Irs Form 9465 Printable

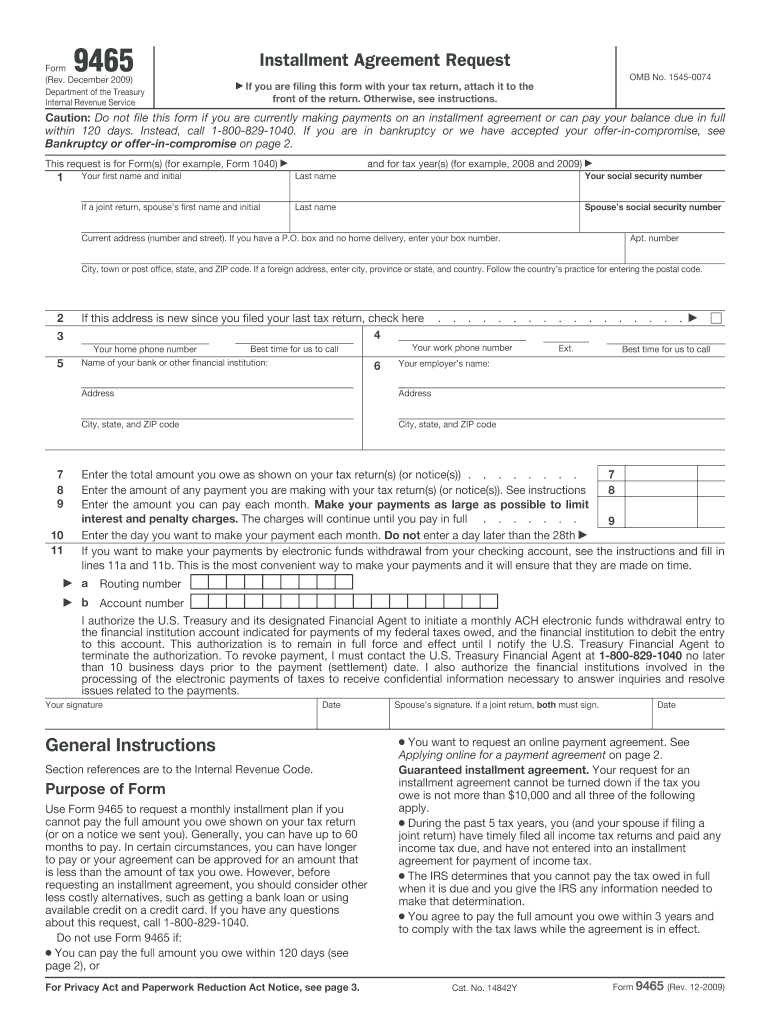

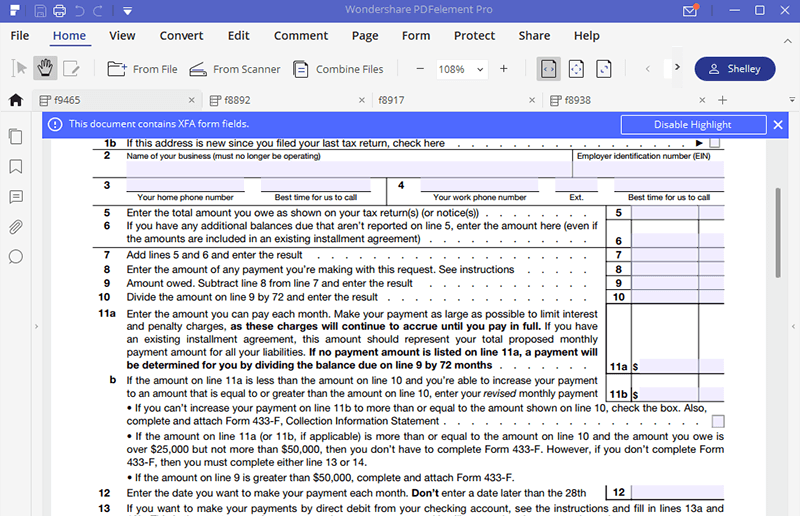

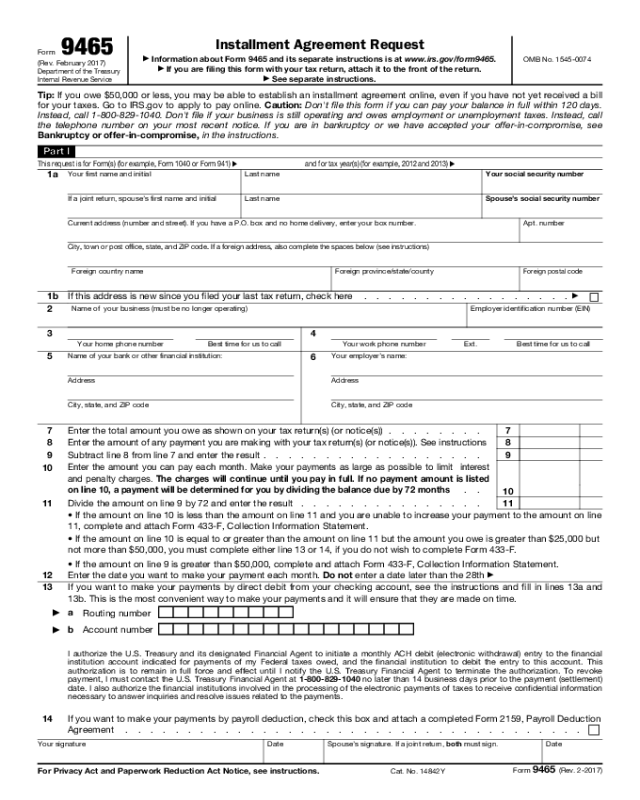

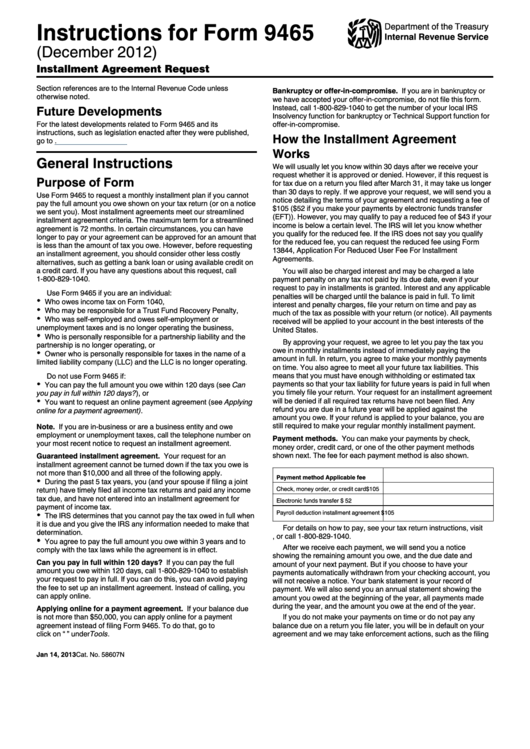

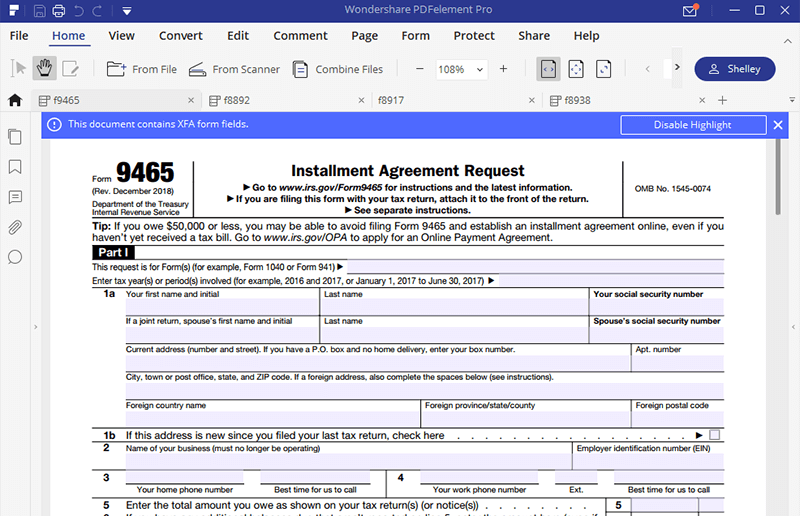

Irs Form 9465 Printable - For instructions and the latest information. Most installment agreements meet our streamlined installment agreement criteria. This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. From within your taxact return ( online ), click the print center dropdown, then click custom print. You can file form 9465 by itself, even if you've already filed your individual tax return. If you are filing this form with your tax return, attach it to the front of the return. If you are filing this form with your tax return, attach it to the front of the return.

2009 Form IRS 9465 Fill Online, Printable, Fillable, Blank pdfFiller

More about the federal form 9465 we last updated federal form 9465 in january 2023 from the federal internal revenue service. This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) No street address is needed. Web irs free file online: Web attach form 9465 to the front of.

Filling Out Money Order For Taxes Make Money Taking Surveys App

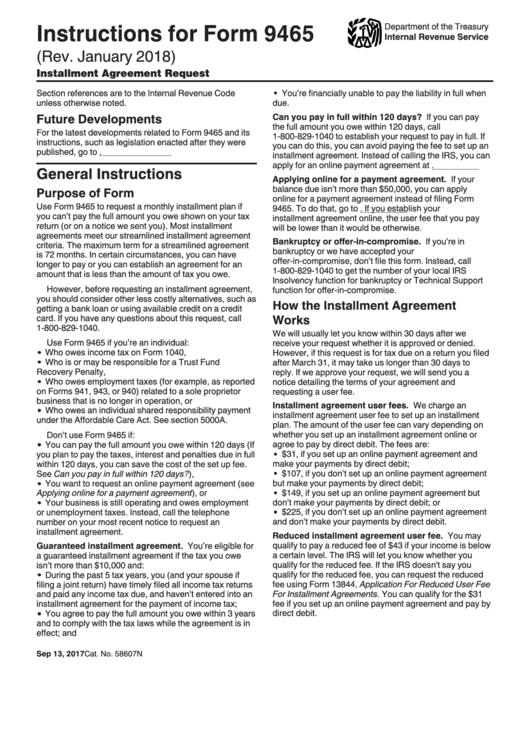

Web irs free file online: Download this form print this form more about the federal form 9465 individual income tax ty 2022 complete this form to request an installment payment agreement with the irs for unpaid taxes. February 2017) installment agreement request information about form 9465 and its separate instructions is at department of the treasury internal revenue service www.irs.gov/form9465..

Form 9465 Edit, Fill, Sign Online Handypdf

Most installment agreements meet our streamlined installment agreement criteria. To print and mail form 9465: Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe..

Instructions For Form 9465 (Rev. December 2012) printable pdf download

For instructions and the latest information. If you are filing this form with your tax return, attach it to the front of the return. Web irs free file online: Click print, then click the pdf link that is provided for printing. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file.

Irs Form 9465 Fs Universal Network

You can file form 9465 by itself, even if you've already filed your individual tax return. Answer the following questions to find an irs free file provider. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Web the irs encourages you to pay a portion of the amount you owe.

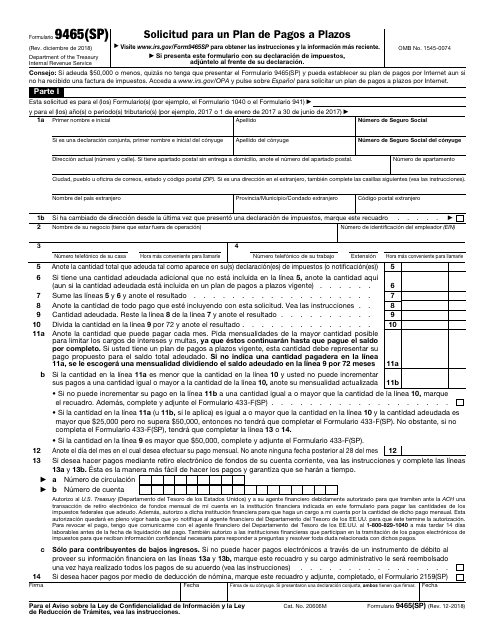

IRS Formulario 9465(SP) Download Fillable PDF or Fill Online Solicitud

If you have already filed your return or you are filing this form in response to a notice, file form 9465 by itself with the internal revenue service center at the address below for the place where you live. Web irs free file online: No street address is needed. Form 9465 is available in all versions of taxact ®. To.

Irs Form 9465 Fillable and Editable PDF Template

Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. To print and mail form 9465: Download this form print this form more about the federal form 9465 individual income tax ty 2022 complete this form to request an installment payment agreement with the irs for unpaid taxes. No street address.

Instructions For Form 9465 Installment Agreement Request printable

Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Form 9465 is available in all versions of taxact ®. Download this form print this form more about the federal form 9465 individual income tax ty 2022.

IRS Form 9465 Instructions for How to Fill it Correctly File

Click print, then click the pdf link that is provided for printing. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return.

IRS Form 9465 Installment Agreement Request Fill Online, Printable

Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or.

Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Answer the following questions to find an irs free file provider. To print and mail form 9465: Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. If you are filing this form with your tax return, attach it to the front of the return. Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. The maximum term for a streamlined agreement is 72 months. You can file form 9465 by itself, even if you've already filed your individual tax return. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). No street address is needed. December 2018) department of the treasury internal revenue service. Click print, then click the pdf link that is provided for printing. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Most installment agreements meet our streamlined installment agreement criteria. Download this form print this form more about the federal form 9465 individual income tax ty 2022 complete this form to request an installment payment agreement with the irs for unpaid taxes. For instructions and the latest information. This form is for income earned in tax year 2022, with tax returns due in april 2023. This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) More about the federal form 9465 we last updated federal form 9465 in january 2023 from the federal internal revenue service. From within your taxact return ( online ), click the print center dropdown, then click custom print.

This Request Is For Form(S) (For Example, Form 1040 Or Form 941) And For Tax Year(S) (For Example, 2010 And 2011)

If you are filing this form with your tax return, attach it to the front of the return. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. For instructions and the latest information. December 2018) department of the treasury internal revenue service.

Form 9465 Is Used By Taxpayers To Request A Monthly Installment Plan If They Cannot Pay The Full Amount Of Tax They Owe.

Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Most installment agreements meet our streamlined installment agreement criteria. If you are filing this form with your tax return, attach it to the front of the return. If you have already filed your return or you are filing this form in response to a notice, file form 9465 by itself with the internal revenue service center at the address below for the place where you live.

Most Installment Agreements Meet Our Streamlined Installment Agreement Criteria.

Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). From within your taxact return ( online ), click the print center dropdown, then click custom print. Answer the following questions to find an irs free file provider. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet.

Web The Irs Encourages You To Pay A Portion Of The Amount You Owe And Then Request An Installment For The Remaining Balance.

To print and mail form 9465: This form is for income earned in tax year 2022, with tax returns due in april 2023. More about the federal form 9465 we last updated federal form 9465 in january 2023 from the federal internal revenue service. February 2017) installment agreement request information about form 9465 and its separate instructions is at department of the treasury internal revenue service www.irs.gov/form9465.