Statement Of Final Return 941 Template

Statement Of Final Return 941 Template - Complete, edit or print tax forms instantly. Choose the payroll tax tab. Annual amounts from payroll records should match the total amounts reported on all forms 941 for the year. Web choose setup > clients and click the payroll taxes tab. Web i can share some information on how to process an employee's final payroll and generate a statement of final return. Web print the federal 941, check the box on line 16, and enter the date final wages were paid, indicating that your business has closed and that you do not need to file returns in the. Web up to 25% cash back this form must be filed by the 15th day of the fourth month after you close your business. Web print the federal form 941. Report income taxes, social security tax, or medicare tax. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment.

What Employers Need to Know about 941 Quarterly Tax Return?

You must file a final return for the year you close your business. Corporations also need to file irs form 966, corporate dissolution or. Web information around form 941, employer's annually federal tax return, including recent updates, related forms, and instructions on how to file. There are two ways to generate the form. Upload, modify or create forms.

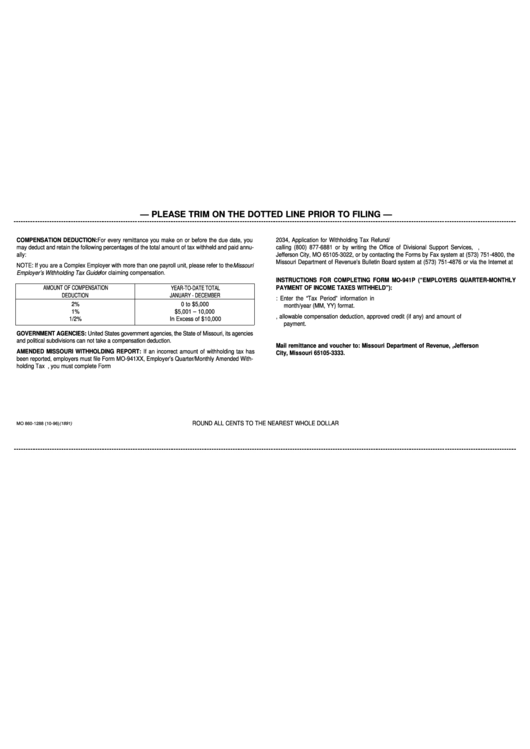

9 Missouri Mo941 Forms And Templates free to download in PDF

But then i found out that i forgot to mark it as final in part 3 of the. Choose the payroll tax tab. Click the final statement button. Complete, edit or print tax forms instantly. Try it for free now!

How do you mark a 941 return FINAL in QBO

Click the final statement button. You must file a final return for the year you close your business. But then i found out that i forgot to mark it as final in part 3 of the. Ad get ready for tax season deadlines by completing any required tax forms today. Try it for free now!

Form 941 Employer's Quarterly Federal Tax Return

Choose the payroll tax tab. Corporations also need to file irs form 966, corporate dissolution or. Web type of final return. In the forms section, click the additional information button for the federal 94x form. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions.

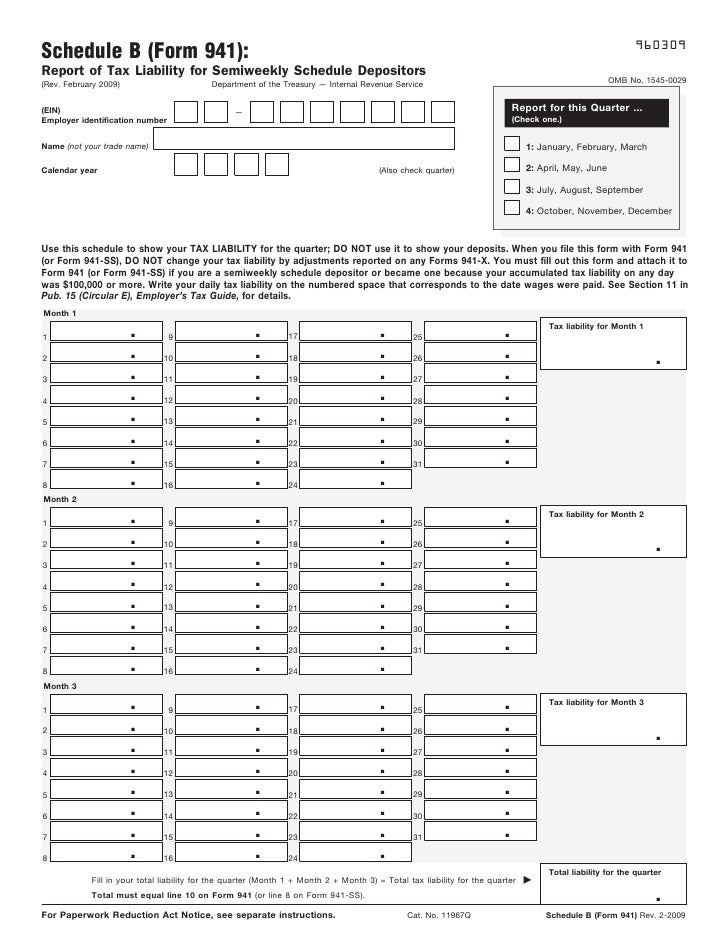

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

Form 941 shall previously by. Choose the payroll tax tab. Complete, edit or print tax forms instantly. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Web to tell the irs that form 941 for a particular quarter is your final return, check the box on line 17 and enter the final date.

20062022 Form IRS 941c Fill Online, Printable, Fillable, Blank pdfFiller

Web you can handle your final payments and filings yourself, print your forms and submit it directly to the irs and state agencies along with your tax payments. Ad get ready for tax season deadlines by completing any required tax forms today. Web print the federal form 941. Web your total taxes after adjustments and credits (form 941, line 12).

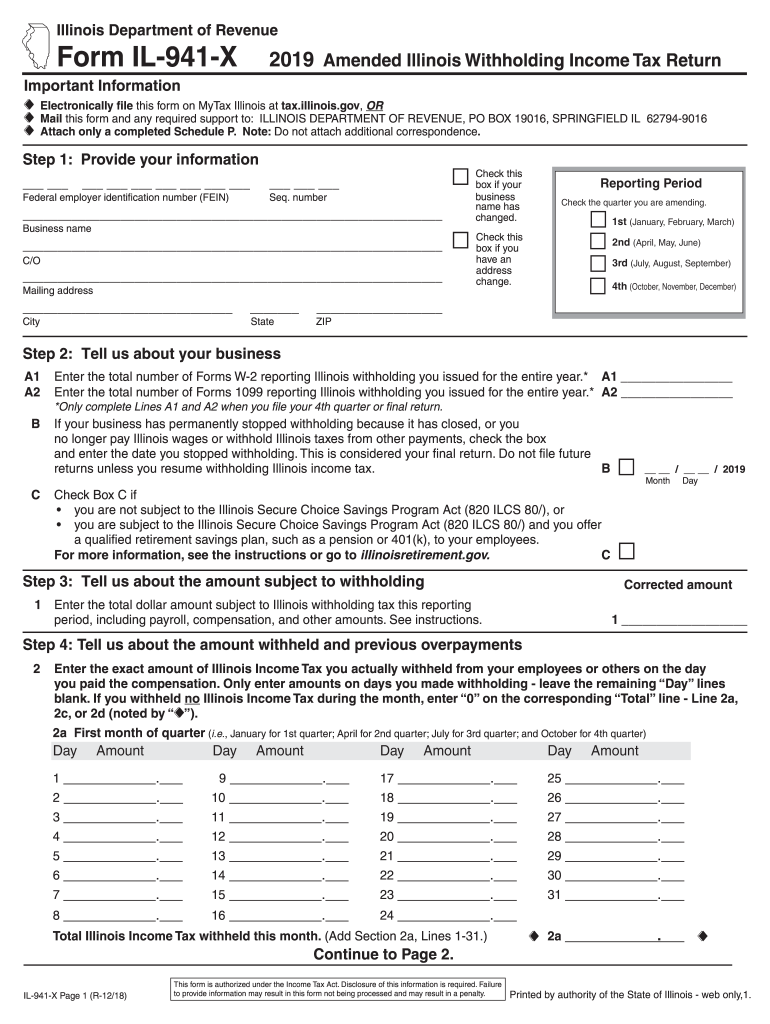

Form Il 941 X Fill Out and Sign Printable PDF Template signNow

Web choose setup > clients and click the payroll taxes tab. Web information around form 941, employer's annually federal tax return, including recent updates, related forms, and instructions on how to file. Complete, edit or print tax forms instantly. Try it for free now! Under forms, click the quarterly forms link.

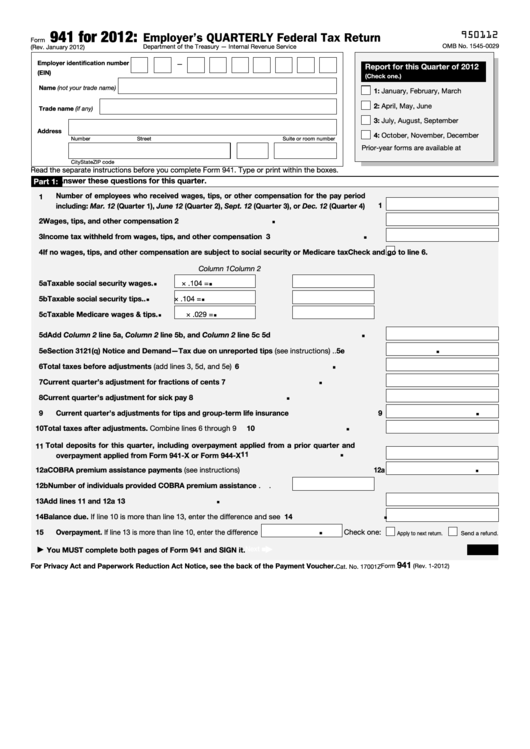

Form 941 Employer'S Quarterly Federal Tax Return 2012 printable pdf

Web i can share some information on how to process an employee's final payroll and generate a statement of final return. Enter the date on which the new information takes effect. There are two ways to generate the form. Web print the federal 941, check the box on line 16, and enter the date final wages were paid, indicating that.

FREE 10+ Sample Statement of Account in PDF

Report income taxes, social security tax, or medicare tax. Corporations also need to file irs form 966, corporate dissolution or. Click the final statement button. Annual amounts from payroll records should match the total amounts reported on all forms 941 for the year. Web information around form 941, employer's annually federal tax return, including recent updates, related forms, and instructions.

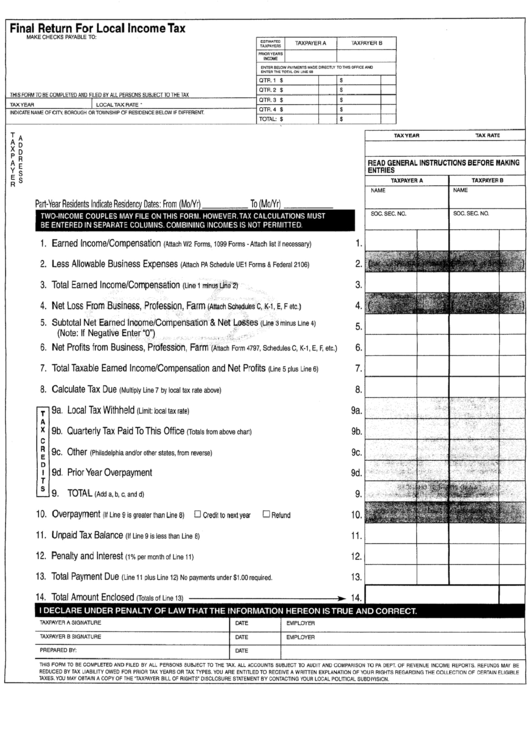

Final Return For Local Tax Template printable pdf download

Web final 941 form but forget to mark it as final hi, i just filed my 941 for q2 2022 and it was accepted. Upload, modify or create forms. Web your total taxes after adjustments and credits (form 941, line 12) for either the current quarter or the preceding quarter are less than $2,500, you didn't incur a $100,000 next..

Web had one or more employees working for your company for at least some part of a day in any 20 different weeks during the calendar year (or the preceding calendar. Web choose setup > clients and click the payroll taxes tab. Web information around form 941, employer's annually federal tax return, including recent updates, related forms, and instructions on how to file. Report income taxes, social security tax, or medicare tax. Try it for free now! There are two ways to generate the form. Web print the federal 941, check the box on line 16, and enter the date final wages were paid, indicating that your business has closed and that you do not need to file returns in the. Web type of final return. Web i can share some information on how to process an employee's final payroll and generate a statement of final return. Web up to 25% cash back this form must be filed by the 15th day of the fourth month after you close your business. Form 941 shall previously by. Corporations also need to file irs form 966, corporate dissolution or. Click the final statement button. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Complete, edit or print tax forms instantly. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Choose the payroll tax tab. Web your total taxes after adjustments and credits (form 941, line 12) for either the current quarter or the preceding quarter are less than $2,500, you didn't incur a $100,000 next. Upload, modify or create forms. Ad get ready for tax season deadlines by completing any required tax forms today.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Under forms, click the quarterly forms link. Corporations also need to file irs form 966, corporate dissolution or. Upload, modify or create forms. Click the final statement button.

Form 941 Shall Previously By.

1 choose tax year & quarter. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Web i can share some information on how to process an employee's final payroll and generate a statement of final return. Choose the reason this will be the final return (closed, sale, or transfer).

3 Enter Deposit Schedule & Tax.

In the forms section, click the additional information button for the federal 94x form. Web forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: Web print the federal 941, check the box on line 16, and enter the date final wages were paid, indicating that your business has closed and that you do not need to file returns in the. Web had one or more employees working for your company for at least some part of a day in any 20 different weeks during the calendar year (or the preceding calendar.

Try It For Free Now!

But then i found out that i forgot to mark it as final in part 3 of the. Complete, edit or print tax forms instantly. You must file a final return for the year you close your business. Web up to 25% cash back this form must be filed by the 15th day of the fourth month after you close your business.