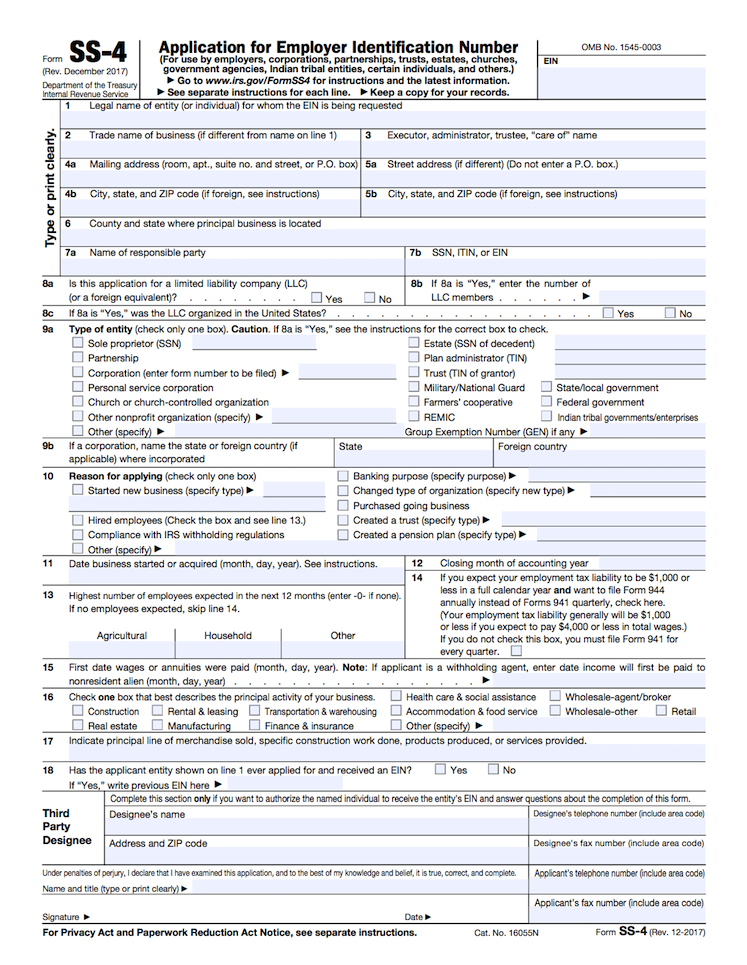

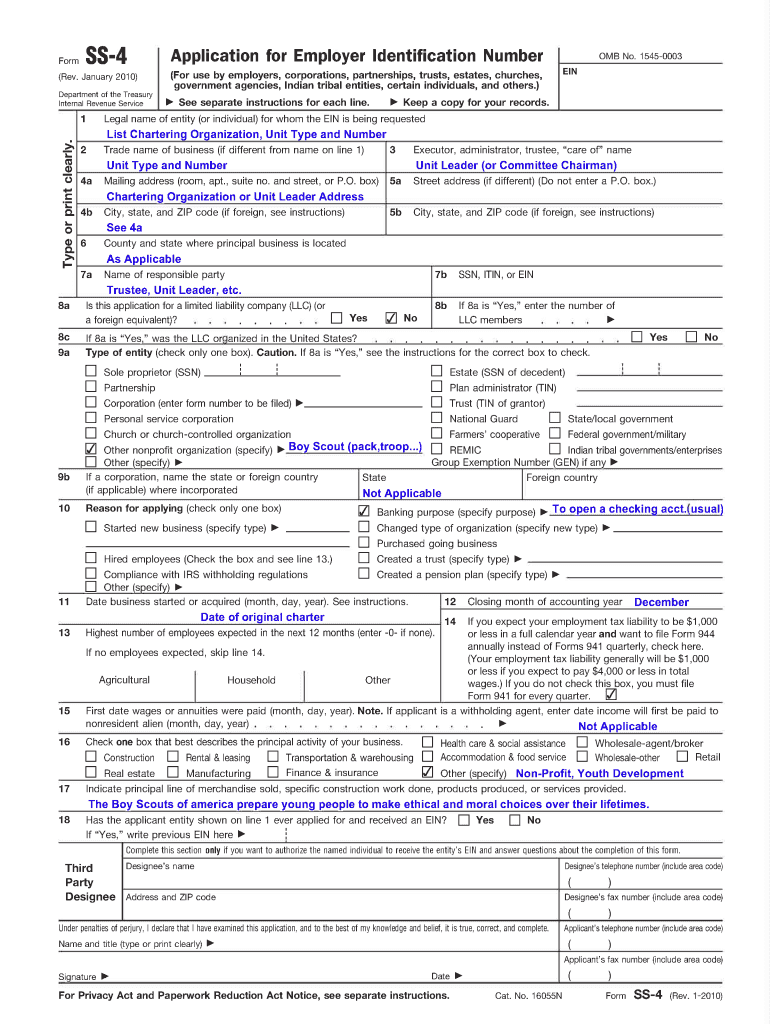

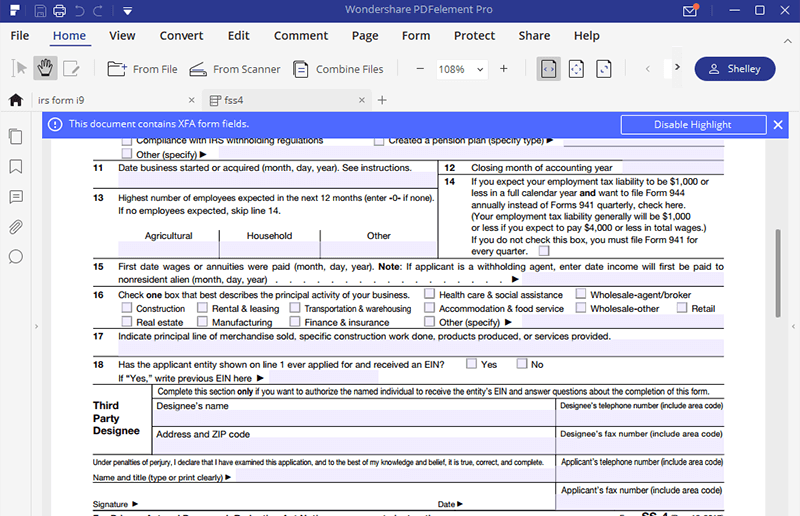

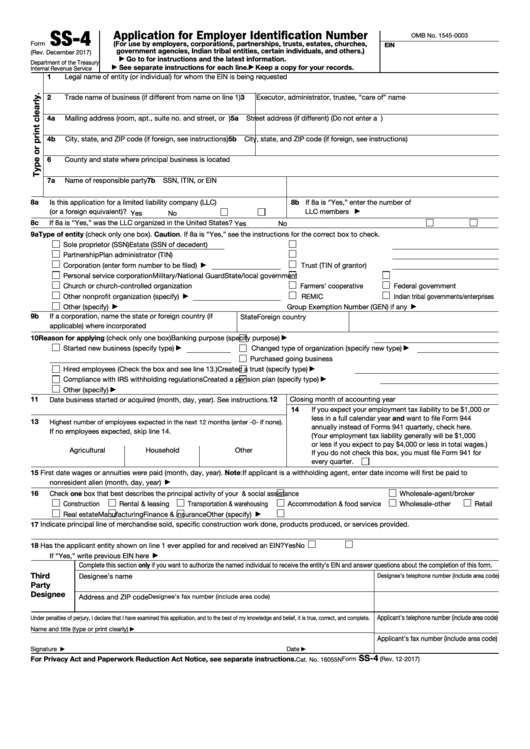

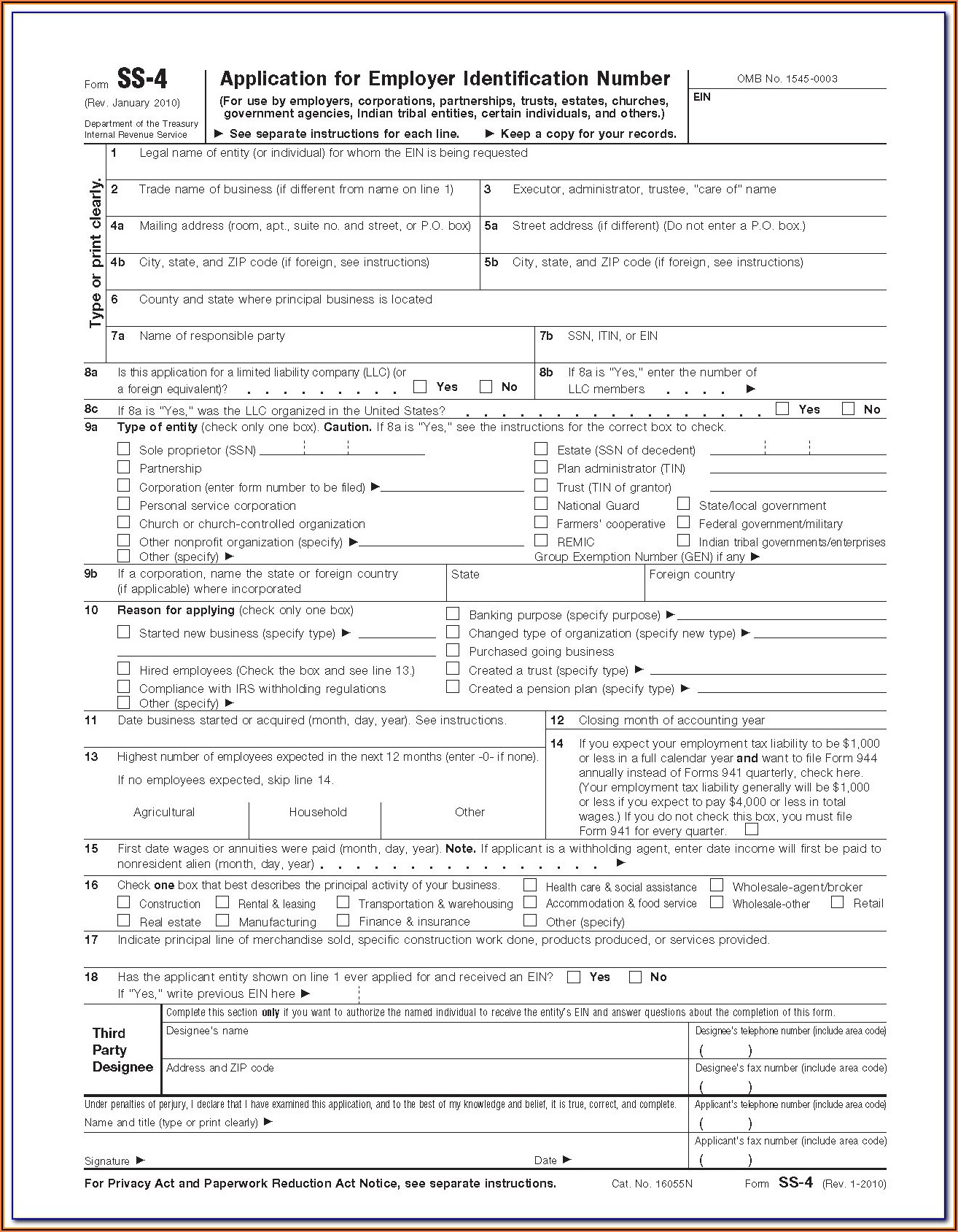

Printable Ss 4 Form

Printable Ss 4 Form - Web a ss 4 is a pdf form that can be filled out, edited or modified by anyone online. (for use by employers, corporations,. Pdf (portable document format) is a file format that captures all the elements of a. Page 1 of 5 omb no. December 2019) department of the treasury internal revenue service. Web 201 rows if you can't find the form you need, or you need help completing a form, please. The ss form 4 is also known as the application for employer identification number. Where to file or fax if you have a principal. Application for employer identification number. Web the principal officer, general partner, grantor, owner, trustor, etc., must have a valid taxpayer identification number (ssn, ein, or itin) in order to use the online application.

printable form ss 4 Fill out & sign online DocHub

Download the blank pdf for free to print the copy. All forms individual forms information returns fiduciary. December 2019) department of the treasury internal revenue service. The document serves as an application for an employer identification number. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021.

How to Get A Copy Of Your Form SS4 Letter Excel Capital

Pdf (portable document format) is a file format that captures all the elements of a. It can be used by employers themselves, partnerships, and. (for use by employers, corporations,. Web how much will i receive? How to complete this application complete and sign this application legibly using only black or blue ink on the.

Form Ss 4 Fill and Sign Printable Template Online US Legal Forms

14 check one box that best describes the principal activity of your business. Web the principal officer, general partner, grantor, owner, trustor, etc., must have a valid taxpayer identification number (ssn, ein, or itin) in order to use the online application. Web how much will i receive? Web the form you are looking for is not available online. Web 201.

How To Get A Copy Of Ss4 Form Irs Darrin Kenney's Templates

(ifyouexpect to pay $4.000 or less in wages, you can mark yes. It can be used by employers themselves, partnerships, and. Many forms must be completed only by a social security representative. Web the form you are looking for is not available online. How to complete this application complete and sign this application legibly using only black or blue ink.

form ss4 instructions Fill Online, Printable, Fillable Blank form

Web use this form to apply for an employer identification number (ein). $520 for married couples who filed jointly with an. The document serves as an application for an employer identification number. Page 1 of 5 omb no. The ss form 4 is also known as the application for employer identification number.

Form SS4 Application for Employer Identification Number Documentshelper

(ifyouexpect to pay $4.000 or less in wages, you can mark yes. Web the form you are looking for is not available online. Web 201 rows if you can't find the form you need, or you need help completing a form, please. The ss form 4 is also known as the application for employer identification number. 14 check one box.

for How to Fill in IRS Form SS4

How to complete this application complete and sign this application legibly using only black or blue ink on the. December 2001) (for use by employers, corporations, partnerships, trusts, estates, churches, government. Web how much will i receive? Web the principal officer, general partner, grantor, owner, trustor, etc., must have a valid taxpayer identification number (ssn, ein, or itin) in order.

Fillable Form Ss4 Application For Employer Identification Number

Web the principal officer, general partner, grantor, owner, trustor, etc., must have a valid taxpayer identification number (ssn, ein, or itin) in order to use the online application. Web use this form to apply for an employer identification number (ein). All forms individual forms information returns fiduciary. December 2001) (for use by employers, corporations, partnerships, trusts, estates, churches, government. December.

Form ss4 Edit, Fill, Sign Online Handypdf

Application for employer identification number. How to complete this application complete and sign this application legibly using only black or blue ink on the. Web the principal officer, general partner, grantor, owner, trustor, etc., must have a valid taxpayer identification number (ssn, ein, or itin) in order to use the online application. $260 for each taxpayer with an adjusted gross.

Irs Forms Ss 4 Form Resume Examples n49mjLLYZz

$260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. December 2019) department of the treasury internal revenue service. How to complete this application complete and sign this application legibly using only black or blue ink on the. Web how much will i receive? Web a ss 4 is a pdf form that can be.

Web a ss 4 is a pdf form that can be filled out, edited or modified by anyone online. December 2019) department of the treasury internal revenue service. Web use this form to apply for an employer identification number (ein). Web how much will i receive? $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. The ss form 4 is also known as the application for employer identification number. Where to file or fax if you have a principal. Web the form you are looking for is not available online. Many forms must be completed only by a social security representative. It can be used by employers themselves, partnerships, and. 14 check one box that best describes the principal activity of your business. (for use by employers, corporations,. Pdf (portable document format) is a file format that captures all the elements of a. December 2001) (for use by employers, corporations, partnerships, trusts, estates, churches, government. (ifyouexpect to pay $4.000 or less in wages, you can mark yes. The document serves as an application for an employer identification number. $520 for married couples who filed jointly with an. Page 1 of 5 omb no. Web the principal officer, general partner, grantor, owner, trustor, etc., must have a valid taxpayer identification number (ssn, ein, or itin) in order to use the online application. How to complete this application complete and sign this application legibly using only black or blue ink on the.

Web Use This Form To Apply For An Employer Identification Number (Ein).

December 2019) department of the treasury internal revenue service. The ss form 4 is also known as the application for employer identification number. Web how much will i receive? December 2001) (for use by employers, corporations, partnerships, trusts, estates, churches, government.

Page 1 Of 5 Omb No.

$260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. All forms individual forms information returns fiduciary. Web a ss 4 is a pdf form that can be filled out, edited or modified by anyone online. Web the principal officer, general partner, grantor, owner, trustor, etc., must have a valid taxpayer identification number (ssn, ein, or itin) in order to use the online application.

How To Complete This Application Complete And Sign This Application Legibly Using Only Black Or Blue Ink On The.

(for use by employers, corporations,. The document serves as an application for an employer identification number. Web the form you are looking for is not available online. Pdf (portable document format) is a file format that captures all the elements of a.

Where To File Or Fax If You Have A Principal.

$520 for married couples who filed jointly with an. (ifyouexpect to pay $4.000 or less in wages, you can mark yes. 14 check one box that best describes the principal activity of your business. Application for employer identification number.