Futures Contract Template

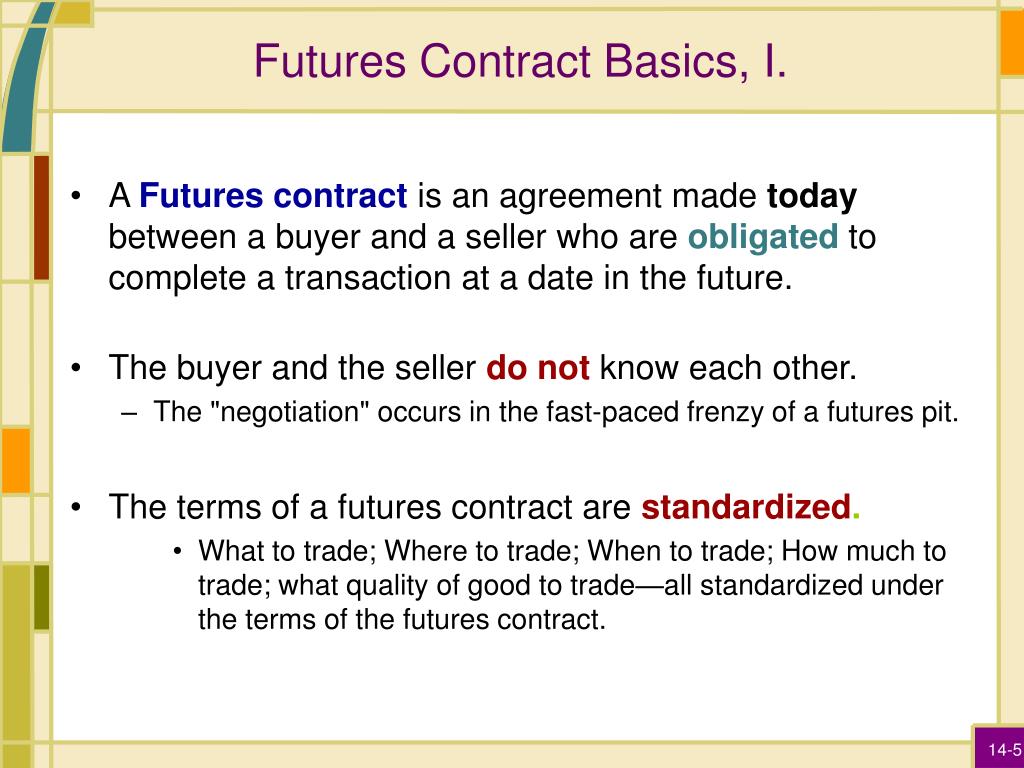

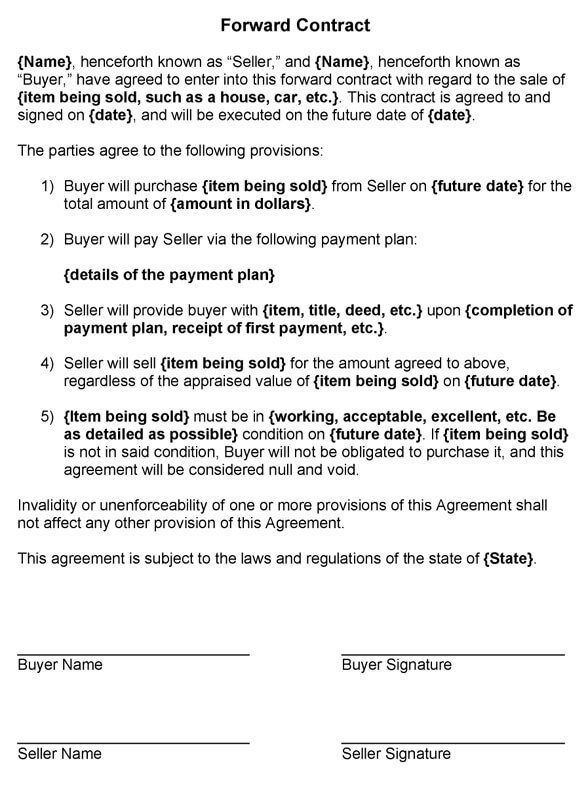

Futures Contract Template - Which can be in the form of a commodities, stocks, currency, metals, bonds, or any other securities. Web futures contracts are agreements made for an underlying asset; First, a futures contract is a legally binding agreement to buy or sell a standardized. It’s also known as a derivative because future. These contracts have expiration dates and set prices. Ad easily make your business document and get attorney document review for free. Web a futures contract is an agreement to either buy or sell an asset on a publicly traded exchange. The contract specifies when the seller will deliver the asset. (called the underlying asset or just underlying) in. Upon receipt of instructions, the custodian shall enter into a futures margin procedural agreement among the appropriate fund, the custodian and the.

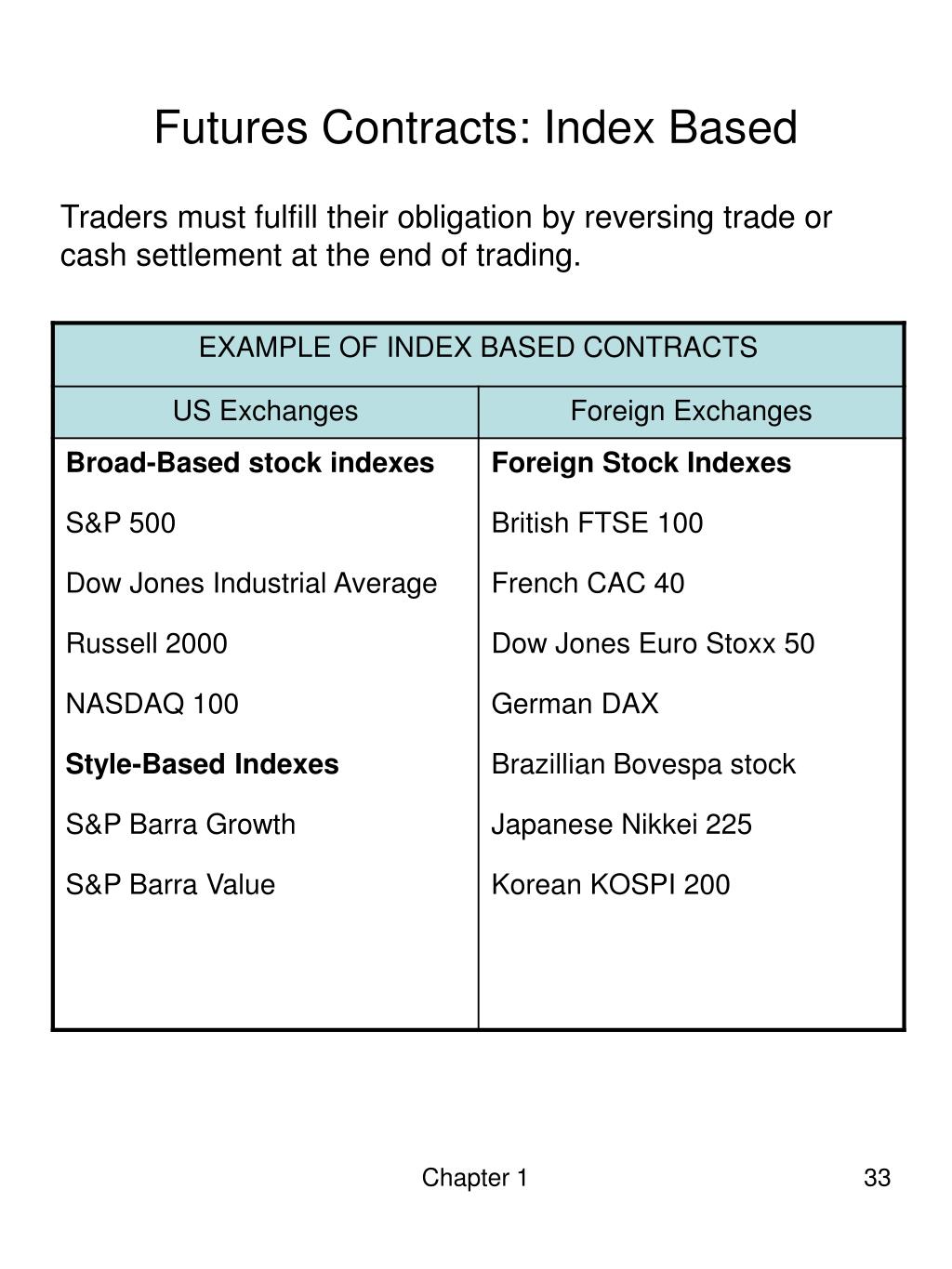

Stock Index Futures or Options Contract Futures Contract Hedge

Web a futures contract is an agreement to buy or sell an agreed upon quantity of an underlying asset, at a specified date, for a stated price. Ad easily make your business document and get attorney document review for free. Confidently manage your business operations using our free, customizable documents. Web in finance, a futures contract (sometimes called futures) is.

Forward Contract Futures Contract Derivative (Finance)

This article will cover what a. Ad edit, fill & esign pdf documents online. There are four common types:. Web in finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the. Upon receipt of instructions, the custodian shall enter into a.

840203 Futures Contract Option (Finance)

Ad edit, fill & esign pdf documents online. Futures contracts are standardized for quality and quantity to facilitate trading on a futures exchange. (called the underlying asset or just underlying) in. A futures contract is a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. These contracts.

PPT CHAPTER 1 Futures Markets Introduction PowerPoint Presentation

Web futures contracts are agreements made for an underlying asset; Web the outstanding futures contract calculator helps you determine your profit or loss, whether you are long or short in the futures market. Web if, in five months’ time when the futures contract expires, the spot price is still $1,700 a tonne, the writer of the contract owes you $100.

PPT CHAPTER 1 Futures Markets Introduction PowerPoint Presentation

The danger is always that. Web a futures contract is a legal agreement that binds a buyer and a seller to trade specific assets at a predetermined price and date in the future. Ad a diverse offering of futures & futures options products. Web an equity futures contract is a financial arrangement between two counterparties to buy or sell equity.

PPT Futures Contracts PowerPoint Presentation, free download ID6723715

Web the outstanding futures contract calculator helps you determine your profit or loss, whether you are long or short in the futures market. (called the underlying asset or just underlying) in. Web futures—also called futures contracts— allow traders to lock in the price of the underlying asset or commodity. The danger is always that. First, a futures contract is a.

How do forex swaps work? India Dictionary

The contract specifies when the seller will deliver the asset. Web how does the future contract work? Web a futures contract is an agreement to buy or sell an underlying asset at a later date for a predetermined price. Web a futures contract is an agreement to either buy or sell an asset on a publicly traded exchange. Upon receipt.

Futures on Commodity Trading Example & Introduction Options, Futures

Tools that can help create, optimize, & automate any futures trading strategy. Web futures account agreement nuveen long/short commodity total return fund amended version 7.2015 thank you for your interest in opening a futures trading account with sg. So, while the price of oil is. Ad a diverse offering of futures & futures options products. Web a futures contract is.

PPT Futures Markets PowerPoint Presentation, free download ID1473978

Web if, in five months’ time when the futures contract expires, the spot price is still $1,700 a tonne, the writer of the contract owes you $100 per tonne. Futures contracts are standardized for quality and quantity to facilitate trading on a futures exchange. The buyer of a futures contract is taking on the. Web the washington commanders and the rest.

What Are Futures And Should You Invest In Them? Rocket HQ

Web the outstanding futures contract calculator helps you determine your profit or loss, whether you are long or short in the futures market. The buyer of a futures contract is taking on the. Web futures account agreement nuveen long/short commodity total return fund amended version 7.2015 thank you for your interest in opening a futures trading account with sg. Web.

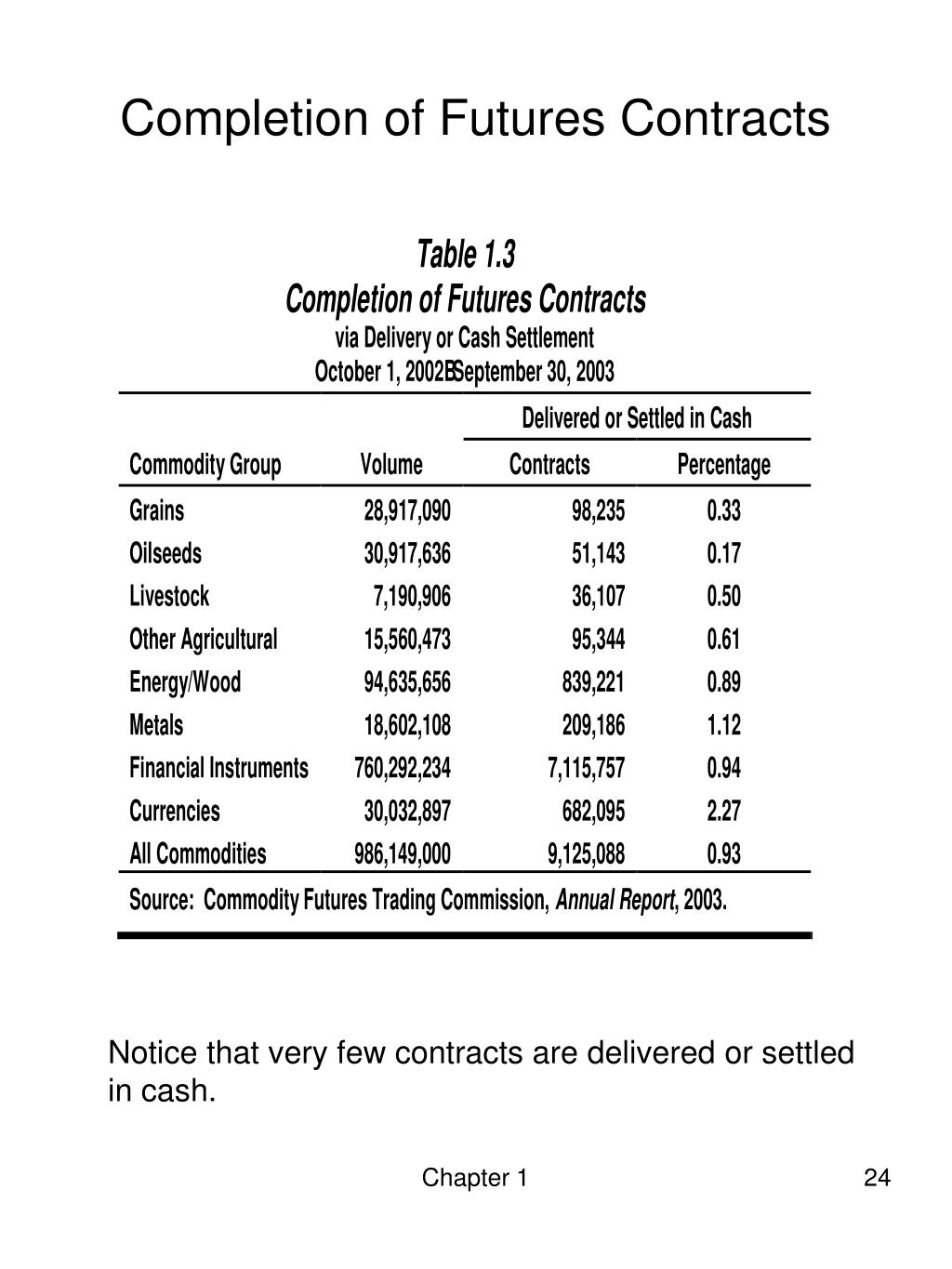

Web the washington commanders and the rest of the nfl are making moves as they work their way through a season of ups and downs and news and views. A futures contract is a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. Answer simple questions to create custom legal contracts unique to you. The following paper covers the fundamentals of futures contracts. These contracts have expiration dates and set prices. Confidently manage your business operations using our free, customizable documents. Web a futures contract is distinct from a forward contract in two important ways: Web futures account agreement nuveen long/short commodity total return fund amended version 7.2015 thank you for your interest in opening a futures trading account with sg. The danger is always that. Web a futures contract is a legal agreement that binds a buyer and a seller to trade specific assets at a predetermined price and date in the future. It’s also known as a derivative because future. Web the outstanding futures contract calculator helps you determine your profit or loss, whether you are long or short in the futures market. Web a futures contract is an agreement to buy or sell an agreed upon quantity of an underlying asset, at a specified date, for a stated price. Which can be in the form of a commodities, stocks, currency, metals, bonds, or any other securities. The buyer of a futures contract is taking on the. Conveniently collected and displayed for easy reference,. First, a futures contract is a legally binding agreement to buy or sell a standardized. Ad edit, fill & esign pdf documents online. Upon receipt of instructions, the custodian shall enter into a futures margin procedural agreement among the appropriate fund, the custodian and the. Web if, in five months’ time when the futures contract expires, the spot price is still $1,700 a tonne, the writer of the contract owes you $100 per tonne.

These Contracts Have Expiration Dates And Set Prices.

Web the washington commanders and the rest of the nfl are making moves as they work their way through a season of ups and downs and news and views. Web futures contracts are agreements made for an underlying asset; The danger is always that. Web abstract futures contracts are widely utilized throughout the investment universe, but not always understood.

Web A Futures Contract Is A Contract Between Two Parties To Exchange Assets Or Services At A Specified Time In The Future At A Price Agreed Upon At The Time Of The Contract.

(called the underlying asset or just underlying) in. Web a futures contract is an agreement to buy or sell an underlying asset at a later date for a predetermined price. Web futures—also called futures contracts— allow traders to lock in the price of the underlying asset or commodity. Web learn how to calculate profit and loss for futures contracts and why it is important to know, with specific examples.

It’s Also Known As A Derivative Because Future.

The following paper covers the fundamentals of futures contracts. First, a futures contract is a legally binding agreement to buy or sell a standardized. Ad easily make your business document and get attorney document review for free. Ad edit, fill & esign pdf documents online.

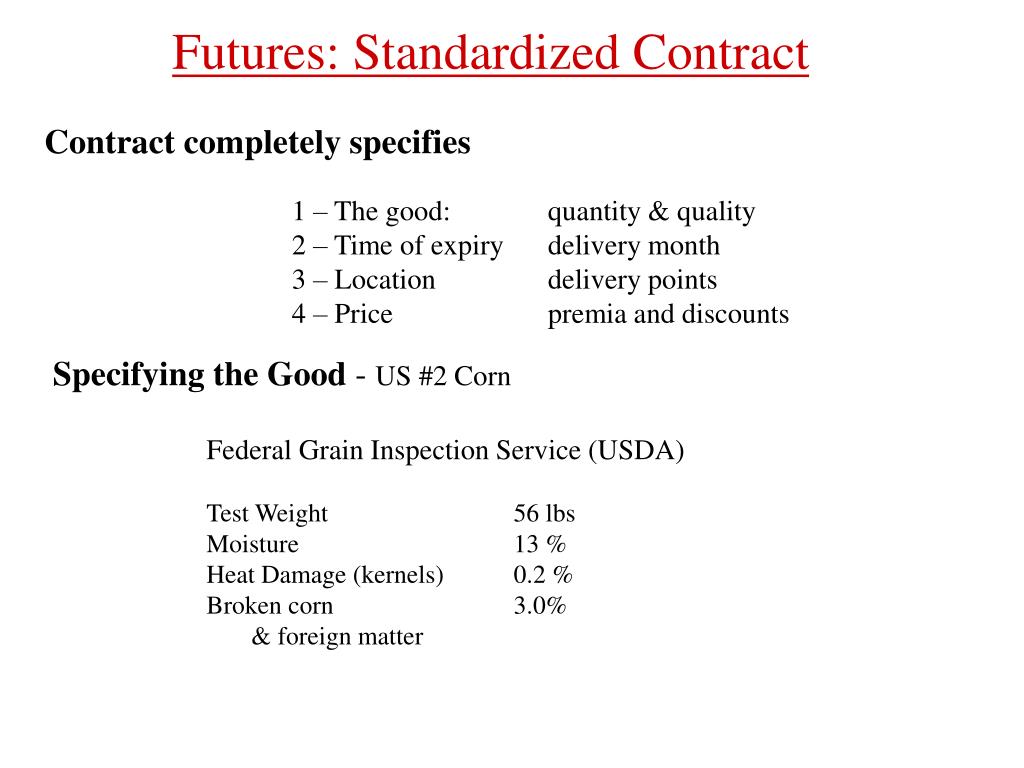

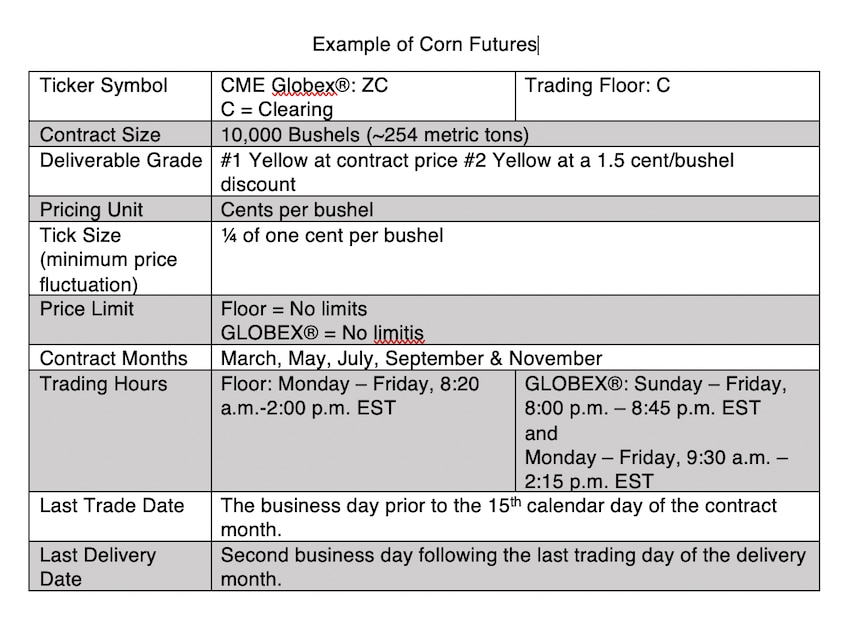

Futures Contracts Are Standardized For Quality And Quantity To Facilitate Trading On A Futures Exchange.

Upon receipt of instructions, the custodian shall enter into a futures margin procedural agreement among the appropriate fund, the custodian and the. There are four common types:. The contract specifies when the seller will deliver the asset. Web a futures contract is an agreement to either buy or sell an asset on a publicly traded exchange.