Printable Tax Deduction Worksheet

Printable Tax Deduction Worksheet - Enter here and on schedule 1 (form 1040), line 15. Edit your printable tax deduction worksheet online type text, add images, blackout confidential details, add comments, highlights and more. Type text, add images, blackout confidential details, add comments,. Examples of what type of. Number of regular withholding allowances. In most cases, your federal income tax. Web standard deduction can’t be used. Multiply line 12 by 50% (0.50). Web tax deduction worksheet this worksheet allows you to itemize your tax deductions for a given year. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number.

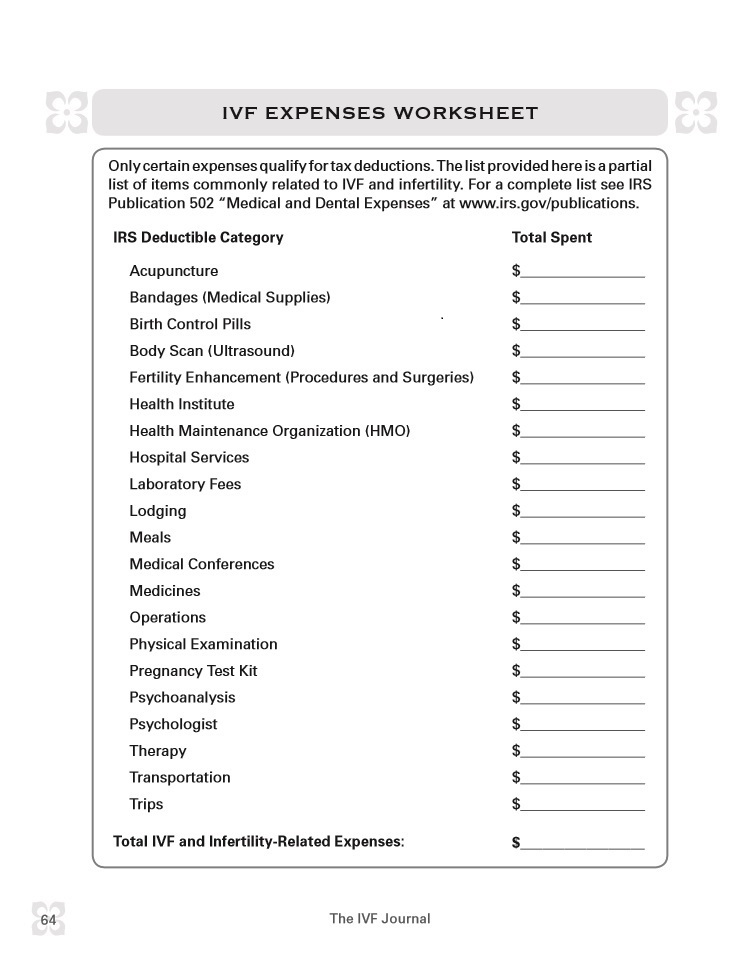

5 Itemized Tax Deduction Worksheet /

Multiply line 12 by 50% (0.50). Web to calculate the simplified home office deduction you simply multiply the square footage of your home used for business by $5 per square foot. Web the government offers a number of deductions and credits to help lower the tax burden on individuals, which means more money in your pocket. Multiply the number of.

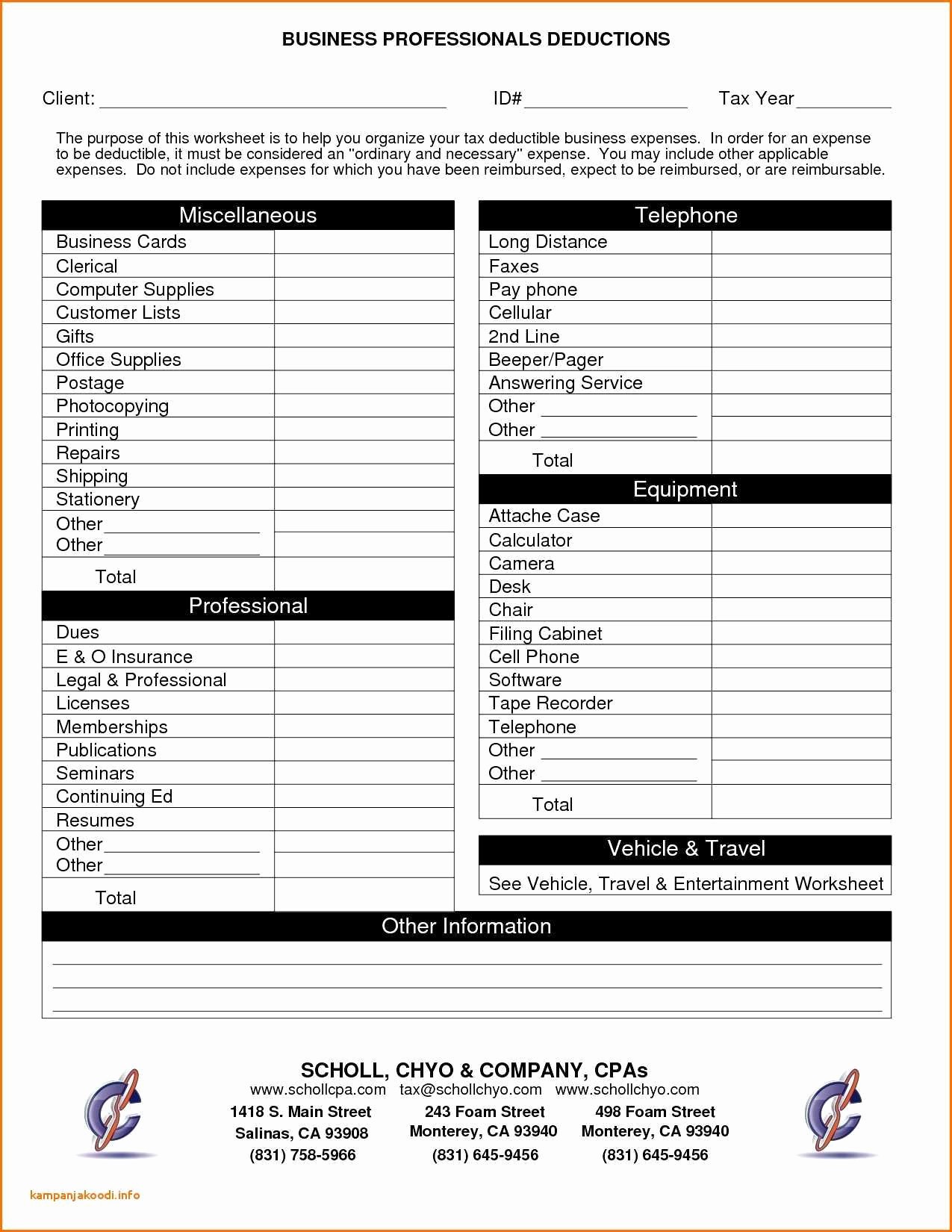

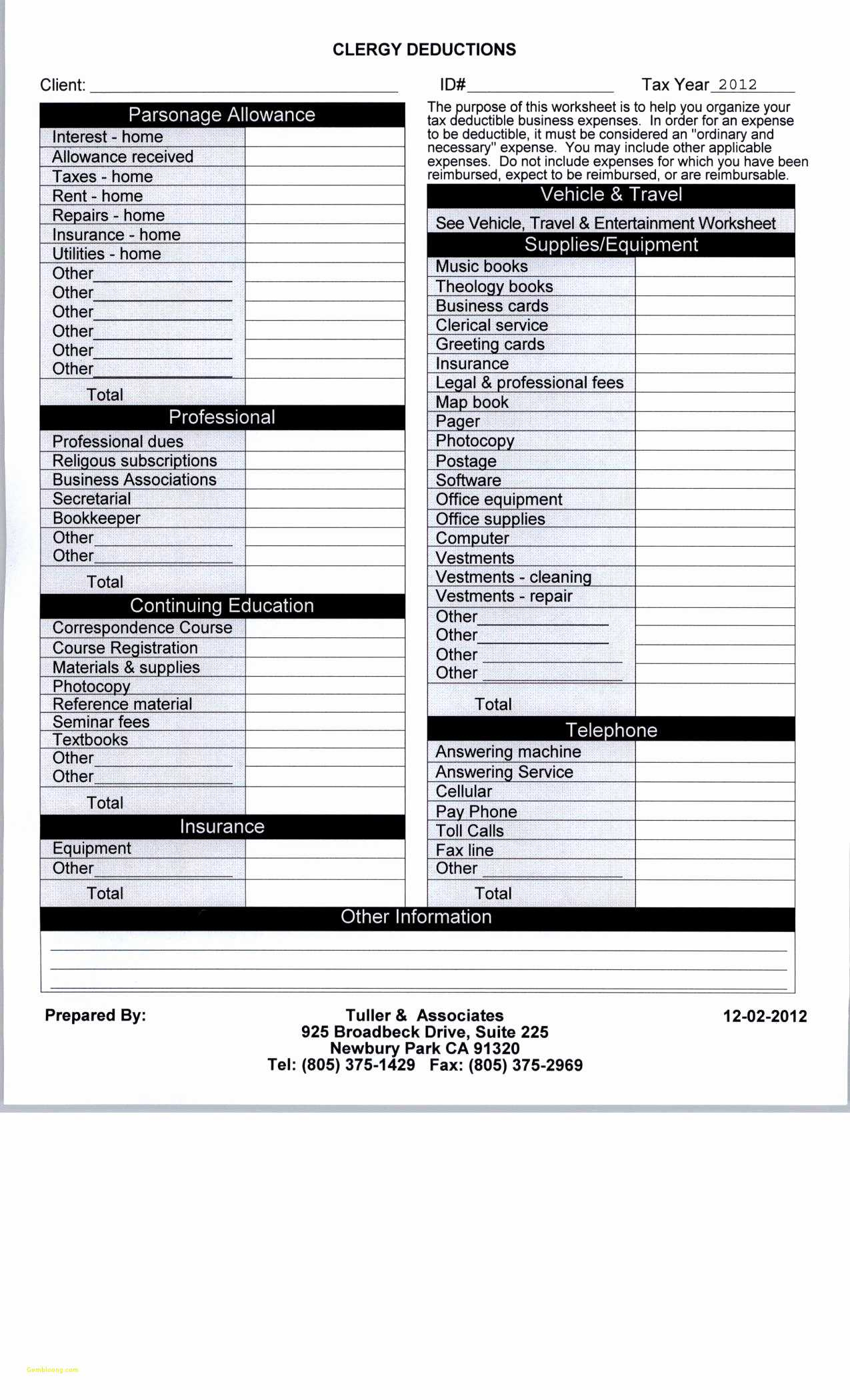

10 Best Images of Business Tax Deductions Worksheet Tax Itemized

Web download your free copy of our business expense categories worksheet. Multiply line 12 by 50% (0.50). Type text, add images, blackout confidential details, add comments,. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Web if your total income will be $200,000 or.

Printable Yearly Itemized Tax Deduction Worksheet Fill Online

Our tax organizers are designed to help you maximize your deductions and minimize any problems in preparing and filing your. In most cases, your federal income tax. It doesn’t matter which spouse files first. Web small business worksheet client: This list is a great quick reference guide and includes:

Itemized Deductions Form 1040 Schedule A Free Download Worksheet

Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Web standard deduction can’t be used. Web you can also download it, export it or print it out. Printable yearly itemized tax deduction worksheet get printable yearly. Tax deductions for calendar year 2 0 ___ ___ marketing.

8 Tax Itemized Deduction Worksheet /

Web the government offers a number of deductions and credits to help lower the tax burden on individuals, which means more money in your pocket. Web this downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax refunds, social security,. It doesn’t matter which spouse files first. As a result, your maximum. Sign it.

Printable Itemized Deductions Worksheet

Edit your itemized deductions worksheet online. Web the government offers a number of deductions and credits to help lower the tax burden on individuals, which means more money in your pocket. Web download your free copy of our business expense categories worksheet. Our tax organizers are designed to help you maximize your deductions and minimize any problems in preparing and.

Itemized Deductions Spreadsheet in Business Itemized Deductions

Edit your itemized deductions worksheet online. Examples of what type of. As a result, your maximum. Web small business worksheet client: Edit your printable tax deduction worksheet online type text, add images, blackout confidential details, add comments, highlights and more.

14 Best Images of Home Office Employee Worksheet Tax Deduction

Web you can also download it, export it or print it out. In most cases, your federal income tax. Number of regular withholding allowances. Multiply line 12 by 50% (0.50). Tax deductions for calendar year 2 0 ___ ___ marketing.

Small Business Deductions Worksheet petermcfarland.us

Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. It doesn’t matter which spouse files first. Sign it in a few clicks draw. Number of regular withholding allowances. Printable yearly itemized tax deduction worksheet get printable yearly.

Tax Deduction Spreadsheet Spreadsheet Downloa tax deduction sheet. tax

Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Our tax organizers are designed to help you maximize your deductions and minimize any problems in preparing and filing your. Web this downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax refunds, social security,. Web download.

In most cases, your federal income tax. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Enter here and on schedule 1 (form 1040), line 15. If too little is withheld, you will generally owe tax when you file. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. Our tax organizers are designed to help you maximize your deductions and minimize any problems in preparing and filing your. Number of regular withholding allowances. Web download your free copy of our business expense categories worksheet. Web you can also download it, export it or print it out. Tax deductions for calendar year 2 0 ___ ___ marketing. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Examples of what type of. Sign it in a few clicks draw. Type text, add images, blackout confidential details, add comments,. Multiply line 12 by 50% (0.50). Web small business worksheet client: Edit your itemized deductions worksheet online. It doesn’t matter which spouse files first. Web use worksheet a for regular withholding allowances. Edit your printable tax deduction worksheet online type text, add images, blackout confidential details, add comments, highlights and more.

Web You Can Also Download It, Export It Or Print It Out.

Enter here and on schedule 1 (form 1040), line 15. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. If too little is withheld, you will generally owe tax when you file.

Sign It In A Few Clicks Draw.

Multiply line 12 by 50% (0.50). Web about schedule a (form 1040), itemized deductions. Use other worksheets on the following pages as applicable. As a result, your maximum.

Web This Downloadable File Contains Worksheets For, Wages And Pensions, Ira Distributions, Interest And Dividends, Miscellaneous Income (Tax Refunds, Social Security,.

Web use worksheet a for regular withholding allowances. Examples of what type of. Web the government offers a number of deductions and credits to help lower the tax burden on individuals, which means more money in your pocket. Web standard deduction can’t be used.

Web Download Our Free 2022 Small Business Tax Deductions Worksheet, And We’ll Walk You Through How To Use It Right Now In This Blog Post.

Edit your printable tax deduction worksheet online type text, add images, blackout confidential details, add comments, highlights and more. Web small business worksheet client: This list is a great quick reference guide and includes: Printable yearly itemized tax deduction worksheet get printable yearly.