Irs Mileage Template

Irs Mileage Template - Web washington — the internal revenue service today issued the 2021 optional standard mileage rates used to calculate the deductible costs of operating an. 31, 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the 58.5 cents per mile rate. See an overview of previous mileage rates. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Ad register and subscribe now to work on your icw med mileage expense & more fillable forms. Web designed to help you accurately record your business or personal travel, these templates provide a convenient way to keep track of mileage for reimbursement or tax purposes. Ad download or email mileage log & more fillable forms, register and subscribe now! Web your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. For example, a vehicle with $6,000 of expenses and 50 percent of total. Go paperless, fill & sign documents electronically.

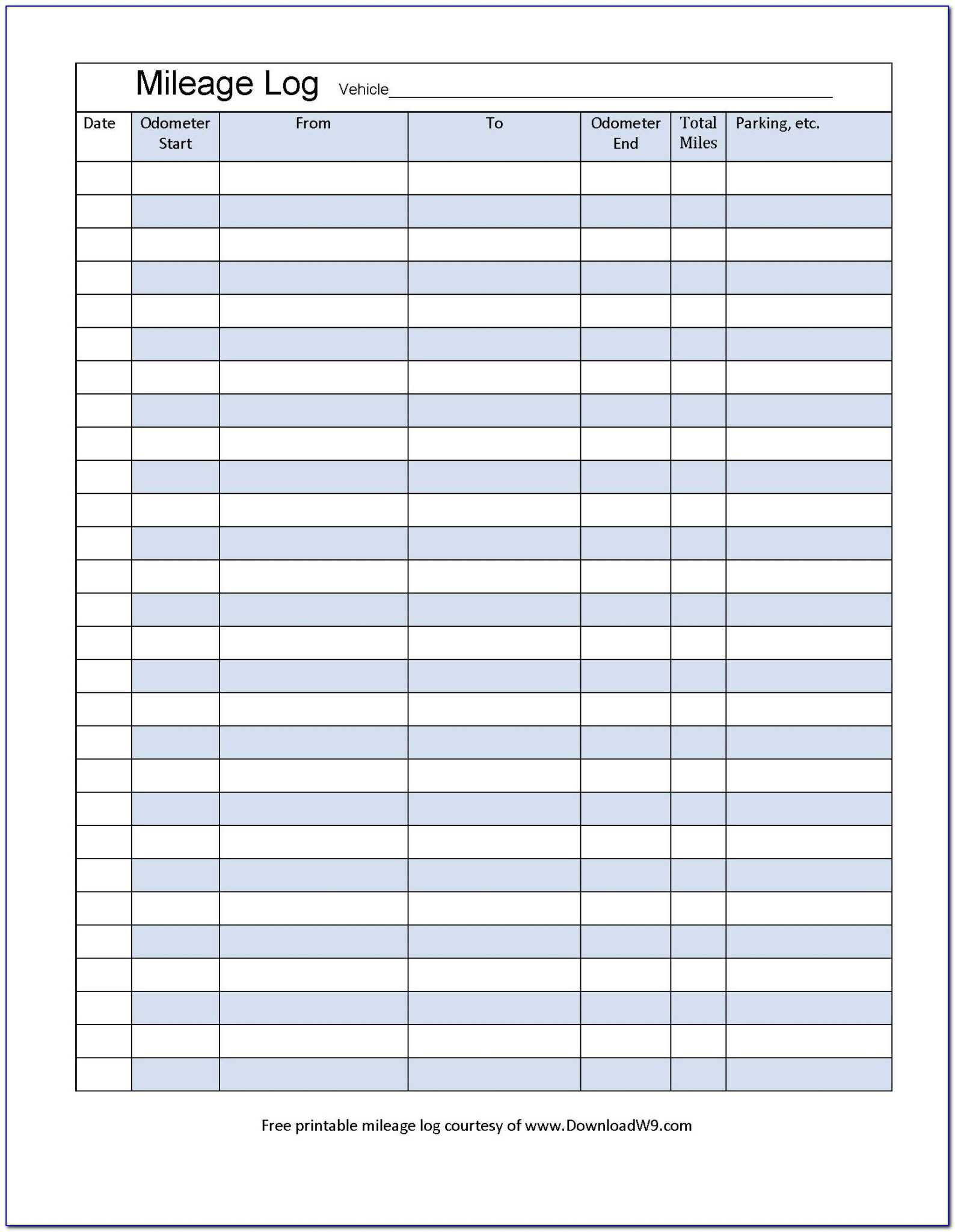

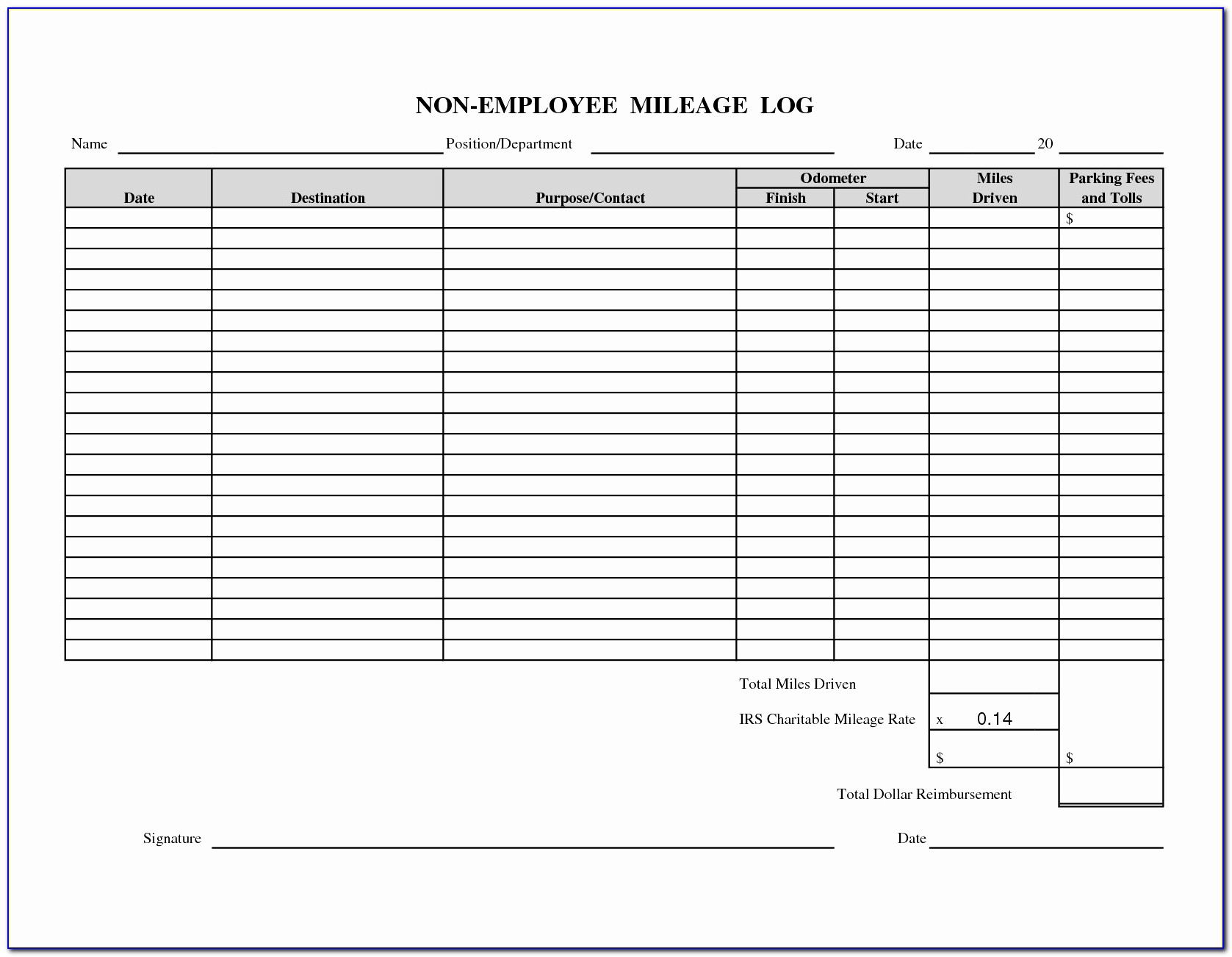

Irs Mileage Log Form Form Resume Examples e4K4V6Y5Qn With Mileage

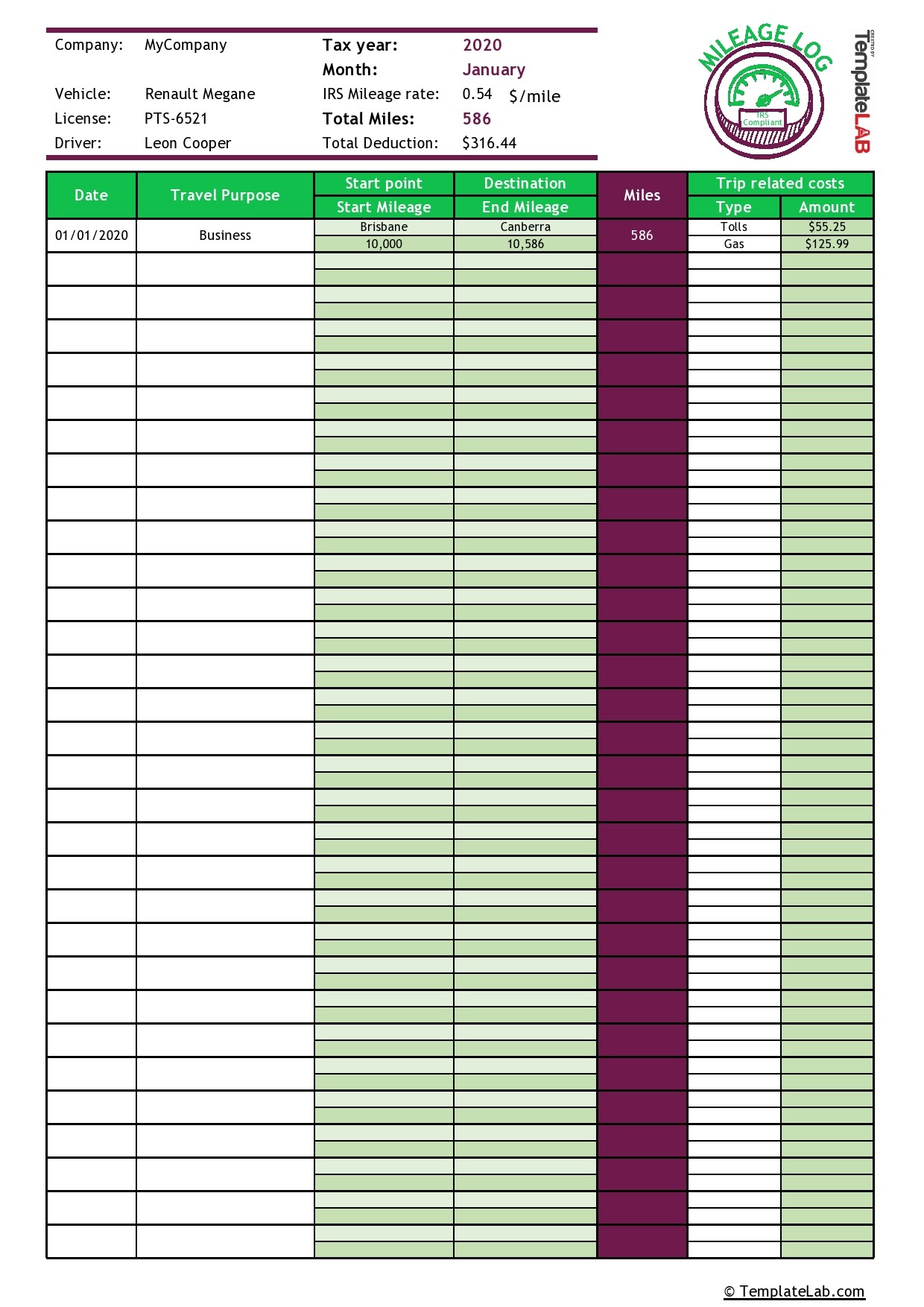

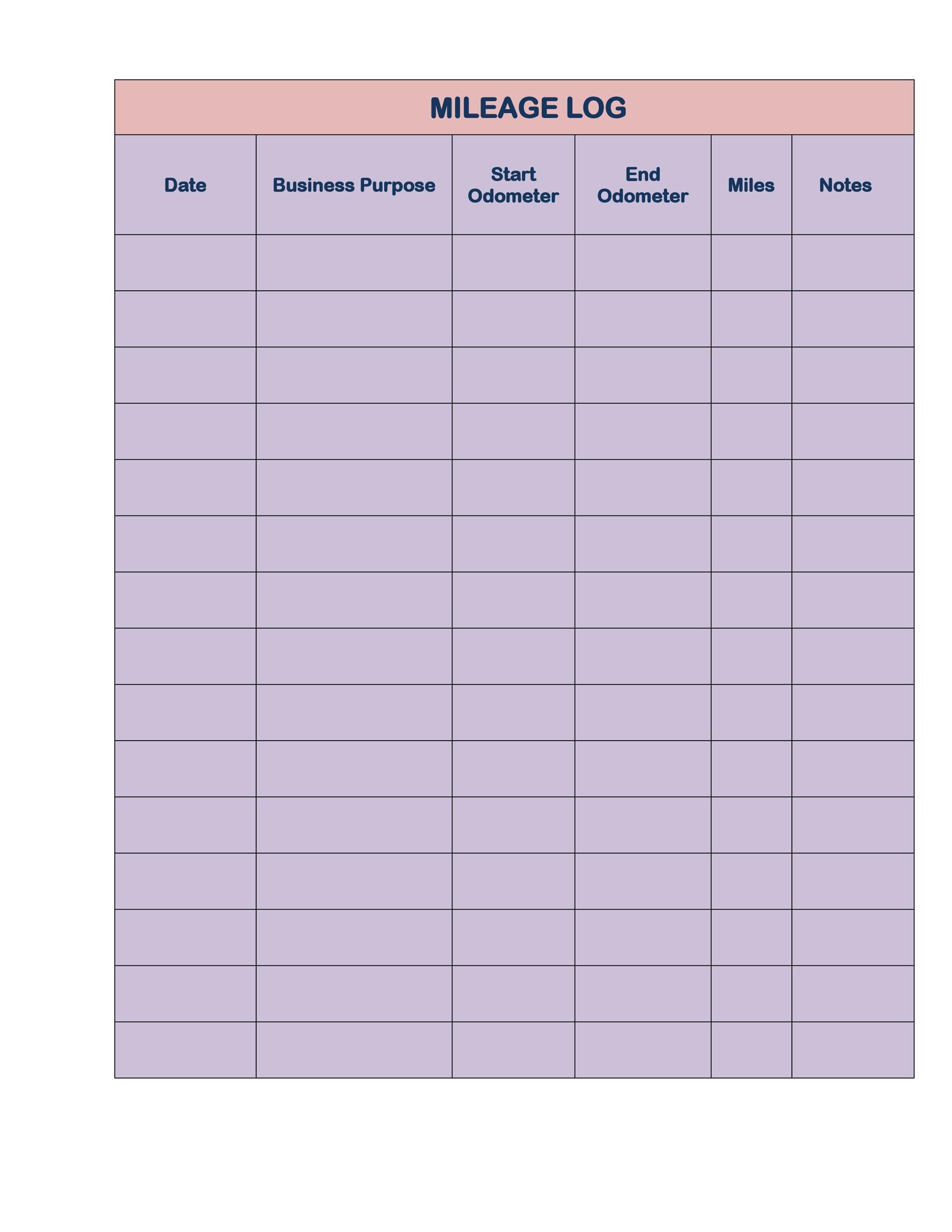

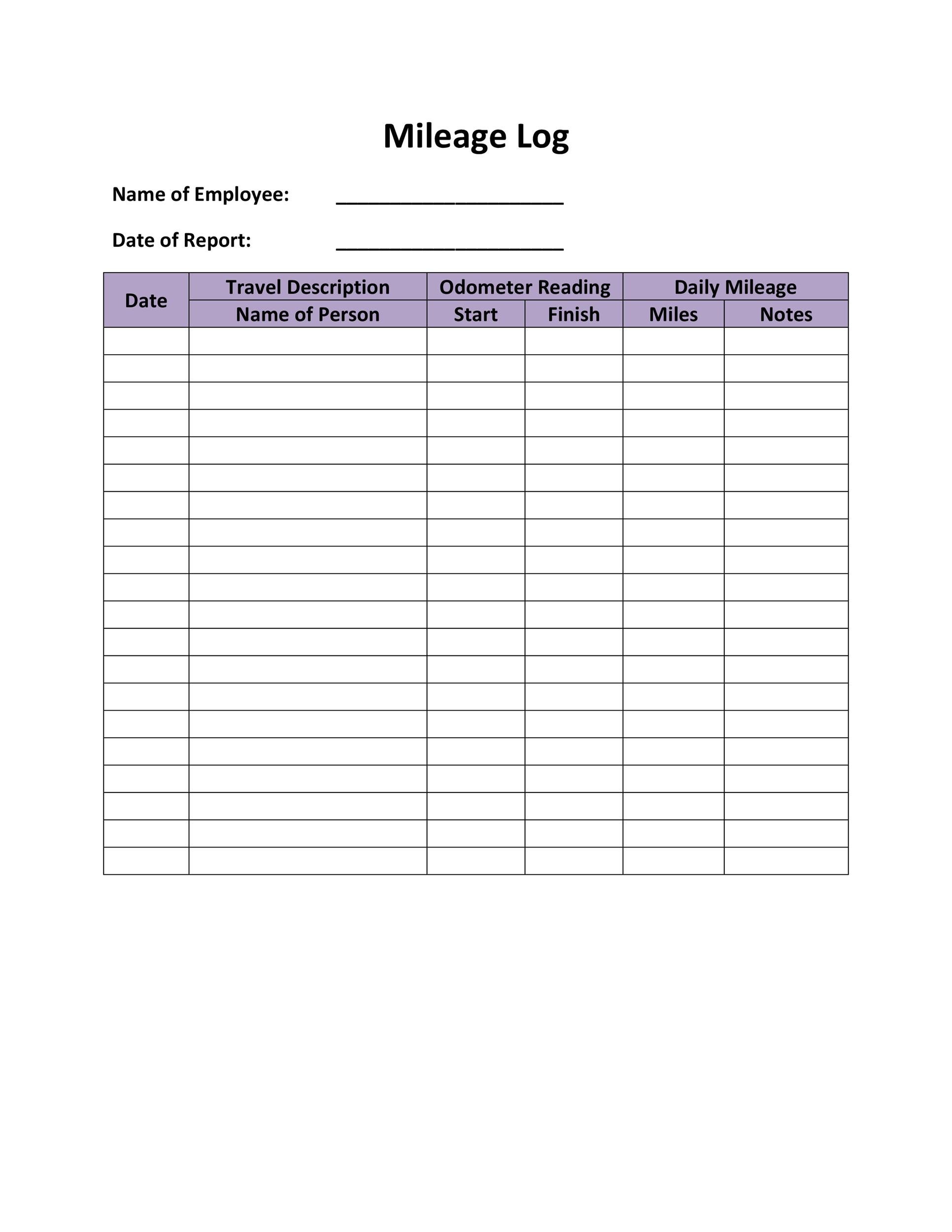

Use one of gofar mileage tracking templates to make your life easier when it comes to logging your daily, weekly, monthly or yearly business miles. In 2022, the mileage rate was 58.5 cents per mile. Avail of the best irs mileage log templates. Web washington — the internal revenue service today issued the 2021 optional standard mileage rates used to.

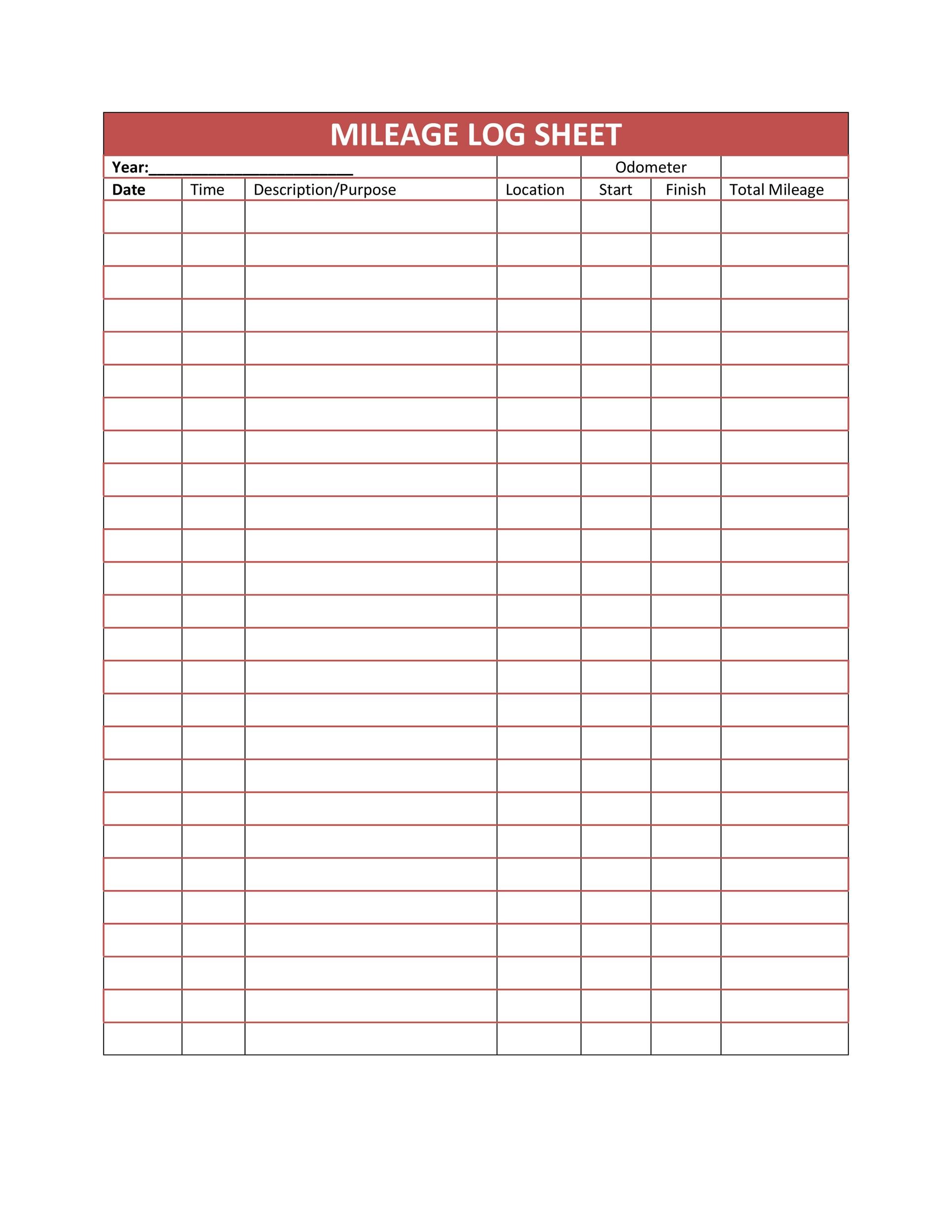

25 Printable IRS Mileage Tracking Templates GOFAR

As a rule of thumb, it is usually worth it to keep tax records that date back a long time, though at a minimum you should keep a. Upload, modify or create forms. Web the percentage of mileage on the vehicle for business is then deducted from the costs on your taxes. Web your mileage log and mileage logs can.

Irs Mileage Log Book Template Awesome Receipt Form Template Business

Web effective july 1 through dec. Web washington — the internal revenue service today issued the 2021 optional standard mileage rates used to calculate the deductible costs of operating an. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. See an overview of.

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

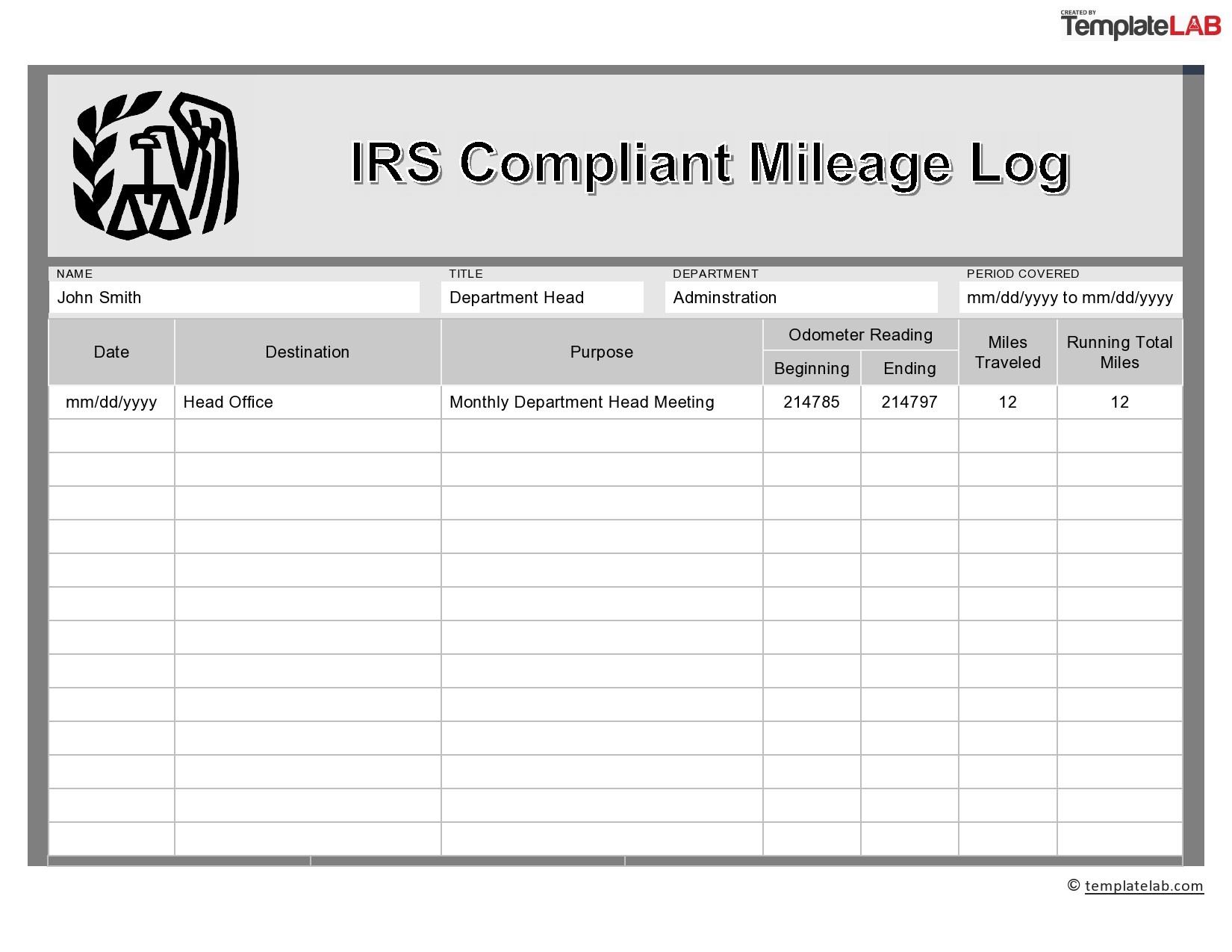

As a rule of thumb, it is usually worth it to keep tax records that date back a long time, though at a minimum you should keep a. Web how long should you keep your tax records? Ad register and subscribe now to work on your icw med mileage expense & more fillable forms. Web download irs compliant mileage log.

25 Printable Irs Mileage Tracking Templates Gofar In Mileage Report

Web your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. 31, 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the 58.5 cents per mile rate. Web effective july 1 through dec. Web our free mileage log templates will enable.

30 Printable Mileage Log Templates (Free) Template Lab

Remember to use the 2022 irs mileage rate if you log trips for last year. Web washington — the internal revenue service today issued the 2021 optional standard mileage rates used to calculate the deductible costs of operating an. Avail of the best irs mileage log templates. Free irish printable driven log form to upload. Web designed to help you.

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Web your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. Web how long should you keep your tax records? Web download irs compliant mileage log template 2022 (excel, openoffice calc & google sheets) we have created an irs compliant mileage log template with predefined. Web our free mileage log.

Irs Mileage Log Template shatterlion.info

Web the percentage of mileage on the vehicle for business is then deducted from the costs on your taxes. Web effective july 1 through dec. In 2022, the mileage rate was 58.5 cents per mile. Web your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. Go paperless, fill &.

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Ad register and subscribe now to work on your icw med mileage expense & more fillable forms. Ad download or email mileage log & more fillable forms, register and subscribe now! Web download irs compliant mileage log template 2022 (excel, openoffice calc & google sheets) we have created an irs compliant mileage log template with predefined. Web your mileage log.

Irs Mileage Log Template Excel For Your Needs

Go paperless, fill & sign documents electronically. Web the percentage of mileage on the vehicle for business is then deducted from the costs on your taxes. See an overview of previous mileage rates. Ad register and subscribe now to work on your icw med mileage expense & more fillable forms. Web download the free 2023 mileage log template as a.

Web how long should you keep your tax records? Web formula ( total miles) * (standard irs mileage rate) for example, if you drove 50 miles for your business in 2023, your mileage reimbursement calculation would. Web download irs compliant mileage log template 2022 (excel, openoffice calc & google sheets) we have created an irs compliant mileage log template with predefined. Web your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. Free irish printable driven log form to upload. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Web download the free 2023 mileage log template as a pdf, sheets or excel version also keep track of your trassen. Avail of the best irs mileage log templates. In 2022, the mileage rate was 58.5 cents per mile. Ad download or email mileage log & more fillable forms, register and subscribe now! For example, a vehicle with $6,000 of expenses and 50 percent of total. They are absolutely free of cost! 31, 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the 58.5 cents per mile rate. See an overview of previous mileage rates. Web 17 rows the following table summarizes the optional standard mileage rates for. Go paperless, fill & sign documents electronically. Try it for free now! Remember to use the 2022 irs mileage rate if you log trips for last year. Ad register and subscribe now to work on your icw med mileage expense & more fillable forms. Use one of gofar mileage tracking templates to make your life easier when it comes to logging your daily, weekly, monthly or yearly business miles.

Ad Register And Subscribe Now To Work On Your Icw Med Mileage Expense & More Fillable Forms.

For example, a vehicle with $6,000 of expenses and 50 percent of total. Web the percentage of mileage on the vehicle for business is then deducted from the costs on your taxes. Upload, modify or create forms. Free irish printable driven log form to upload.

See An Overview Of Previous Mileage Rates.

Web effective july 1 through dec. 31, 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the 58.5 cents per mile rate. Web download the free 2023 mileage log template as a pdf, sheets or excel version also keep track of your trassen. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses.

Use One Of Gofar Mileage Tracking Templates To Make Your Life Easier When It Comes To Logging Your Daily, Weekly, Monthly Or Yearly Business Miles.

Web designed to help you accurately record your business or personal travel, these templates provide a convenient way to keep track of mileage for reimbursement or tax purposes. Avail of the best irs mileage log templates. As a rule of thumb, it is usually worth it to keep tax records that date back a long time, though at a minimum you should keep a. Go paperless, fill & sign documents electronically.

Web How Long Should You Keep Your Tax Records?

Web 17 rows the following table summarizes the optional standard mileage rates for. Try it for free now! Web washington — the internal revenue service today issued the 2021 optional standard mileage rates used to calculate the deductible costs of operating an. They are absolutely free of cost!