Printable Small Business Tax Deductions Worksheet

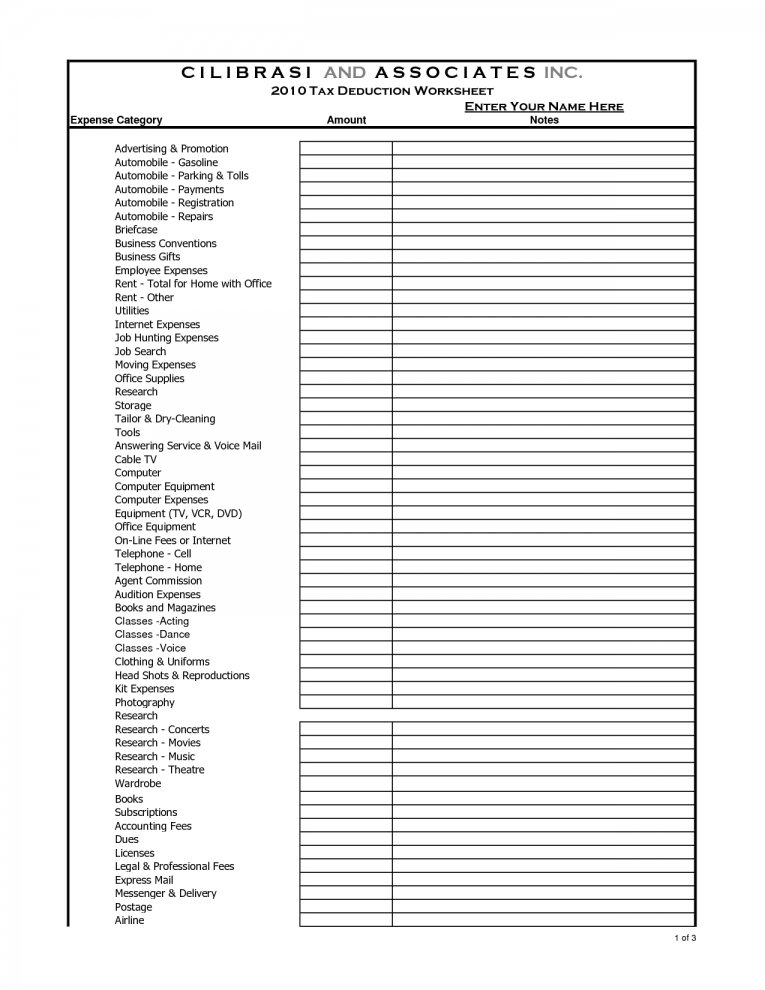

Printable Small Business Tax Deductions Worksheet - Tax deductions for calendar year 2 0 ___ ___ hired help space $_____. Save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Ad finally an accounting software you want to use, easy, beautiful. Web this small business tax preparation checklist breaks down the six basics of filing small business taxes and includes a downloadable checklist to stay on top of your. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. Know exactly what you'll pay each month. The percentage of that $45,000 income that is taxed depends on your business’s tax rate. Web organize your finances for your small business with this free small business tax spreadsheet in excel. Check out this comprehensive list of small business tax deductions for 2022 von kassey mossy tax & accounting.

9 Best Images of Tax Deduction Worksheet Business Tax Deductions

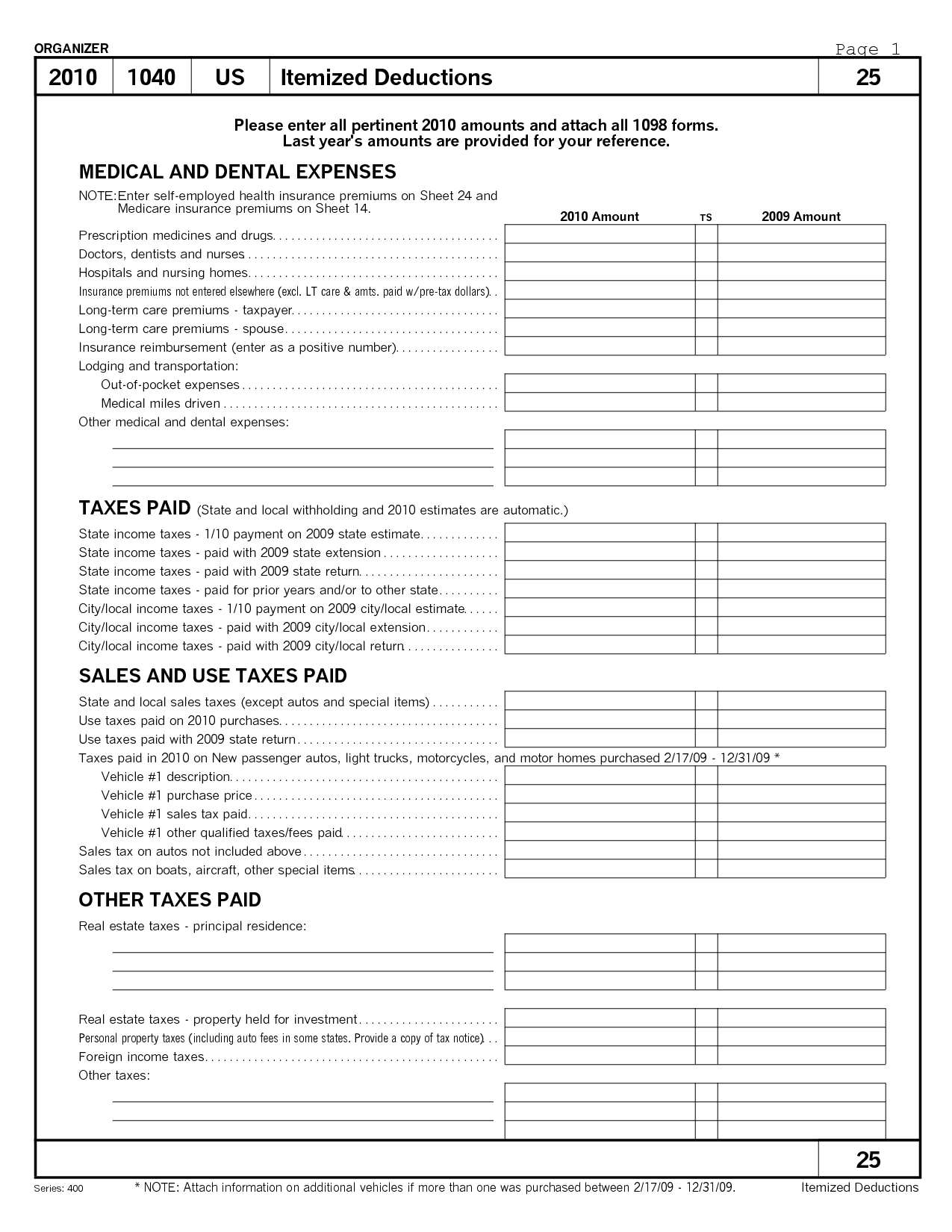

Federal section>deductions>itemized deductions>medical and dental expenses if mfs and. You’ll only be liable for taxes on $45,000 of that business income. The percentage of that $45,000 income that is taxed depends on your business’s tax rate. Learn how to do your taxes for your small business. Web this small business tax preparation checklist breaks down the six basics of filing.

Tax Deduction Worksheet for Police Officers Fill and Sign Printable

Your actual tax savings with deductions will depend on your effective tax rate. Ad finally an accounting software you want to use, easy, beautiful. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. Web this small business tax preparation.

Self Employment Printable Small Business Tax Deductions Worksheet

The percentage of that $45,000 income that is taxed depends on your business’s tax rate. Save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Check out this comprehensive list of small business tax deductions for 2022 von kassey.

5 Itemized Tax Deduction Worksheet /

Save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. The percentage of that $45,000 income that is taxed depends on your business’s tax rate. Web organize your finances for your small business with this free small.

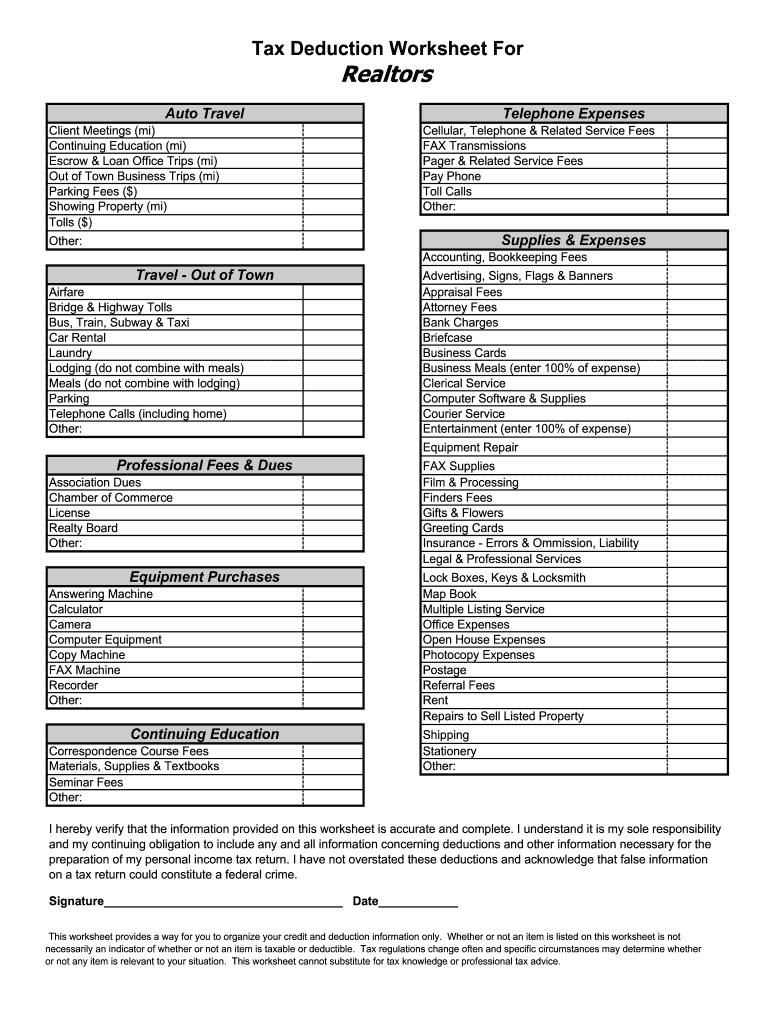

Real Estate Agent Tax Deductions Worksheet 2021 Fill Online

Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. The percentage of that $45,000 income that is taxed depends on your business’s tax rate. Web organize your finances for your small business with this free small business tax spreadsheet.

Small Business Tax Deductions Worksheets

Web identifying every available deduction is an important part of calculating your small business taxes. Web excel | google sheets. Web organize your finances for your small business with this free small business tax spreadsheet in excel. Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. Know exactly what you'll pay.

Self Employment Printable Small Business Tax Deductions Worksheet

This worksheet allows you to itemize your tax deductions for a given year. Ad gusto payroll is easy to use and loved by customers. Save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Pay as you go, cancel any time. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the.

California Itemized Deductions Worksheet

Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from your qualified trade or business, plus 20% of the. Web organize your finances for your small business with this free small business tax spreadsheet in excel. Know exactly what you'll pay each month. Web the.

Self Employment Printable Small Business Tax Deductions Worksheet

Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. This worksheet allows you to itemize your tax deductions for a given year. Web organize your finances for your small business with this free small business tax spreadsheet in excel. Web to help you minimize your tax liability, here is a list of 20+ small.

Tax Deduction Worksheet Small business tax deductions, Small business

The percentage of that $45,000 income that is taxed depends on your business’s tax rate. Web use this form to figure your qualified business income deduction. Web schedule a (form 1040) to deduct interest, taxes, and casualty losses not related to your business. Web if you expect to claim deductions other than the standard deduction and want to reduce your.

Your actual tax savings with deductions will depend on your effective tax rate. Advertising on line 9 of form 1040, schedule c , you can fully deduct. Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. Ad gusto payroll is easy to use and loved by customers. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. In order for an expense to be deductible, it must be considered an ordinary. Ad finally an accounting software you want to use, easy, beautiful. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. This printable small business expense report template offers an easy way to track company expenses. Say you earn $50,000 a year and qualify for $5,000 in tax deductions. Web use this form to figure your qualified business income deduction. Tax deductions for calendar year 2 0 ___ ___ hired help space $_____. Web schedule a (form 1040) to deduct interest, taxes, and casualty losses not related to your business. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Check out this comprehensive list of small business tax deductions for 2022 von kassey mossy tax & accounting. Web this small business tax preparation checklist breaks down the six basics of filing small business taxes and includes a downloadable checklist to stay on top of your. You’ll only be liable for taxes on $45,000 of that business income. Web organize your finances for your small business with this free small business tax spreadsheet in excel. This worksheet allows you to itemize your tax deductions for a given year. Pay as you go, cancel any time.

Web This Small Business Tax Preparation Checklist Breaks Down The Six Basics Of Filing Small Business Taxes And Includes A Downloadable Checklist To Stay On Top Of Your.

Web excel | google sheets. Advertising on line 9 of form 1040, schedule c , you can fully deduct. Web don’t get stuck with a huge tax bill next year! Below, you will find a detailed description of what’s included in.

Web Organize Your Finances For Your Small Business With This Free Small Business Tax Spreadsheet In Excel.

Web identifying every available deduction is an important part of calculating your small business taxes. Web schedule a (form 1040) to deduct interest, taxes, and casualty losses not related to your business. Save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction.

In Order For An Expense To Be Deductible, It Must Be Considered An Ordinary.

Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. Know exactly what you'll pay each month. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Say you earn $50,000 a year and qualify for $5,000 in tax deductions.

Pay As You Go, Cancel Any Time.

Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from your qualified trade or business, plus 20% of the. This printable small business expense report template offers an easy way to track company expenses. Your actual tax savings with deductions will depend on your effective tax rate. The percentage of that $45,000 income that is taxed depends on your business’s tax rate.