Gross Receipts Template

Gross Receipts Template - Web small businesses need a dependable way to create receipts for customer purchases. Web business receipt template. In general, “total income” or “gross income” plus cost of goods sold = gross receipts. Cut storage and clutter costs. Create a high quality document now! The requirement to file a gross receipts template varies depending on. Formstemplates.com has been visited by 100k+ users in the past month Gross receipts components and rules can vary by state and municipality. It’s normally used for tax purposes. Web create and download professional sales receipts instantly with our free receipt generator.

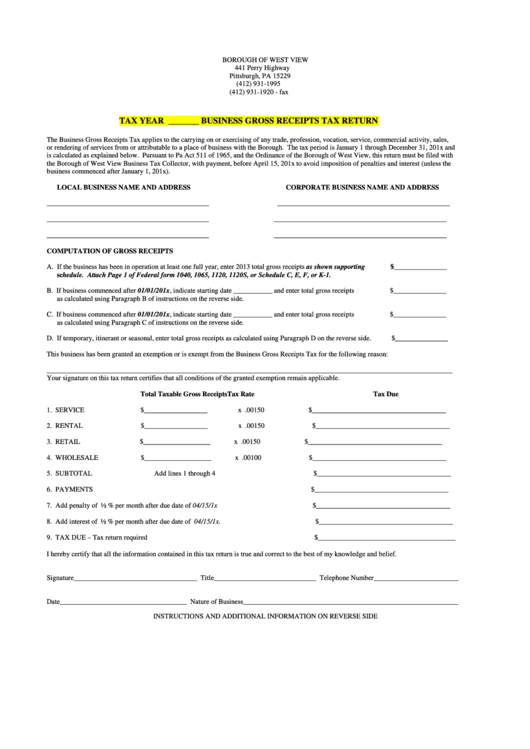

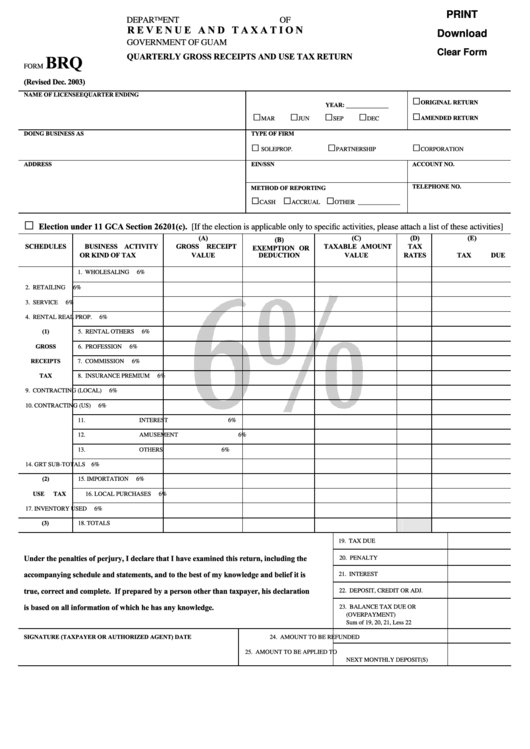

Business Gross Receipts Tax Return printable pdf download

Assisting documentation will oft include your cash register tapes, purchase books, or deposit information. Web basically, gross receipts are the total amount of revenue your business collects during the year. Ad create and send pdf receipts using 100 professional templates. Certified professional employer organizations (cpeos). Cut storage and clutter costs.

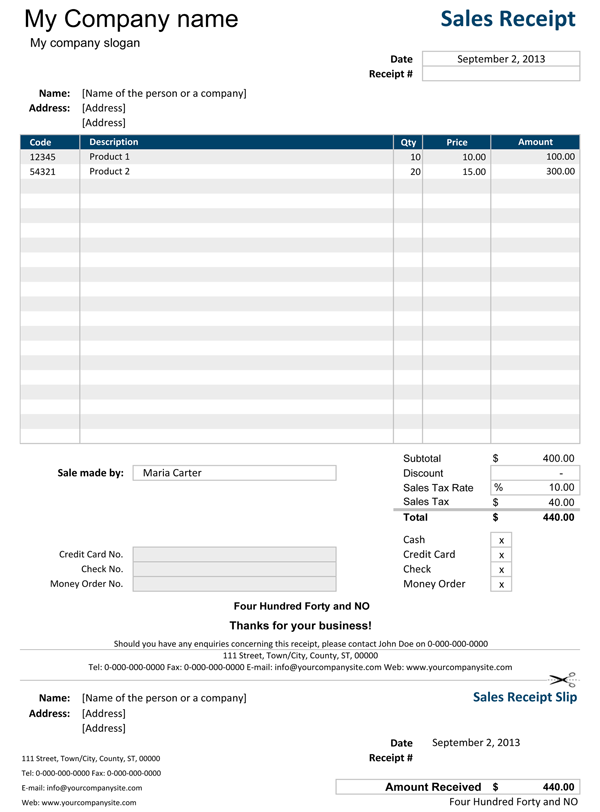

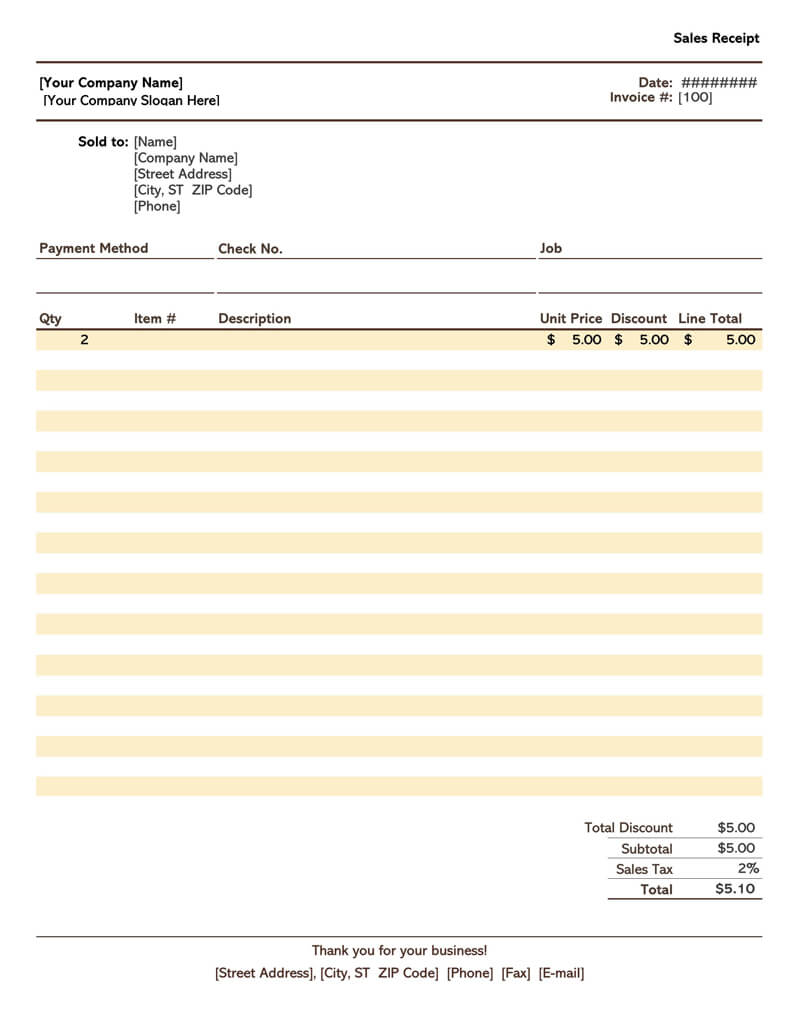

Payment Invoice Template Excel PDF Template

A gross receipt is typically filled. It’s normally used for tax purposes. Gross receipts components and rules can vary by state and municipality. Web international taxpayers governmental liaisons federal state local governments indian tribal governments tax exempt bonds gross receipts are the total amounts the organization received from all sources during its annual accounting period, without subtracting any costs or.

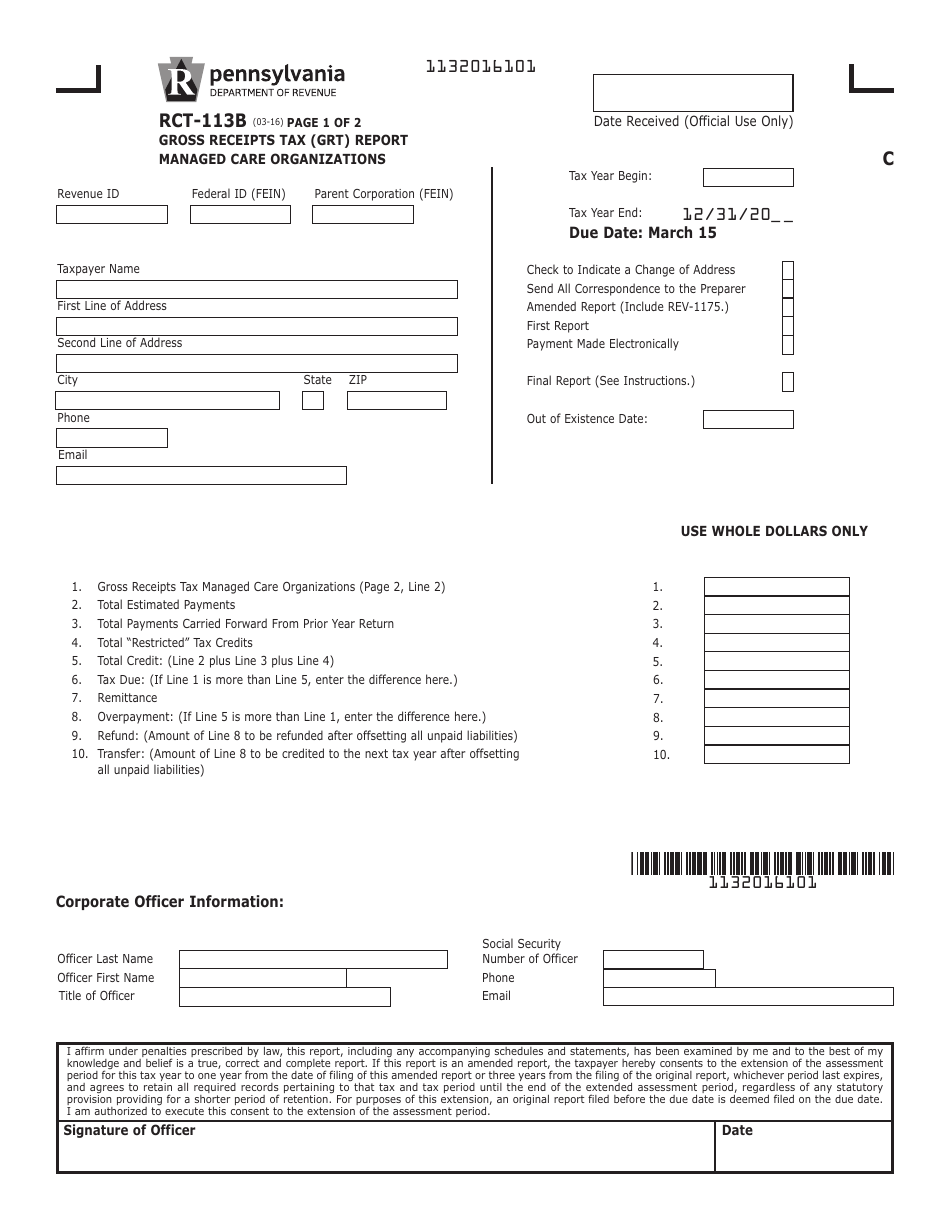

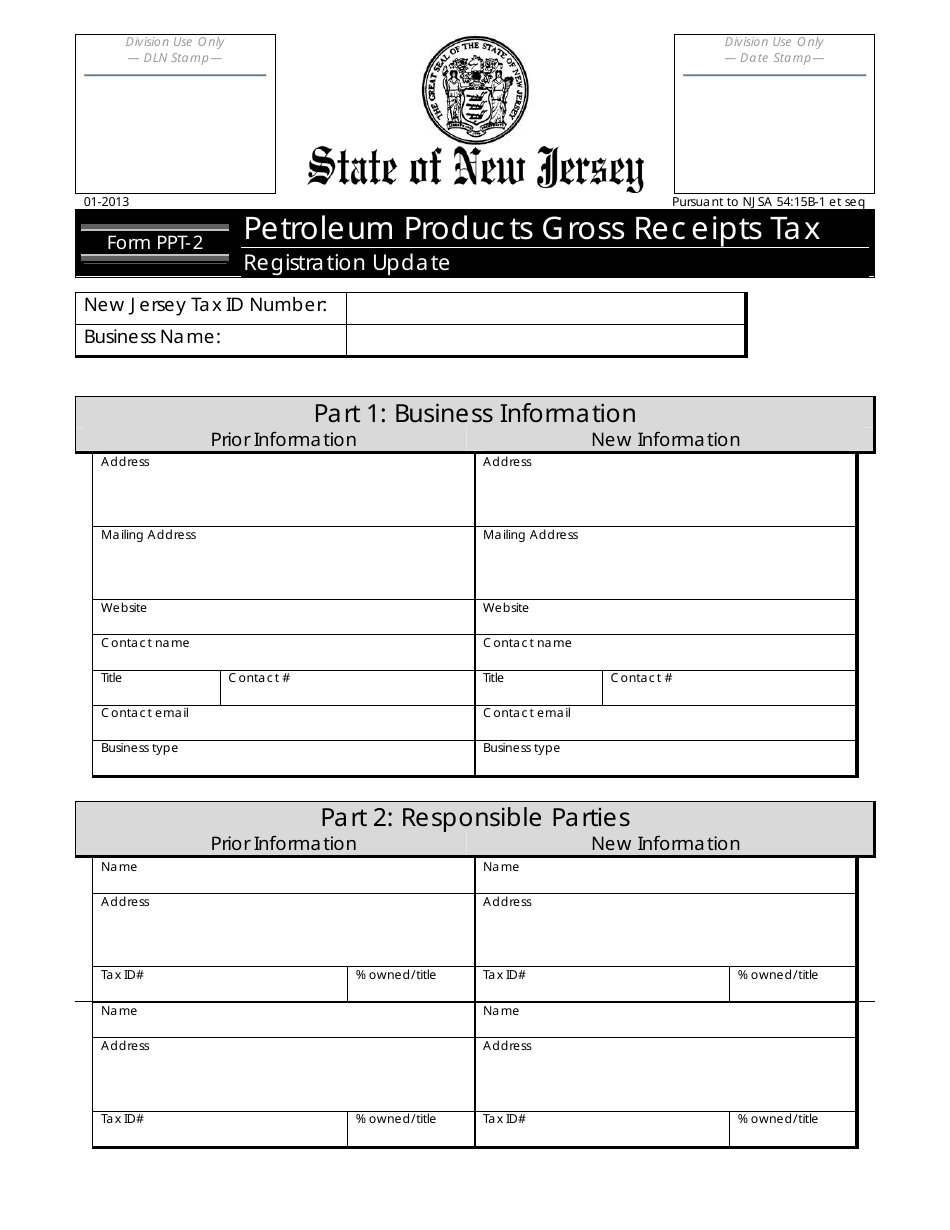

Form RCT113B Download Printable PDF or Fill Online Gross Receipts Tax

Certified professional employer organizations (cpeos). Page last reviewed or updated: You can easily download and share these fillable, printable templates for a variety of business types and use cases. A business receipt template is an acknowledgment of a payment received for a product or service provided by a company. To fill out gross receipts, you’ll need receipt books and deposit.

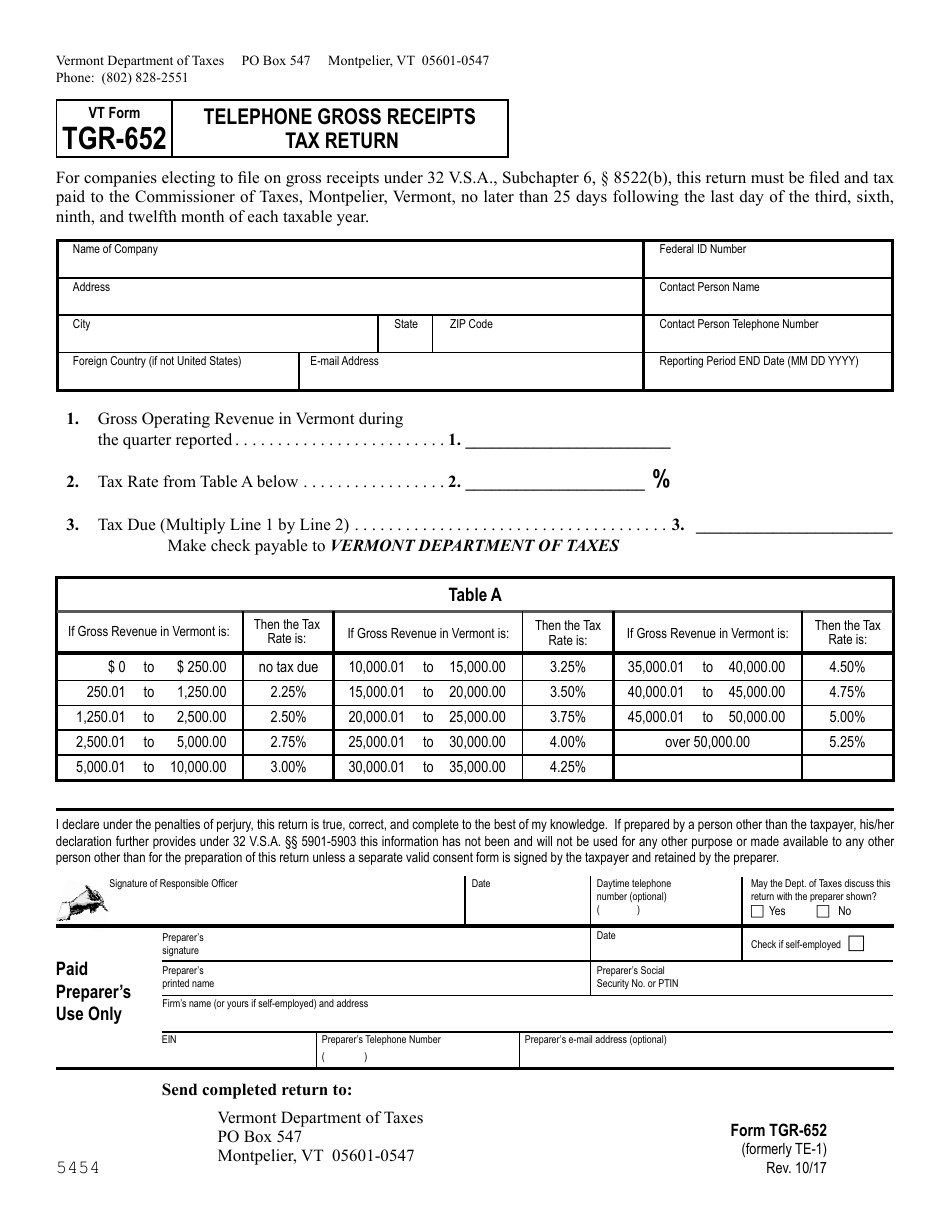

VT Form TGR652 Download Printable PDF or Fill Online Telephone Gross

Page last reviewed or updated: To fill out gross receipts, you’ll need receipt books and deposit information. A gross receipt is a form normally used for tax purposes. Web basically, gross receipts are the total amount of revenue your business collects during the year. Web create and download professional sales receipts instantly with our free receipt generator.

Fillable Form Brq Quarterly Gross Receipts And Use Tax Return

Web business receipt template. This printable expense report should be accompanied by receipts for each transaction listed. Web gross receipts or sales. Web a digital platform allows you to create a receipt from anywhere on the go with just a few clicks. Page last reviewed or updated:

Excel Spreadsheet Receipt Template Excel Templates

How to fill out gross receipts template? A gross receipt the a form normally used for tax application. Certified professional employer organizations (cpeos). This printable expense report should be accompanied by receipts for each transaction listed. Computers shows all of the proceeds you’ve received from your business — detailing that sources of that income and the amounts gainful.

Form PPT2 Download Fillable PDF or Fill Online Petroleum Products

Page last reviewed or updated: Web up to $40 cash back what is gross receipts template? In general, “total income” or “gross income” plus cost of goods sold = gross receipts. It shows all of the income you’ve received from your business — detailing the sources of that income and the amounts paid. Web a digital platform allows you to.

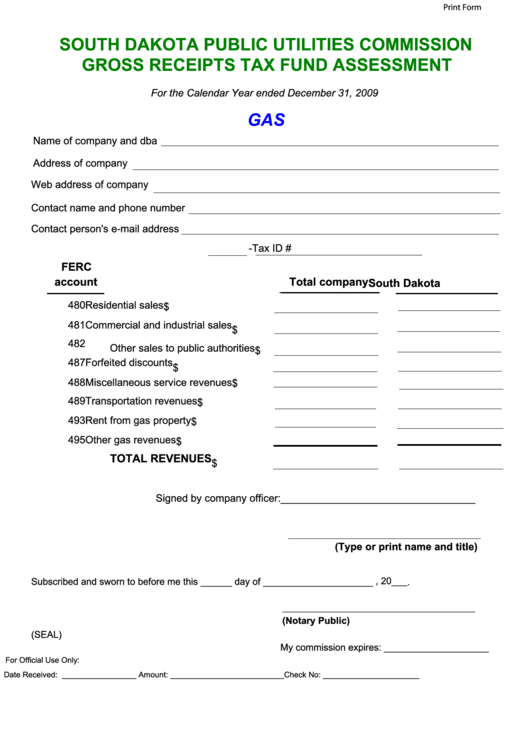

Fillable Gross Receipts Tax Fund Assessment Form 2009 printable pdf

This printable expense report should be accompanied by receipts for each transaction listed. Web by andy marker | march 8, 2022 in this article, you’ll find a comprehensive collection of free microsoft word receipt templates. For small merchants who attend outdoor events frequently, digital receipts are a good option. This is a receipt that shows the income provided to you.

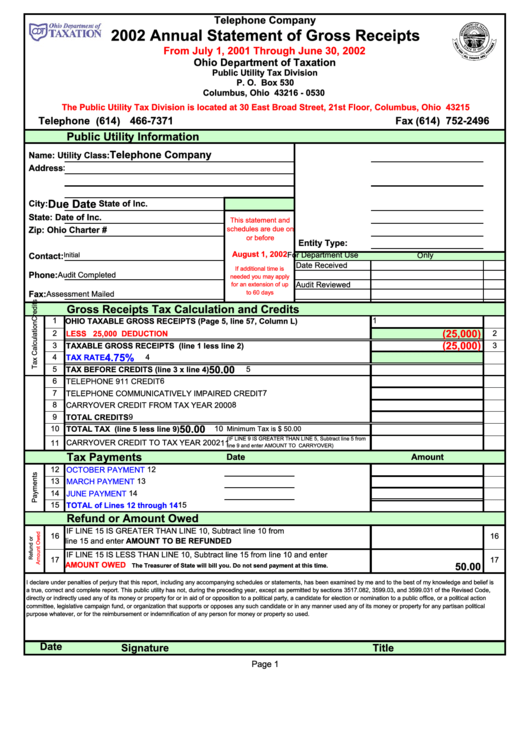

Annual Statement Of Gross Receipts Form 2002 printable pdf download

Assisting documentation will oft include your cash register tapes, purchase books, or deposit information. A gross receipt the a form normally used for tax application. Web gross receipt templates. This can be used for tracking monthly credit card expenses and to support. Who is required to file gross receipts template?

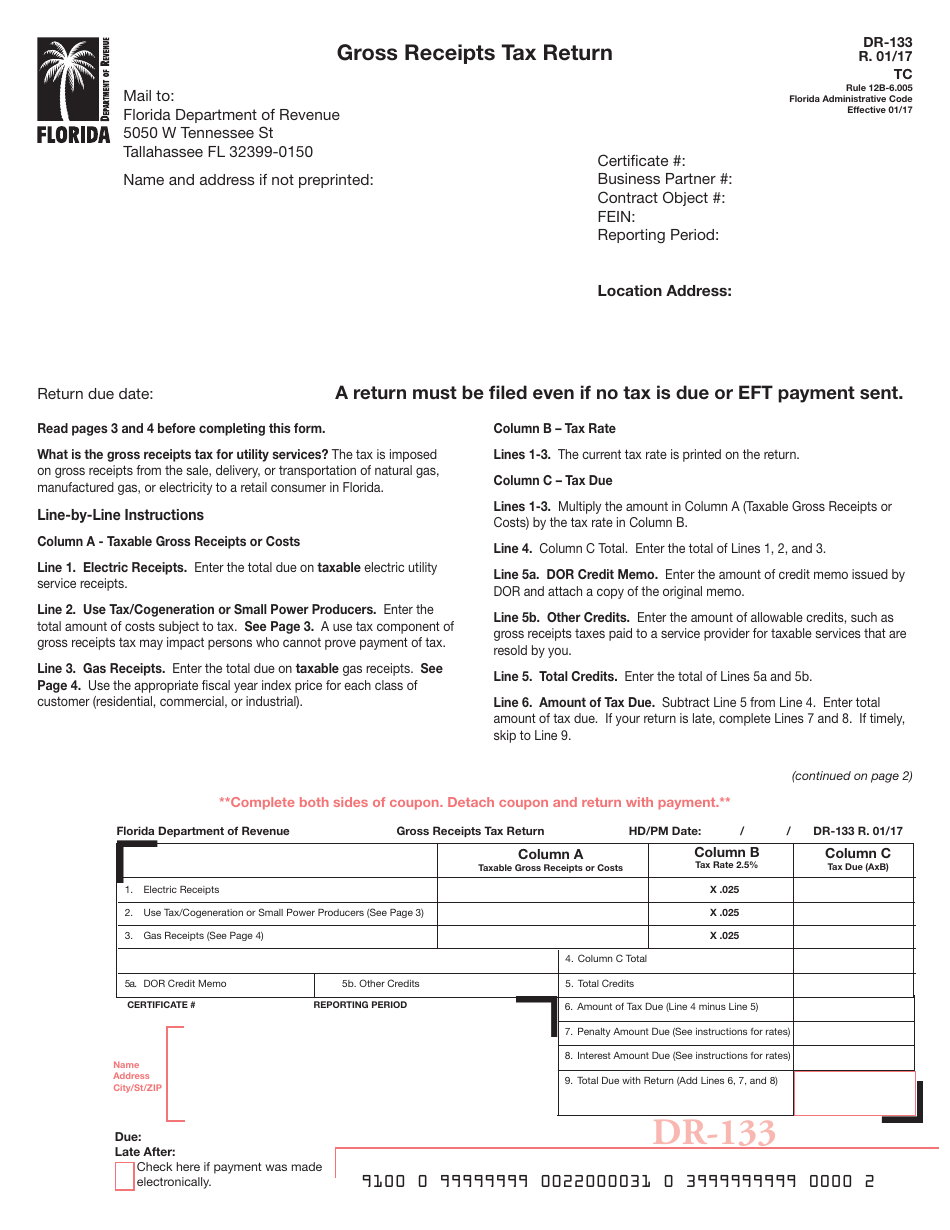

Form DR133 Download Printable PDF or Fill Online Gross Receipts Tax

Create a high quality document now! Web compare 2019 irs income tax return to 2020 tax return. Web by andy marker | march 8, 2022 in this article, you’ll find a comprehensive collection of free microsoft word receipt templates. Some government authorities send gross receipt templates to businesses for them to fill it out. A gross receipt is typically filled.

To ensure you understand what your state or locality considers gross receipts, consult your state or city. Page last reviewed or updated: In general, “total income” or “gross income” plus cost of goods sold = gross receipts. It shows all of the income you’ve received from your business — detailing the sources of that income and the amounts paid. The records must be kept for 3 years after the due date of the return or statement to which they relate. This printable expense report should be accompanied by receipts for each transaction listed. Web business receipt template. This is a receipt that shows the income provided to you by your business. How to fill out gross receipts template? Enter the transaction details, customize the template, and easily print, or download the sales receipt as pdf. Web up to $40 cash back what is gross receipts template? Web by andy marker | march 8, 2022 in this article, you’ll find a comprehensive collection of free microsoft word receipt templates. Web compare 2019 irs income tax return to 2020 tax return. Computers shows all of the proceeds you’ve received from your business — detailing that sources of that income and the amounts gainful. Web international taxpayers governmental liaisons federal state local governments indian tribal governments tax exempt bonds gross receipts are the total amounts the organization received from all sources during its annual accounting period, without subtracting any costs or expenses. Use this free fillable and printable receipt template to fill in all necessary information for detailed, official customer receipts, and keep a physical or electronic copy for your records. A business receipt template is an acknowledgment of a payment received for a product or service provided by a company. Web a digital platform allows you to create a receipt from anywhere on the go with just a few clicks. Create a high quality document now! A gross receipts template is a standardized document or form used to record and track.

A Gross Receipt Is Typically Filled.

A gross receipts template is a standardized document or form used to record and track. Web create and download professional sales receipts instantly with our free receipt generator. Formstemplates.com has been visited by 100k+ users in the past month To ensure you understand what your state or locality considers gross receipts, consult your state or city.

This Can Be Used For Tracking Monthly Credit Card Expenses And To Support.

Cut storage and clutter costs. Web basically, gross receipts are the total amount of revenue your business collects during the year. Web a digital platform allows you to create a receipt from anywhere on the go with just a few clicks. You can easily download and share these fillable, printable templates for a variety of business types and use cases.

Web Business Receipt Template.

A gross receipt is a form normally used for tax purposes. Page last reviewed or updated: A device and a connection to the internet are all you need to create and send receipts. Certified professional employer organizations (cpeos).

A Gross Receipt The A Form Normally Used For Tax Application.

This template automatically provides a subtotal based on all item totals. The requirement to file a gross receipts template varies depending on. It’s normally used for tax purposes. You must keep records to substantiate any information returns, employer statements to employees, or tip allocations.