Itemized Donation List Printable

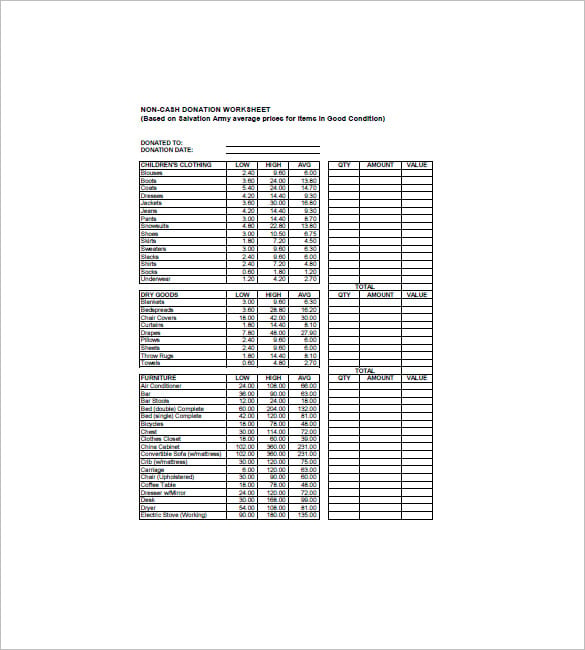

Itemized Donation List Printable - Web your receipts should include a reasonably accurate description of items donated. To help guide you, goodwill industries international has compiled a list providing price ranges for. Web under the irs itemized deduction section, the donors can have their cash or property donations reimbursed, specifically those that are above 250 dollars and are made to. Ad contributions worksheet form & more fillable forms, register and subscribe now! Web the irs requires an item to be in good condition or better to take a deduction. Sign it in a few clicks draw your. Web donation value guide all donations of appliances, electronics and equipment assumed to be working, and all clothing and furniture donations in good condition. Web generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized deductions. Save your time spent on printing, putting your signature on, and scanning a paper copy of itemized donation. But the actual rules for charitable deductions can.

Donation Itemized List Template For Your Needs

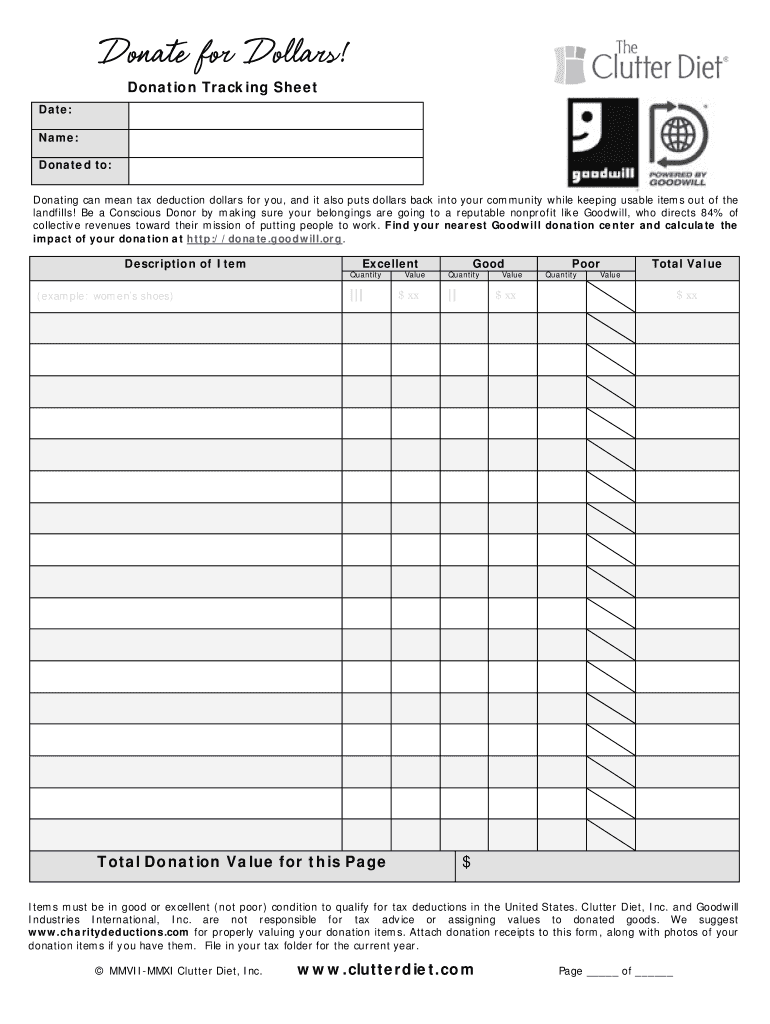

Upload, modify or create forms. Web following special tax law changes made earlier this year, cash donations of up to $300 made before december 31, 2020, are now deductible when people file their taxes in. Save your time spent on printing, putting your signature on, and scanning a paper copy of itemized donation. Internal revenue service (irs) requires donors to.

Itemized Donation List Printable Goodwill Master of

Try it for free now! Web donation value guide all donations of appliances, electronics and equipment assumed to be working, and all clothing and furniture donations in good condition. Publication 561 is designed to help donors and appraisers determine: Web generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized deductions. Web the.

itemized donation list printable 2017

Web generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized deductions. Ad your donation gives children the critical care they need to thrive while in poverty. Web the irs requires an item to be in good condition or better to take a deduction. The value of property (other than. But the actual.

10+ Donation Form Download [Word, Excel] 2019 Templates Study

Web under the irs itemized deduction section, the donors can have their cash or property donations reimbursed, specifically those that are above 250 dollars and are made to. Upload, modify or create forms. Discover the answers you need here! List templates 8+ donation list templates for all those who need donations, whether you are running a. There are a number.

Donation List Template 8+ Free Word, Excel, PDF Format Download

Web updated january 19, 2023 most people know that donating to charity can help them save on their income taxes. Web about publication 561, determining the value of donated property. One should prepare a list for each separate entity and date donations. Use get form or simply click on the template preview to open it in the editor. Ad search.

Itemized Donation List Printable Qualads

Try it for free now! Web about publication 561, determining the value of donated property. It includes low and high estimates. Web to claim your deduction, you must itemize deductions on your federal income tax return and provide a receipt from the salvation army that includes the amount of the donation and. Follow these steps to print the charitable contributions.

8 Tax Itemized Deduction Worksheet /

Web generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized deductions. Publication 561 is designed to help donors and appraisers determine: Over 60 yrs of experience helping children. List templates 8+ donation list templates for all those who need donations, whether you are running a. One should prepare a list for each.

Donation Tracking Template For Your Needs

Web following special tax law changes made earlier this year, cash donations of up to $300 made before december 31, 2020, are now deductible when people file their taxes in. Publication 561 is designed to help donors and appraisers determine: Web under the irs itemized deduction section, the donors can have their cash or property donations reimbursed, specifically those that.

Itemized Donation List Printable

Over 60 yrs of experience helping children. Use get form or simply click on the template preview to open it in the editor. Web about publication 561, determining the value of donated property. One should prepare a list for each separate entity and date donations. Web is there a way to print out the list of donated items in turbotax?

Itemized Donation List Printable

One should prepare a list for each separate entity and date donations. There are a number of tax deductions you can take in addition to your. But the actual rules for charitable deductions can. Web under the irs itemized deduction section, the donors can have their cash or property donations reimbursed, specifically those that are above 250 dollars and are.

List templates 8+ donation list templates for all those who need donations, whether you are running a. Ad your donation gives children the critical care they need to thrive while in poverty. Ad contributions worksheet form & more fillable forms, register and subscribe now! Over 60 yrs of experience helping children. To help guide you, goodwill industries international has compiled a list providing price ranges for. Try it for free now! Gifts to individuals are not. Edit your donation value guide online type text, add images, blackout confidential details, add comments, highlights and more. Discover the answers you need here! Web cocodoc collected lots of free itemized donation list printable for our users. Use get form or simply click on the template preview to open it in the editor. Web updated january 19, 2023 most people know that donating to charity can help them save on their income taxes. Web donation value guide all donations of appliances, electronics and equipment assumed to be working, and all clothing and furniture donations in good condition. But the actual rules for charitable deductions can. Web generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized deductions. It includes low and high estimates. Upload, modify or create forms. One should prepare a list for each separate entity and date donations. Save your time spent on printing, putting your signature on, and scanning a paper copy of itemized donation. There are a number of tax deductions you can take in addition to your.

The Value Of Property (Other Than.

Web submit itemized donation list printable 2023 in minutes, not hours. To help guide you, goodwill industries international has compiled a list providing price ranges for. Try it for free now! Over 60 yrs of experience helping children.

Web Under The Irs Itemized Deduction Section, The Donors Can Have Their Cash Or Property Donations Reimbursed, Specifically Those That Are Above 250 Dollars And Are Made To.

Web about publication 561, determining the value of donated property. You can edit these pdf forms online and download them on your computer for free. Upload, modify or create forms. Use get form or simply click on the template preview to open it in the editor.

Web Updated January 19, 2023 Most People Know That Donating To Charity Can Help Them Save On Their Income Taxes.

Web is there a way to print out the list of donated items in turbotax? Discover the answers you need here! Web the list of some common items, below, gives you an idea of what your donated clothing and household goods are worth, as suggested in the salvation army’s. Web your receipts should include a reasonably accurate description of items donated.

Ad Search For Answers From Across The Web With Searchandshopping.org.

Follow these steps to print the charitable contributions summary in turbotax online. Edit your donation value guide online type text, add images, blackout confidential details, add comments, highlights and more. Web to claim your deduction, you must itemize deductions on your federal income tax return and provide a receipt from the salvation army that includes the amount of the donation and. There are a number of tax deductions you can take in addition to your.

![10+ Donation Form Download [Word, Excel] 2019 Templates Study](https://www.americanstudents.us/wp-content/uploads/2019/02/DF-3-1.jpg)