Net Present Value Excel Template

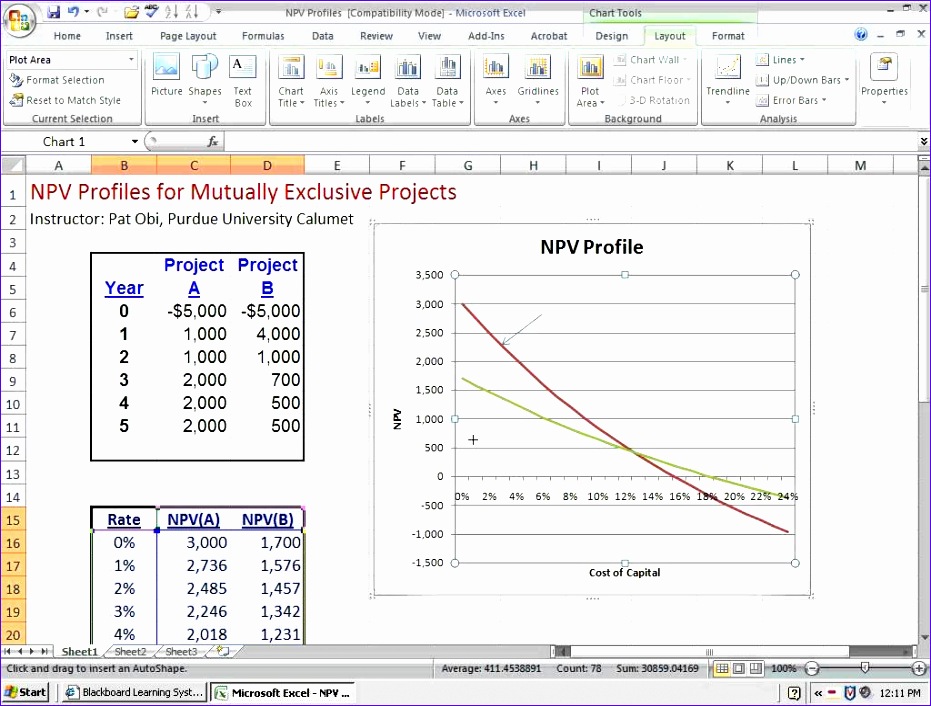

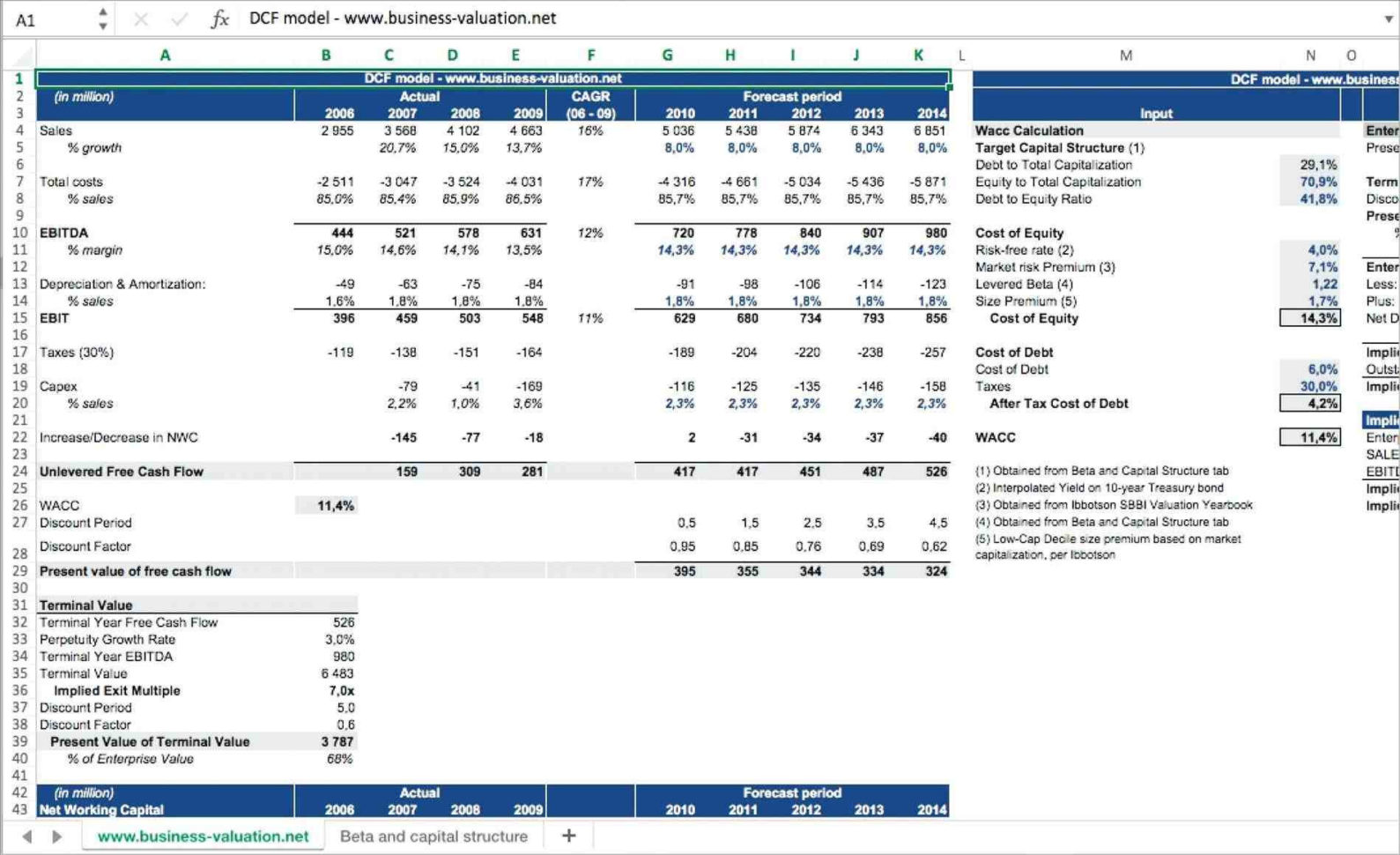

Net Present Value Excel Template - How to use the npv function in excel? How to calculate net present. Web net present value (npv) excel template helps you calculate the present value of a series of cash flows. Net present value is calculated using. Where n is the number of. Web npv = net present value; You can use our free npv calculator to calculate the net present value of up to 10 cash flows. Web step 1 calculate the value of the unlevered firm or project (vu), i.e. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web the npv function uses the following equation to calculate the net present value of an investment:

Best Net Present Value Formula Excel transparant Formulas

Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web net present value (npv) excel template helps you calculate the present value of a series of cash flows. How to use the npv function in excel? You can use our free npv calculator to calculate.

10 Excel Net Present Value Template Excel Templates

Web step 1 calculate the value of the unlevered firm or project (vu), i.e. Therefore, the formula structure was =npv (interest rate,cash flow year 1 to. The formula for npv is: To do this, discount the stream of fcfs by the unlevered cost of. Most financial analysts never calculate the net present value by hand nor with a calculator, instead,.

Net Present Value Excel Template

Web npv = net present value; The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Web to calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Web npv calculates that present value for each of the series.

Net Present Value Calculator Excel Template SampleTemplatess

How to calculate net present. Web to calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Similarly, we have to calculate it for other values. Web what is net present value (npv)? Web the npv function uses the following equation to calculate the net present value of an investment:

Professional Net Present Value Calculator Excel Template Excel TMP

Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Present value is among the topics included in the. Therefore, the formula structure was =npv (interest rate,cash flow year 1 to. It is used to determine the. Where n is the number of.

10 Excel Net Present Value Template Excel Templates

Where n is the number of. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. You can use our free npv calculator to calculate the net present value of up to 10 cash flows. F = future cash flow; This net present value template.

Net Present Value Excel Template

F = future cash flow; Web the npv function uses the following equation to calculate the net present value of an investment: Therefore, the formula structure was =npv (interest rate,cash flow year 1 to. Z1 = cash flow in time 1 z2 = cash flow in time 2 r = discount rate x0 = cash outflow in time 0 (i.e..

8 Npv Calculator Excel Template Excel Templates

Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web net present value excel template updated: Web how to use the npv formula in excel. First, we have to calculate the present value the output will be: April 12, 2022 net present value is used.

Professional Net Present Value Calculator Excel Template Excel

How to use the npv function in excel? Web to calculate the net present value (npv), our recommendation is to use the xnpv function in excel. F = future cash flow; Web step 1 calculate the value of the unlevered firm or project (vu), i.e. April 12, 2022 net present value is used in capital budgeting and investment planning so.

Net Present Value Calculator Excel Templates

First, we have to calculate the present value the output will be: This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web net present value excel template updated: Its value with all equity financing. Web net present value (npv) excel template helps you calculate the present value of a series.

To do this, discount the stream of fcfs by the unlevered cost of. You can use our free npv calculator to calculate the net present value of up to 10 cash flows. Net present value is calculated using. Net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. Present value is among the topics included in the. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web net present value (npv) excel template helps you calculate the present value of a series of cash flows. Web net present value template. Similarly, we have to calculate it for other values. How to use the npv function in excel? Z1 = cash flow in time 1 z2 = cash flow in time 2 r = discount rate x0 = cash outflow in time 0 (i.e. Web npv formula the formula for net present value is: Web the npv function uses the following equation to calculate the net present value of an investment: Its value with all equity financing. Web to calculate the net present value (npv), our recommendation is to use the xnpv function in excel. Most financial analysts never calculate the net present value by hand nor with a calculator, instead, they use excel. Web npv = net present value; Web how do you calculate net present value in excel? Web step 1 calculate the value of the unlevered firm or project (vu), i.e. Use this free excel template to easily calculate the npv.

You Can Use Our Free Npv Calculator To Calculate The Net Present Value Of Up To 10 Cash Flows.

It is used to determine the. Web step 1 calculate the value of the unlevered firm or project (vu), i.e. Its value with all equity financing. This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows.

Use This Free Excel Template To Easily Calculate The Npv.

April 12, 2022 net present value is used in capital budgeting and investment planning so that the profitability of a. Web the npv function uses the following equation to calculate the net present value of an investment: Net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. To do this, discount the stream of fcfs by the unlevered cost of.

N = The Number Of Periods In The Future;

F = future cash flow; Net present value is calculated using. Web net present value template. How to calculate net present.

The Net Present Value (Npv) Of An Investment Is The Present Value Of Its Future Cash Inflows Minus The Present Value Of The Cash Outflows.

Web npv formula the formula for net present value is: Web how do you calculate net present value in excel? Present value is among the topics included in the. First, we have to calculate the present value the output will be: