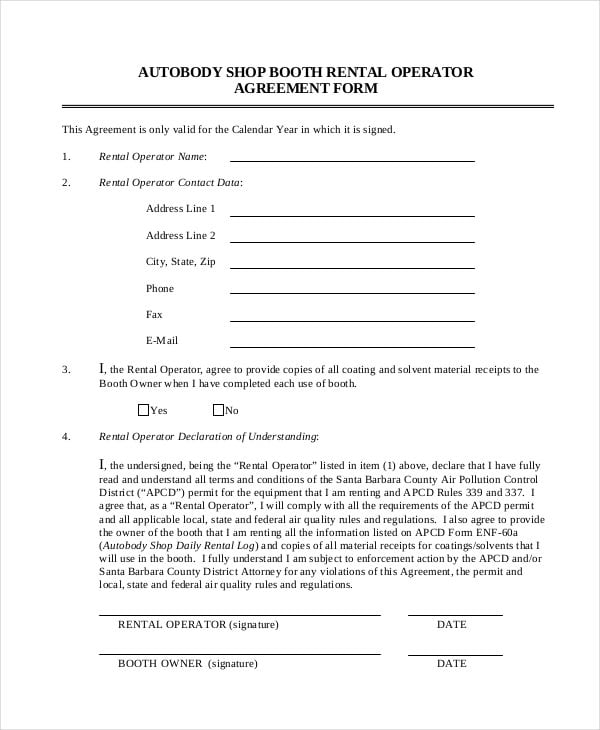

Safe Simple Agreement For Future Equity Template

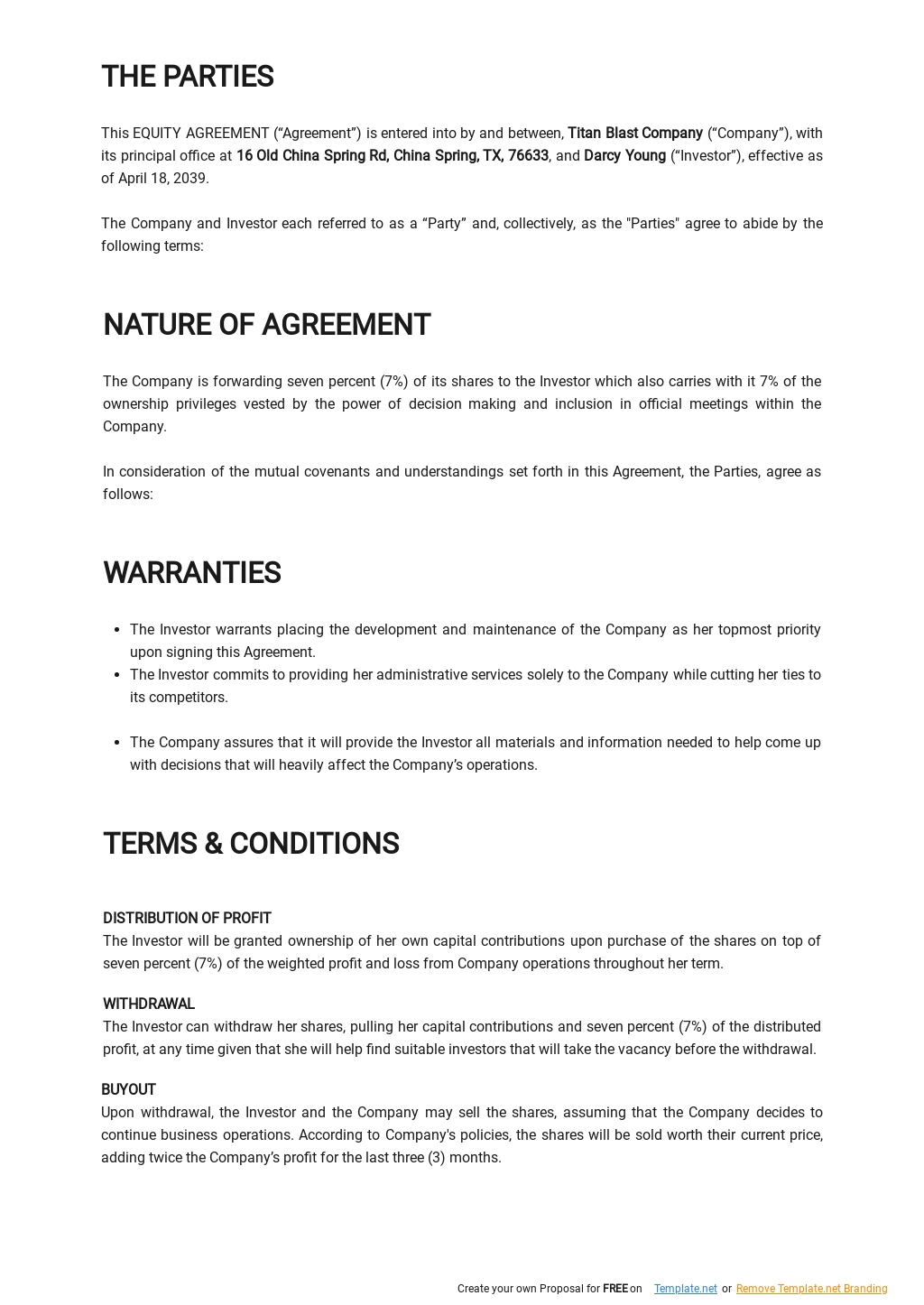

Safe Simple Agreement For Future Equity Template - A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment. 5 minutes follow us on linkedin. Web a simple agreement for future equity term sheet lays out the relationship between the startup company and the investor and determines how the safe works. Web updated february 22, 2023: Web the acronym safe stands for simple agreement for future equity. conceived by y combinator, a prominent startup accelerator, this groundbreaking. Web the simple agreement for future equity: Web simple agreement for future equity (safe) this certifies that in exchange for the payment on or about [date of agreement] by the university of. Web a simple agreement for future equity (safe) note is an innovative form of convertible security that enables small businesses and startups to raise capital while postponing. Ad answer simple questions to make your legal documents. Paul graham and ycombinator have recently created and publicly.

Equity Share Agreement Template Unique Free Holders Agreement Template

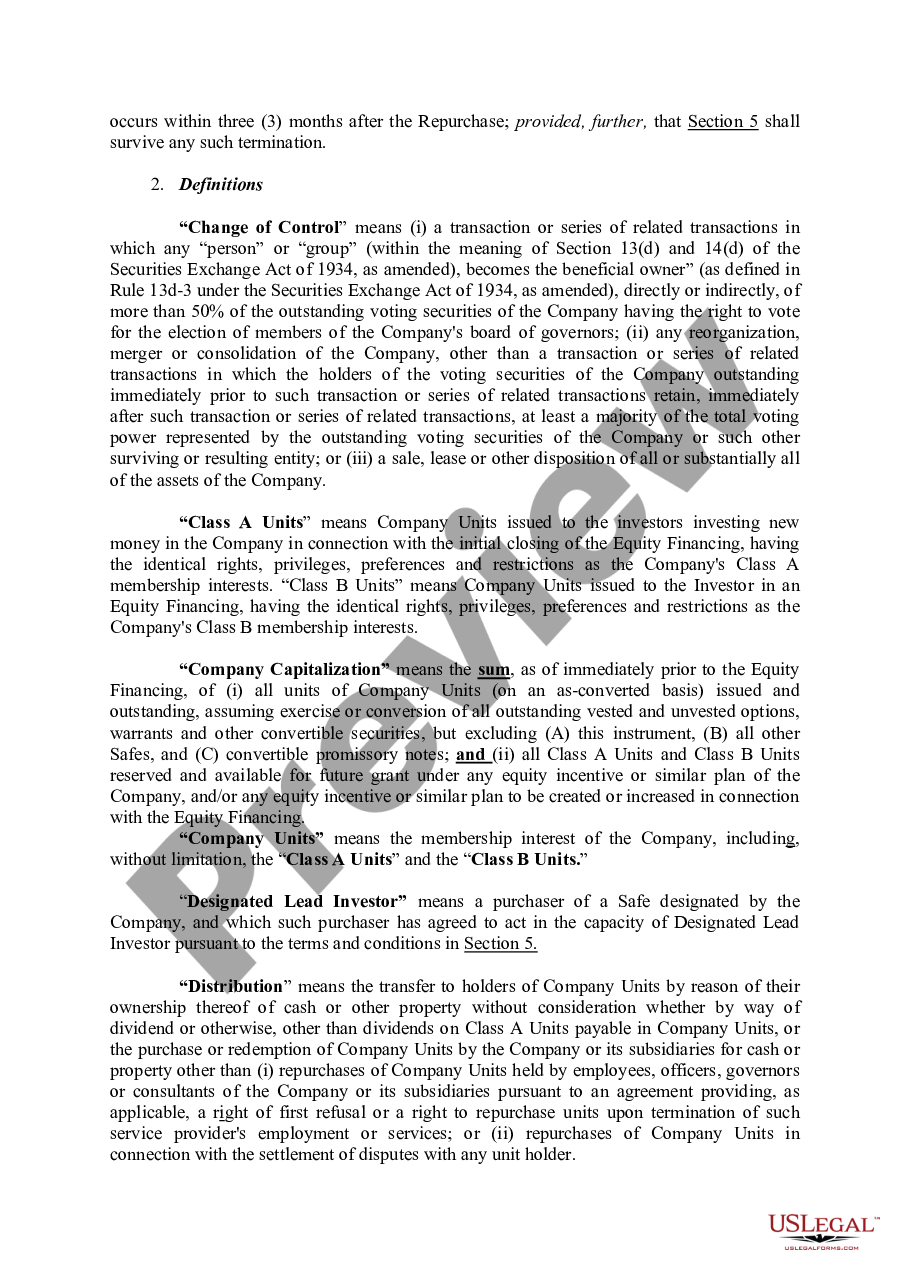

A simple agreement for future equity (safe) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment. Personalized contracts in 5 minutes. A safe agreement is a financial contract that.

Equity Share Agreement Template Beautiful 20 Excellent Business Equity

Web a simple agreement for future equity (safe) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. Paul graham and ycombinator have recently created and publicly. Web a simple agreement for future equity (safe) note is an innovative form of convertible security that enables small businesses and startups to.

Conceptual Photo Showing Simple Agreement For Future Equity Safe Stock

Personalized contracts in 5 minutes. Web what is a simple agreement for future equity (safe) template? A simple agreement for future equity (safe) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of.

Simple Agreement For Future Equity Example

Web the acronym safe stands for simple agreement for future equity. conceived by y combinator, a prominent startup accelerator, this groundbreaking. Web what is a safe (simple agreement for future equity) agreement? All versions of the model form safe for llcs are available at jdform, including the: The safe investor receives the future shares when a priced round of investment.

Free Simple Equity Agreement Template Google Docs, Word, Apple Pages

Web in recent years, a financing alternative called simple agreements for future equity (“safes”) has gained popularity and proven useful for emerging. Web the document titled 'safe (simple agreement for future equity)' is a legal instrument that outlines the terms and conditions for the issuance of shares of a company's capital. A simple agreement for future equity (safe) is an.

Simple Agreement for Future Equity (SAFE) Free Template Sample

A safe way of raising capital practice group leader updated on december 14, 2022 reading time: Web the simple agreement for future equity: Web a safe (simple agreement for future equity) is an agreement between an investor and a company that grants the investor rights for future equity in the company similar to a. Web what is a safe (simple.

SAFE (simple agreement for future equity) Setup and Modify Eqvista

Web updated february 22, 2023: Web this simple agreement for future equity (this “agreement”), dated as of august 10, 2018, certifies that in exchange for the payment in instalments by. A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment. Web a safe (simple agreement for future equity) is an agreement between.

Simple Agreement for Future Equity SAFE is Shown on the Photo Stock

A safe agreement is a financial contract that is drawn up between startups and investors. Safes are intended to provide a simpler mechanism for startups to seek initial funding other than All versions of the model form safe for llcs are available at jdform, including the: Web in recent years, a financing alternative called simple agreements for future equity (“safes”).

Equity For Services Agreement Template Gallery in 2021 Sweat equity

A safe agreement is a financial contract that is drawn up between startups and investors. A simple agreement for future equity (safe) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the.

Maricopa Arizona Simple Agreement for Future Equity US Legal Forms

Web simple agreement for future equity (safe) • the safe is a relatively recent addition to the seed financing toolkit, promoted by the leading startup accelerator, y combinator. The safe investor receives the future shares when a priced round of investment or liquidity event occurs. Ad answer simple questions to make your legal documents. Paul graham and ycombinator have recently.

A safe way of raising capital practice group leader updated on december 14, 2022 reading time: Web in recent years, a financing alternative called simple agreements for future equity (“safes”) has gained popularity and proven useful for emerging. Web simple agreement for future equity (safe) • the safe is a relatively recent addition to the seed financing toolkit, promoted by the leading startup accelerator, y combinator. Personalized contracts in 5 minutes. Web this simple agreement for future equity (this “agreement”), dated as of august 10, 2018, certifies that in exchange for the payment in instalments by. Web a simple agreement for future equity (safe) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. Web a simple agreement for future equity (safe) note is an innovative form of convertible security that enables small businesses and startups to raise capital while postponing. Paul graham and ycombinator have recently created and publicly. All versions of the model form safe for llcs are available at jdform, including the: A safe agreement is a financial contract that is drawn up between startups and investors. Web what is a safe (simple agreement for future equity) agreement? Web a simple agreement for future equity (safe) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. Web updated february 22, 2023: A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment. A simple agreement for future equity (safe) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment. Latex templates for safe (simple agreement for future equity) term sheets. Web a simple agreement for future equity term sheet lays out the relationship between the startup company and the investor and determines how the safe works. Web what is a simple agreement for future equity (safe) template? One of the simplest (and cheapest) ways to invest in an. The safe investor receives the future shares when a priced round of investment or liquidity event occurs.

Web A Simple Agreement For Future Equity Term Sheet Lays Out The Relationship Between The Startup Company And The Investor And Determines How The Safe Works.

Web in recent years, a financing alternative called simple agreements for future equity (“safes”) has gained popularity and proven useful for emerging. A simple agreement for future equity (safe) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment. Ad answer simple questions to make your legal documents. Web updated february 22, 2023:

Web A Simple Agreement For Future Equity (Safe) Is A Financing Contract That May Be Used By A Startup Company To Raise Capital In Its Seed Financing Rounds.

A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment. Web the acronym safe stands for simple agreement for future equity. conceived by y combinator, a prominent startup accelerator, this groundbreaking. Web simple agreement for future equity (safe) this certifies that in exchange for the payment on or about [date of agreement] by the university of. Web what is a simple agreement for future equity (safe) template?

Safes Are Intended To Provide A Simpler Mechanism For Startups To Seek Initial Funding Other Than

Latex templates for safe (simple agreement for future equity) term sheets. The safe investor receives the future shares when a priced round of investment or liquidity event occurs. Web a safe (simple agreement for future equity) is an agreement between an investor and a company that grants the investor rights for future equity in the company similar to a. 5 minutes follow us on linkedin.

Paul Graham And Ycombinator Have Recently Created And Publicly.

All versions of the model form safe for llcs are available at jdform, including the: Web the simple agreement for future equity: Web the document titled 'safe (simple agreement for future equity)' is a legal instrument that outlines the terms and conditions for the issuance of shares of a company's capital. One of the simplest (and cheapest) ways to invest in an.