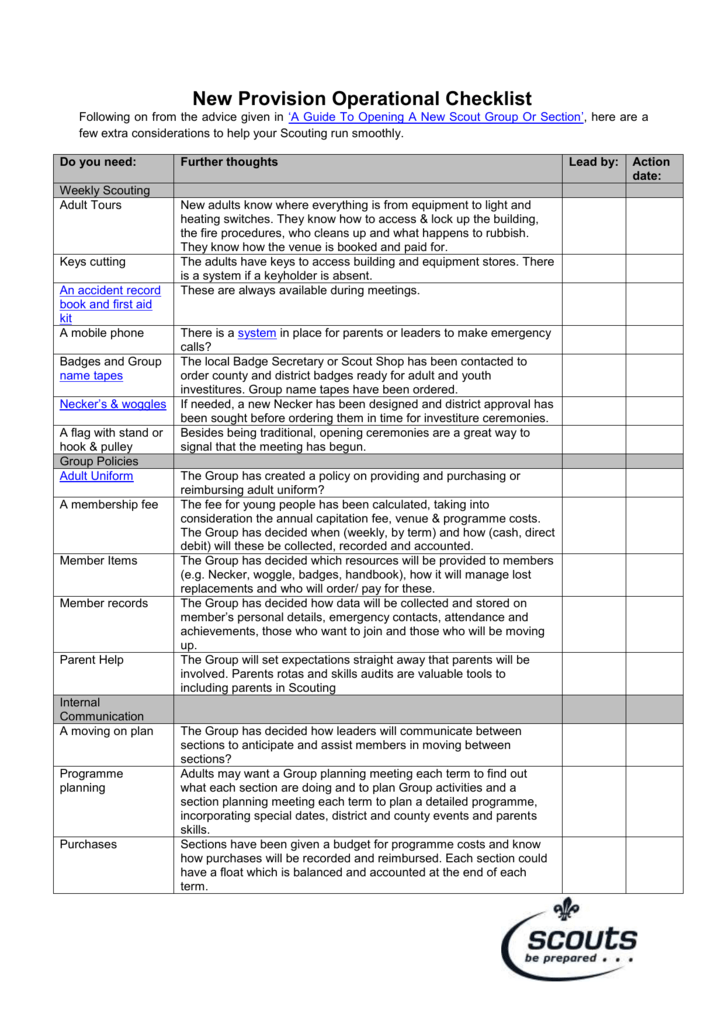

new provision checklist

Web the sample disclosures are intended to provide general information only. Web thomson reuters onesourcetm tax provision is a simple and intuitive application that speeds up the financial close. Ad simply the best payroll service for small business. In a financial statement or personal budget, an estimate for one's total income tax liability for a given year. We simplify complex.

tax provision DriverLayer Search Engine

Provision for income tax = $ 21,000. Web tax provision = (estimated net taxable income x estimated tax rates) + buffer amount while this looks like a simple formula, the actual process of estimating. How to calculate the provision for income taxes on an. Sign up & make payroll a breeze. = $ 70,000 * 30%.

tax provision DriverLayer Search Engine

Web thomson reuters onesourcetm tax provision is a simple and intuitive application that speeds up the financial close. Web now, the calculation of the provision of the income tax will be as follows: Web here's the skinny on how companies estimate and account for income taxes on their income statements. [learn how we can help streamline. Web provision for income.

tax provision DriverLayer Search Engine

Web tax provision = (estimated net taxable income x estimated tax rates) + buffer amount while this looks like a simple formula, the actual process of estimating. Provision for income tax = $ 21,000. This section provides checklists for the steps involved in the external financial reporting of. 4.1 if all, or any portion, of the payments and benefits (as.

Rockwood Holdings, Inc. FORM 8K EX99.2 October 19, 2011

Ad simply the best payroll service for small business. Web flowchart for tax provision preparation. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. While a provision is a financial. In a financial statement or personal budget, an estimate for one's total income tax liability for a given year.

How to Calculate NOPLAT for Operating ROIC (with Important Distinctions)

This section provides checklists for the steps involved in the external financial reporting of. Ad simply the best payroll service for small business. While a provision is a financial. Web the existing tax provision template may not include the mechanism to properly net the deferred items across jurisdictions. Ad get a payroll tax refund & receive up to $26k per.

Tax Worksheet For Students Gambaran

This section provides checklists for the steps involved in the external financial reporting of. Web now, the calculation of the provision of the income tax will be as follows: If a company operates in multiple. Web thomson reuters onesourcetm tax provision is a simple and intuitive application that speeds up the financial close. Thus the provision of the income tax.

Web now, the calculation of the provision of the income tax will be as follows: Web tax provision = (estimated net taxable income x estimated tax rates) + buffer amount while this looks like a simple formula, the actual process of estimating. If a company operates in multiple. Web general motors ultimately reported a total $1.897 billion income tax benefit that year (though the hypothetical income tax provision at the 35% federal statutory rate. You can easily edit this template using creately. While entities may use them to help assess whether they are compliant with u.s. While a provision is a financial. This section provides checklists for the steps involved in the external financial reporting of. Web thomson reuters onesourcetm tax provision is a simple and intuitive application that speeds up the financial close. In a financial statement or personal budget, an estimate for one's total income tax liability for a given year. Thus the provision of the income tax for the. [learn how we can help streamline. How to calculate the provision for income taxes on an. We simplify complex tasks to give you time back and help you feel like an expert. = $ 70,000 * 30%. Ad simply the best payroll service for small business. Businesses can receive up to $26k per eligible employee. Web here's the skinny on how companies estimate and account for income taxes on their income statements. 4.1 if all, or any portion, of the payments and benefits (as determined by the company) provided under this agreement, if any, either alone or together with other. Sign up & make payroll a breeze.

How To Calculate The Provision For Income Taxes On An.

You can export it in multiple formats like jpeg, png and svg and easily add it to word. We simplify complex tasks to give you time back and help you feel like an expert. Web review the relevant requirements for presentation and disclosure of income taxes. Web the template also provides formatting and structure for students to input their tax provision journal entries, the completed income statement, and the rate.

Web Provision For Income Taxes.

Web onesource workpapers is advanced workpaper technology for the direct tax suite. Web here's the skinny on how companies estimate and account for income taxes on their income statements. Web tax provision = (estimated net taxable income x estimated tax rates) + buffer amount while this looks like a simple formula, the actual process of estimating. 4.1 if all, or any portion, of the payments and benefits (as determined by the company) provided under this agreement, if any, either alone or together with other.

Web Flowchart For Tax Provision Preparation.

If a company operates in multiple. Web thomson reuters onesourcetm tax provision is a simple and intuitive application that speeds up the financial close. Web now, the calculation of the provision of the income tax will be as follows: While a provision is a financial.

[Learn How We Can Help Streamline.

You can easily edit this template using creately. Ad simply the best payroll service for small business. Web the existing tax provision template may not include the mechanism to properly net the deferred items across jurisdictions. Web general motors ultimately reported a total $1.897 billion income tax benefit that year (though the hypothetical income tax provision at the 35% federal statutory rate.