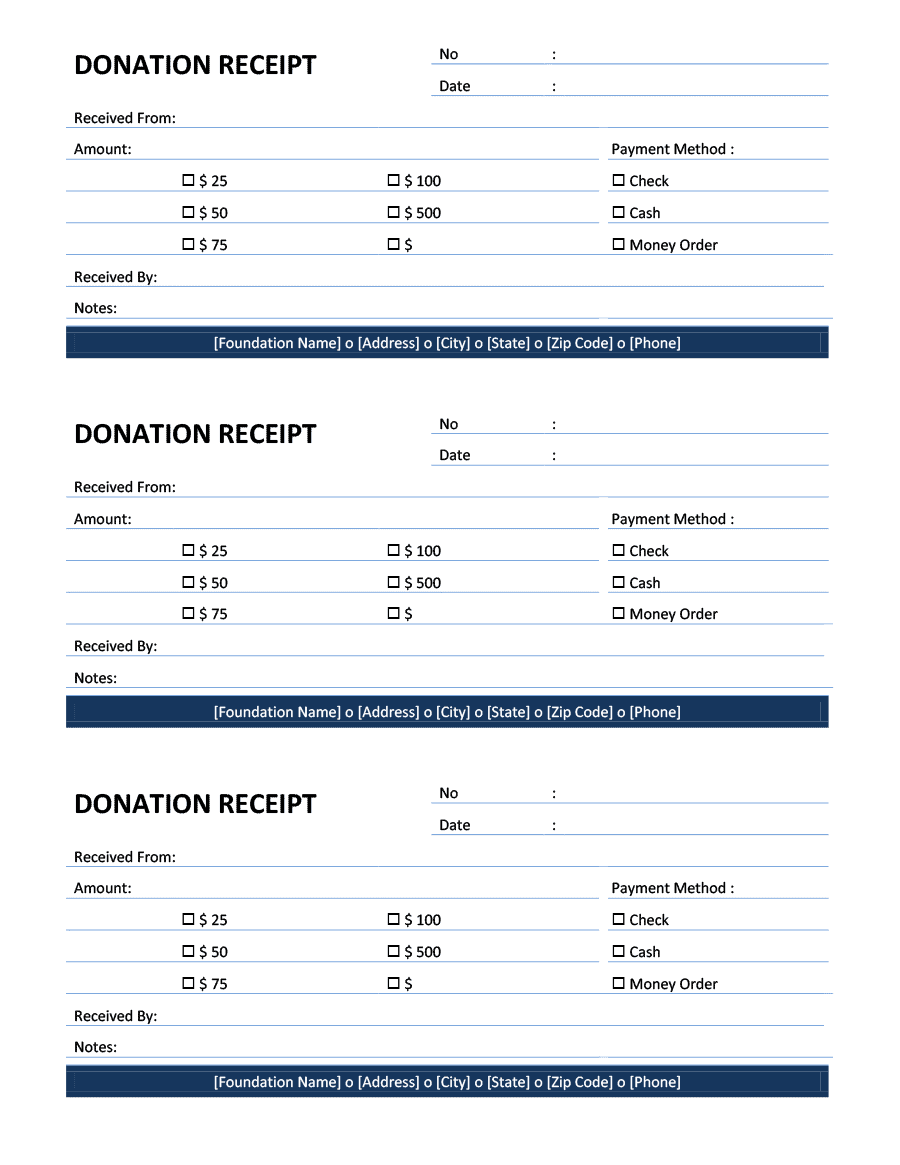

Printable Donation Receipt

Printable Donation Receipt - A donation receipt is a written acknowledgment to your donor of their contribution to your cause. In addition to showing donor. Donated on (date) your donation may be tax. A declaration that states if. If you are responsible for creating. Access legal documents to help you invoice clients, hire employees, gain funding & more. Start tracking your charitable contributions today! Web the irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. Equipment donation receipt download now; If you’re using sumac nonprofit crm, you can setup.

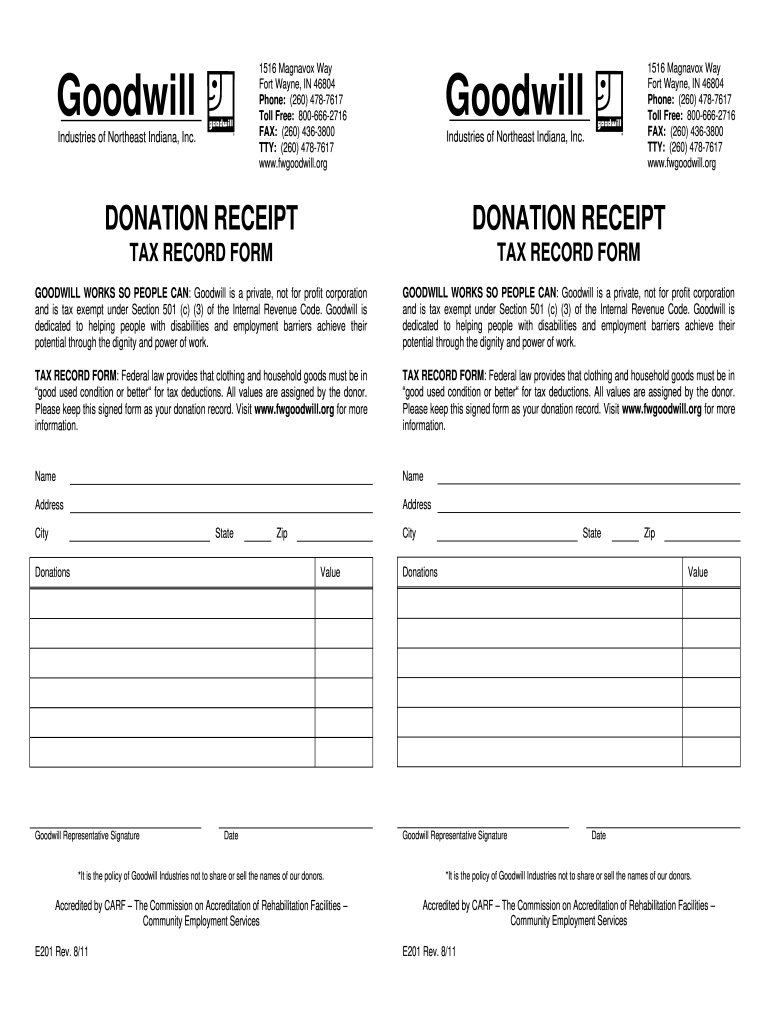

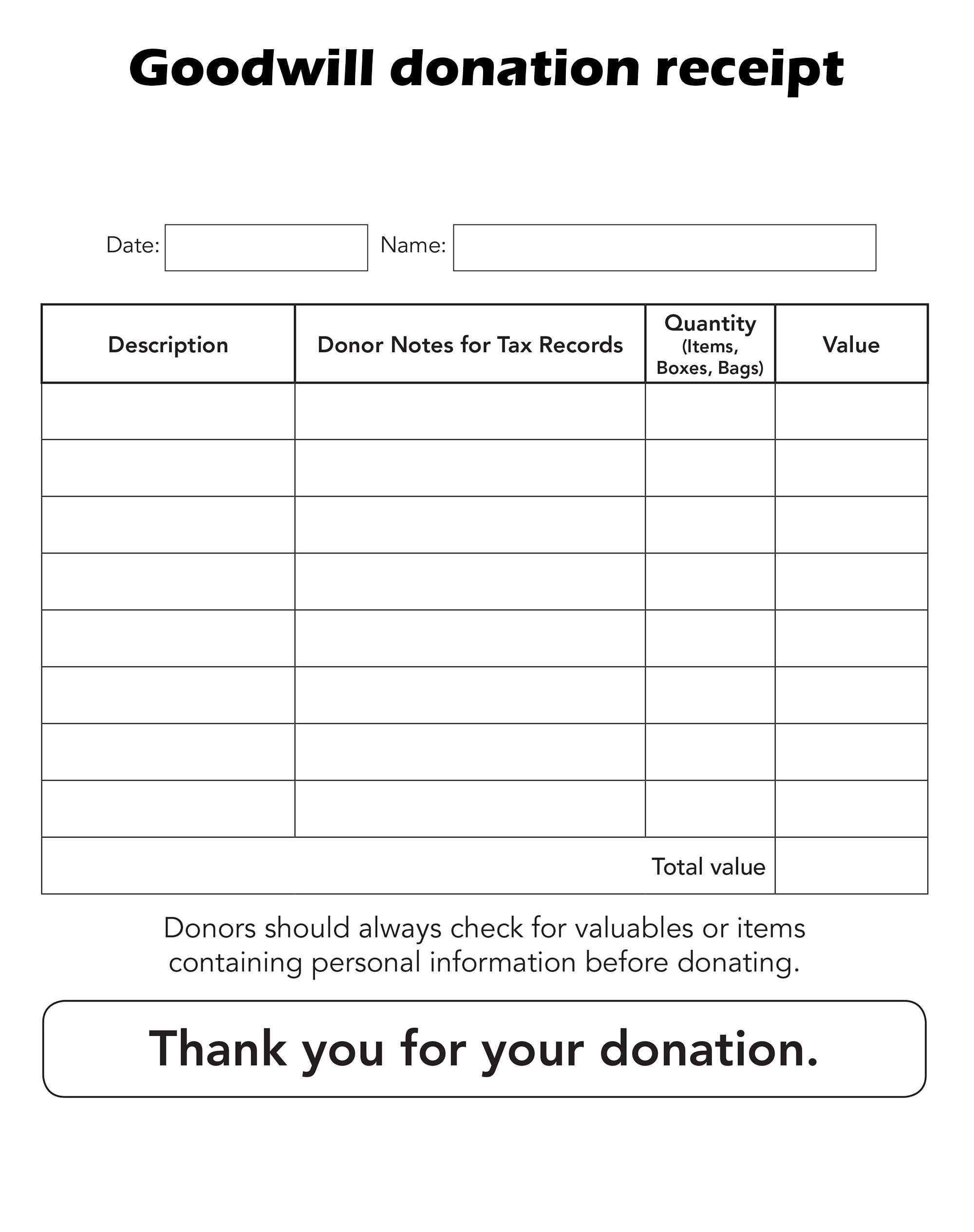

Itemized Donation List Printable Goodwill Master of

Web a person/company making a donation an organization receiving a donation is this receipt for a single donation? A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Donated on (date) your donation may be tax. This can include cash donations, personal property, or.

Printable Donation Receipt Templates PDF, Word, Excel Sample Template

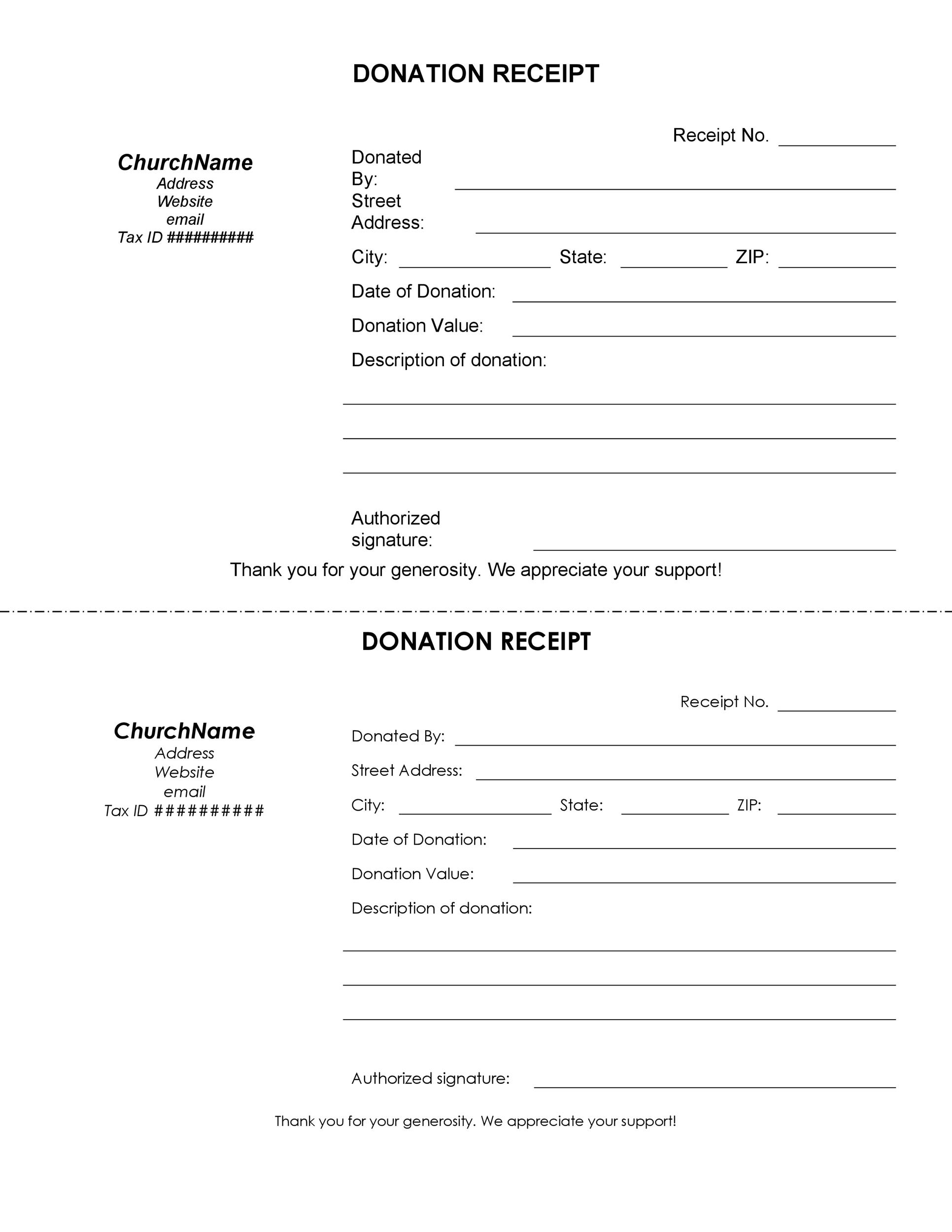

Web the sea turtle foundation recurring donations if you have a monthly giving program, you’ll need a donation receipt template that will automatically thank. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their. Equipment donation receipt download now; Web in the us, it is required that an organization gives a.

18+ Payment Receipt Templates Free Sample, Example Format Download

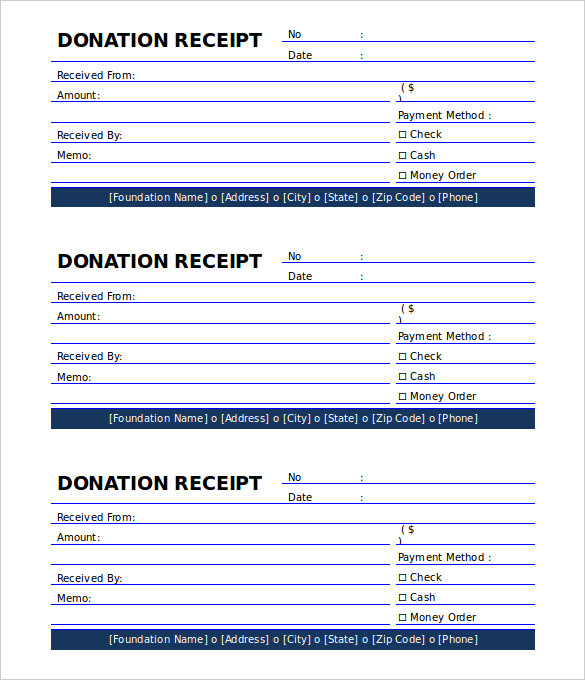

Online donation receipts use an online donation receipt template for anyone who’s made a donate on your website. Web what is a donation receipt? A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. If you are responsible for creating. Web institute donation receipt.

Donation Receipt Template BestTemplatess BestTemplatess

Online donation receipts use an online donation receipt template for anyone who’s made a donate on your website. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their. Web the total amount donated by the donor or benefactor. Web generate accurate and professional donation receipts with our free printable template. Yes.

17+ Donation Receipt Templates Free Word, Excel & PDF Formats

This can include cash donations, personal property, or a vehicle. Formstemplates.com has been visited by 100k+ users in the past month If you’re using sumac nonprofit crm, you can setup. Equipment donation receipt download now; If you are responsible for creating.

6+ Free Donation Receipt Templates Word Excel Formats

Access legal documents to help you invoice clients, hire employees, gain funding & more. Web thank you for your donation and support! A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. School donation receipt download now; Web institute donation receipt template download now;

Non Profit Donation Receipt Templates at

Web the sea turtle foundation recurring donations if you have a monthly giving program, you’ll need a donation receipt template that will automatically thank. A declaration that states if. Yes no, this receipt will be used as a template for. Web the total amount donated by the donor or benefactor. Primarily, the receipt is used by organizations for filing purposes.

Free Sample Printable Donation Receipt Template Form

Web a donation receipt provides documentation to those who give to your organization and serves as a record for tax purposes. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Ad create professional, legal documents for starting & running your business. Web the.

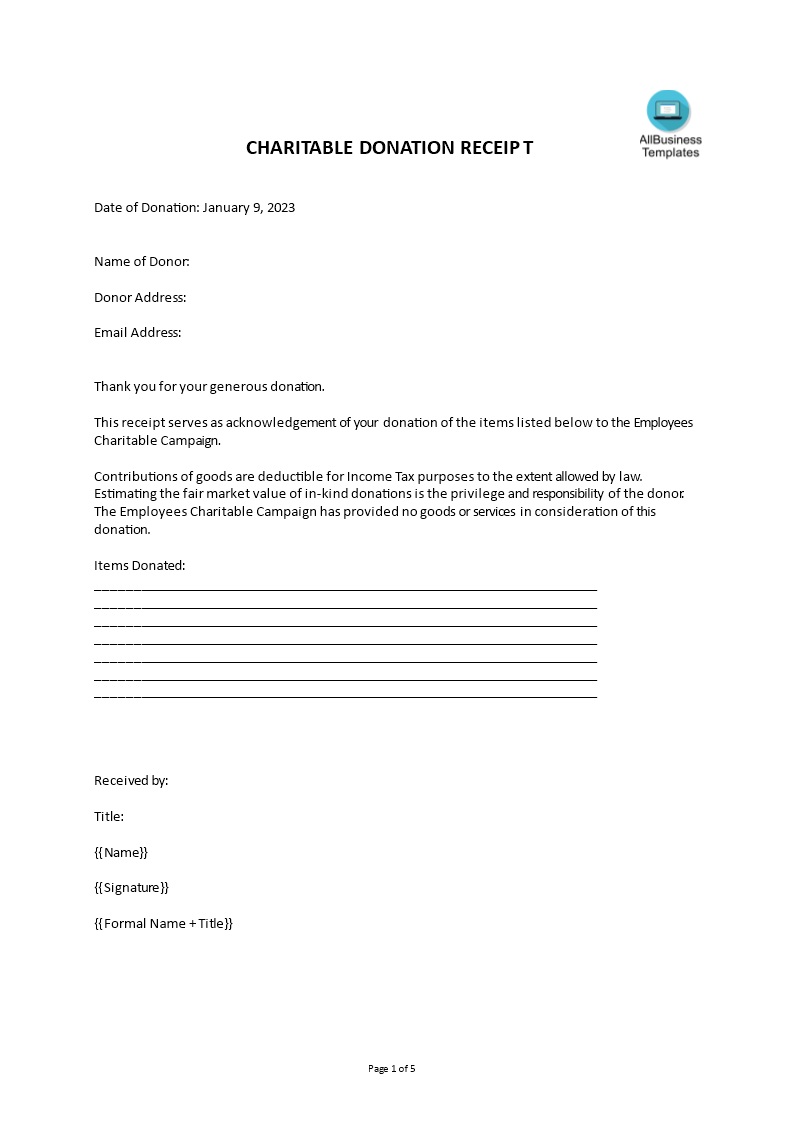

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

Web institute donation receipt template download now; Web the sea turtle foundation recurring donations if you have a monthly giving program, you’ll need a donation receipt template that will automatically thank. Web generate accurate and professional donation receipts with our free printable template. Donor please complete the following: Yes no, this receipt will be used as a template for.

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

Web the sea turtle foundation recurring donations if you have a monthly giving program, you’ll need a donation receipt template that will automatically thank. This can include cash donations, personal property, or a vehicle. Donated on (date) your donation may be tax. Ad create professional, legal documents for starting & running your business. Equipment donation receipt download now;

Web institute donation receipt template download now; Equipment donation receipt download now; Web a person/company making a donation an organization receiving a donation is this receipt for a single donation? School donation receipt download now; Formstemplates.com has been visited by 100k+ users in the past month Ad create professional, legal documents for starting & running your business. Online donation receipts use an online donation receipt template for anyone who’s made a donate on your website. Donor please complete the following: A donation receipt is of great significance if the donor wants to receive a tax deduction when filing their tax. Web generate accurate and professional donation receipts with our free printable template. Access legal documents to help you invoice clients, hire employees, gain funding & more. Web a donation receipt provides documentation to those who give to your organization and serves as a record for tax purposes. Web the irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. If you are responsible for creating. Web the sea turtle foundation recurring donations if you have a monthly giving program, you’ll need a donation receipt template that will automatically thank. In addition to showing donor. If you’re using sumac nonprofit crm, you can setup. A declaration that states if. Web in the us, it is required that an organization gives a donation receipt for any contribution that is $250 or more. Web what is a donation receipt?

Web In The Us, It Is Required That An Organization Gives A Donation Receipt For Any Contribution That Is $250 Or More.

School donation receipt download now; Formstemplates.com has been visited by 100k+ users in the past month If you’re using sumac nonprofit crm, you can setup. Web thank you for your donation and support!

A Declaration That States If.

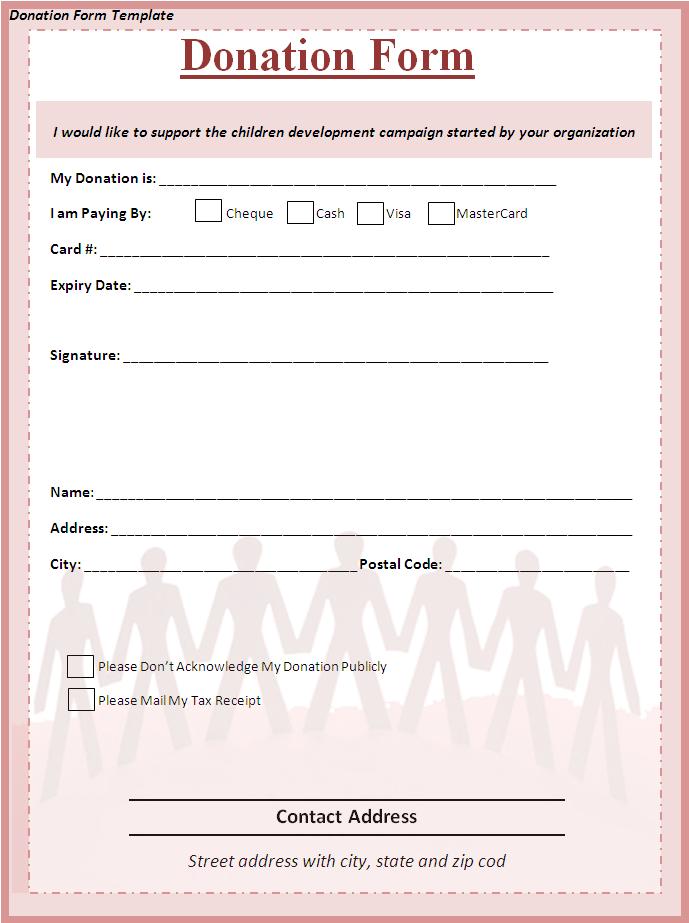

This can include cash donations, personal property, or a vehicle. Yes no, this receipt will be used as a template for. A donation receipt is a written acknowledgment to your donor of their contribution to your cause. If you are responsible for creating.

Start Tracking Your Charitable Contributions Today!

In addition to showing donor. Web generate accurate and professional donation receipts with our free printable template. Web a donation receipt can be in the form of a letter, card, or email. Ad create professional, legal documents for starting & running your business.

Donor Please Complete The Following:

A donation receipt is of great significance if the donor wants to receive a tax deduction when filing their tax. Donated on (date) your donation may be tax. Access legal documents to help you invoice clients, hire employees, gain funding & more. Web the irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy.