Form 1065 Printable

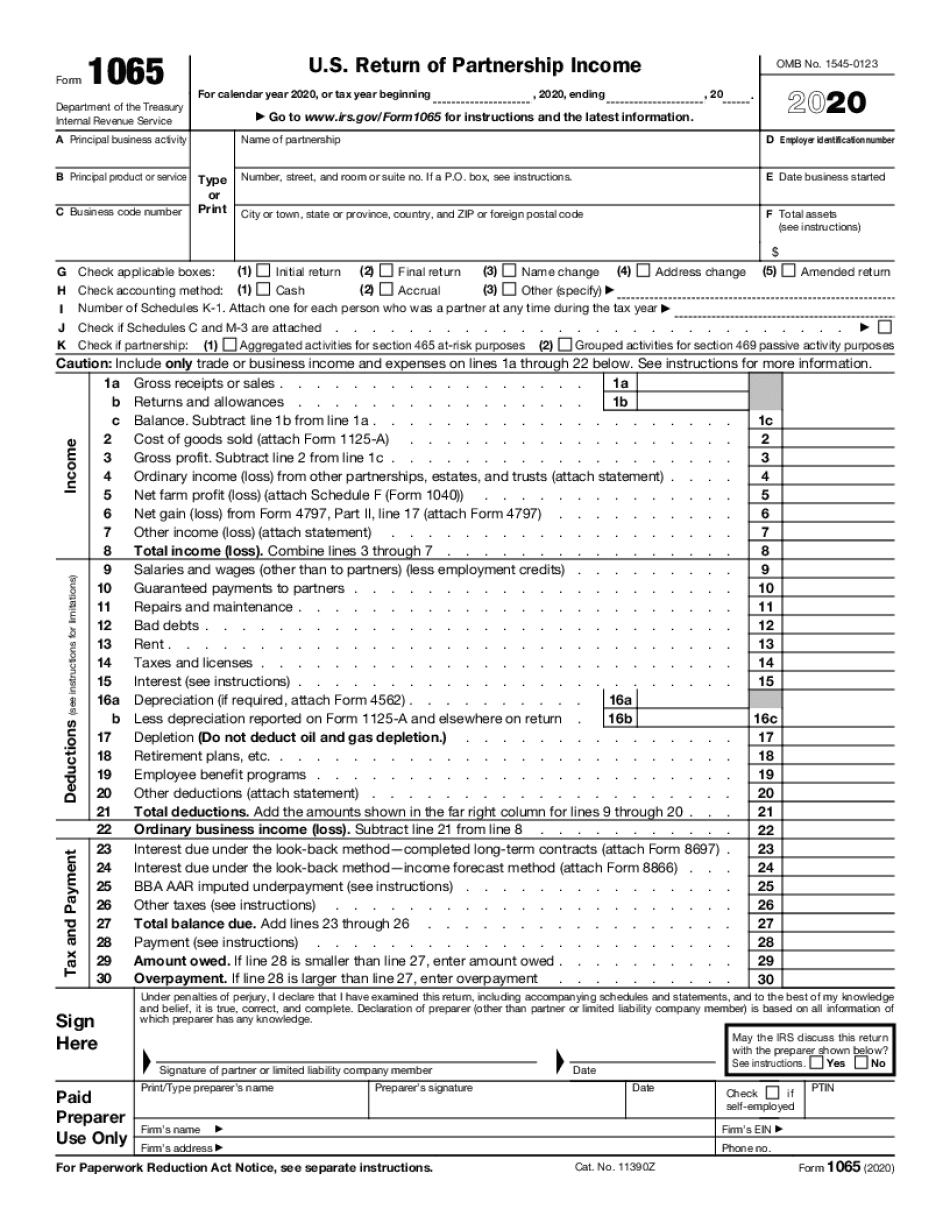

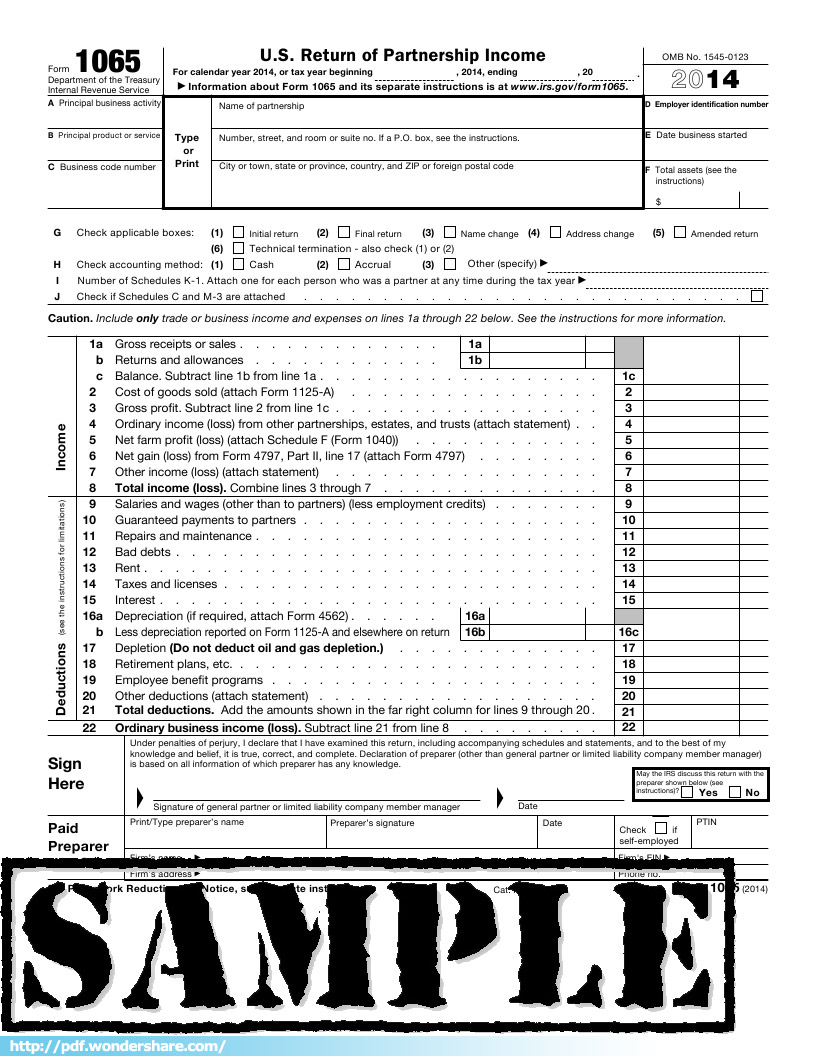

Form 1065 Printable - Web go to www.irs.gov/form1065 for instructions and the latest information. Ad complete irs tax forms online or print government tax documents. Web it is the member’s responsibility to consider and apply any applicable limitations. Get ready for tax season deadlines by completing any required tax forms today. Web go to www.irs.gov/form1065 for instructions and the latest information. More about the federal form 1065 we last updated. Web schedule d (form 1065) department of the treasury internal revenue service. Department of the treasury internal revenue service. For calendar year 2022, or tax year beginning / / 2022. Web the law allows a credit against the personal income tax to a taxpayer, other than a partnership, that is a partner, shareholder, or member of a qualified entity that elects to.

Form 1065 tax return neuqlero

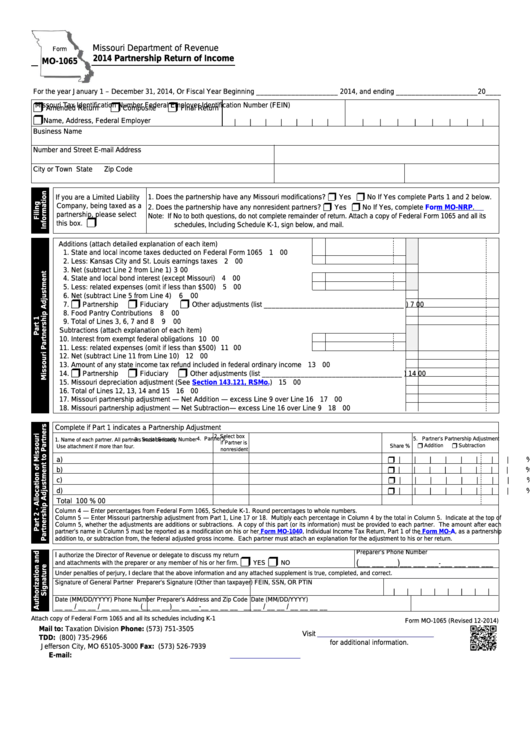

Web go to www.irs.gov/form1065 for instructions and the latest information. Web 1 gross business profitsround to the nearest whole dollar 1(a) enter the amount of ordinary business income (loss) reported on federal form 1065, schedule k, line 1 1(a). For ira partners, the partnership reports the ein of the ira's custodian in item e on the partner's schedule k. If.

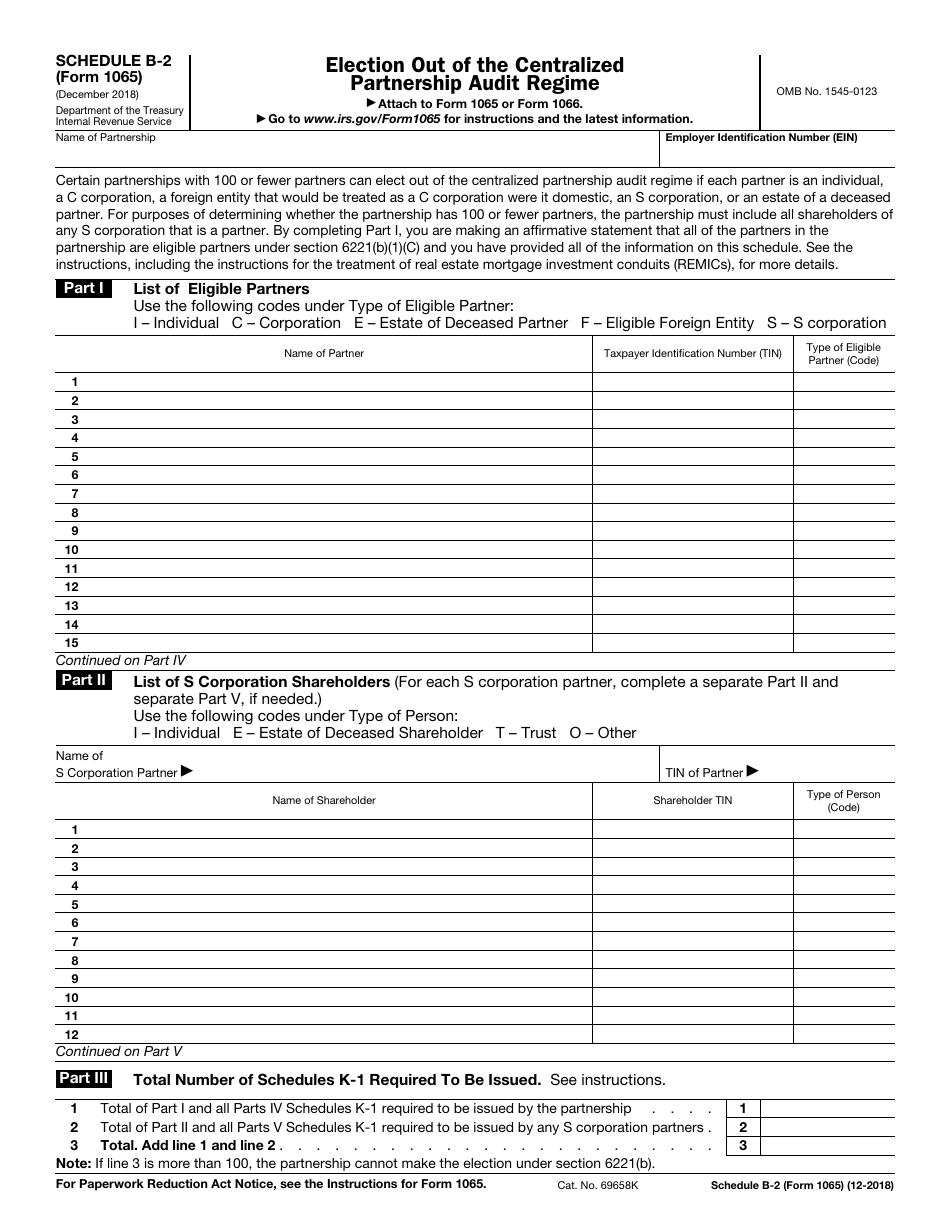

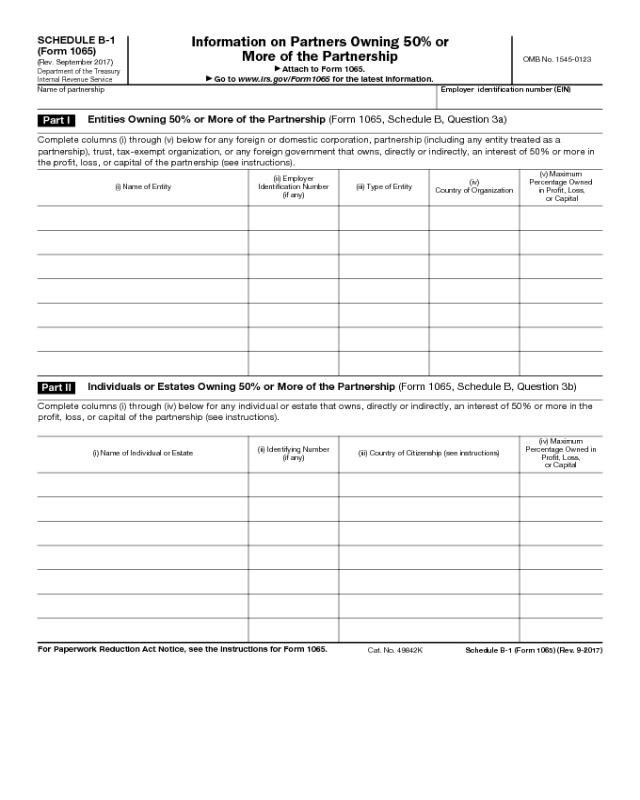

Form 1065 Schedule B1 Edit, Fill, Sign Online Handypdf

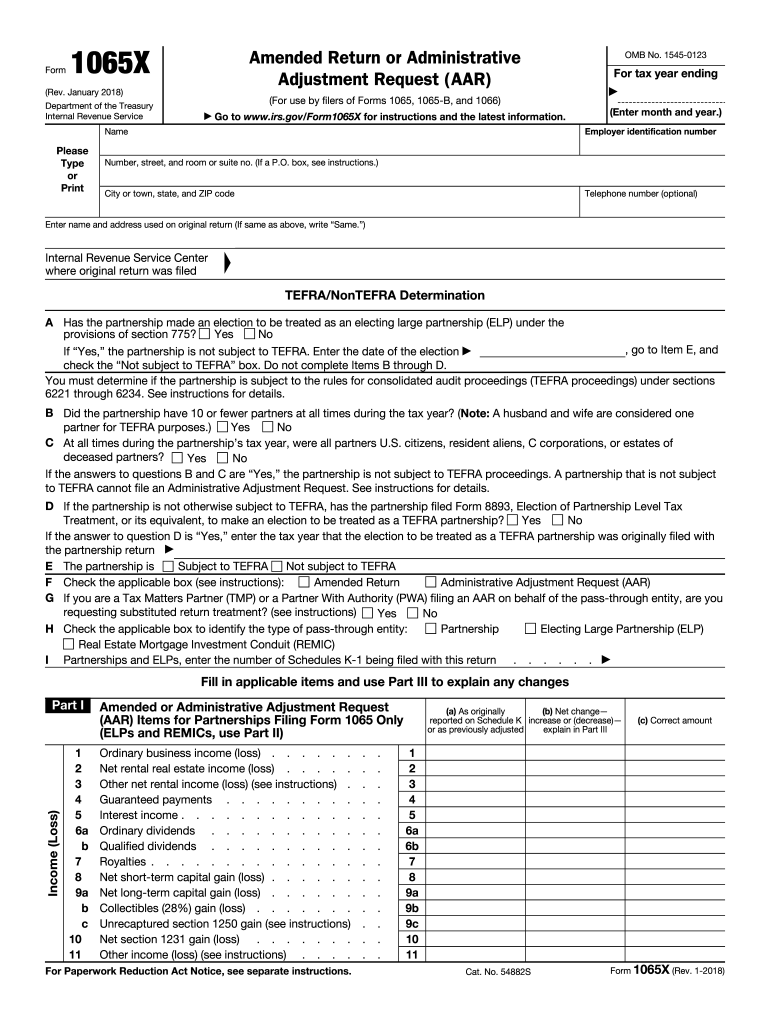

Attach to form 1065 or form 8865. Web the law allows a credit against the personal income tax to a taxpayer, other than a partnership, that is a partner, shareholder, or member of a qualified entity that elects to. And the total assets at the end of the tax year. Web it is the member’s responsibility to consider and apply.

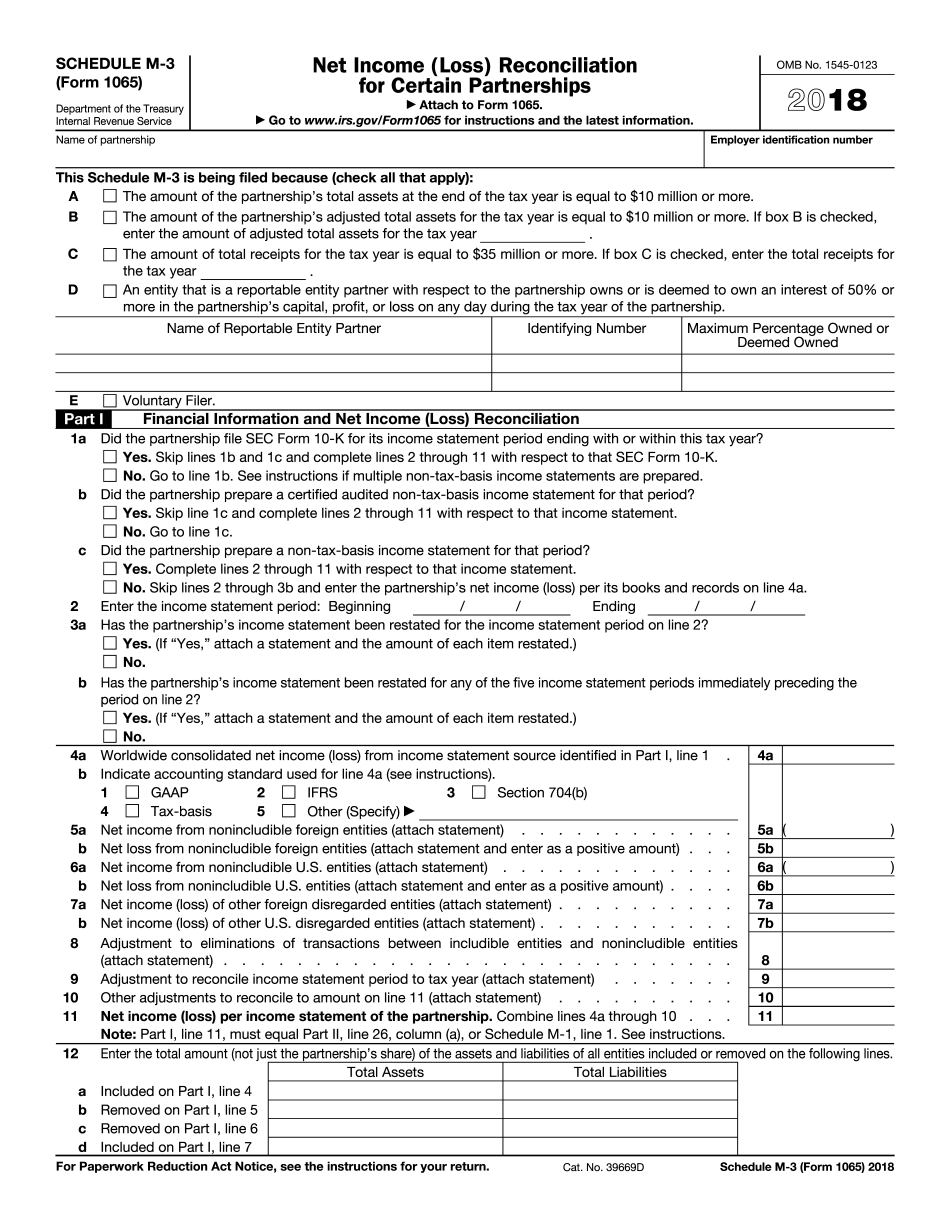

IRS Form 1065 (Schedule M3) 2018 2019 Fill out and Edit Online PDF

Web schedule d (form 1065) department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. More about the federal form 1065 we last updated. For ira partners, the partnership reports the ein of the ira's custodian in item e on the partner's schedule k. Web 1 gross business profitsround to.

Form 1065 Blank Sample to Fill out Online in PDF

For calendar year 2022, or tax year beginning / / 2022. Department of the treasury internal revenue service. Use form 8949 to list your. For ira partners, the partnership reports the ein of the ira's custodian in item e on the partner's schedule k. Web schedule d (form 1065) department of the treasury internal revenue service.

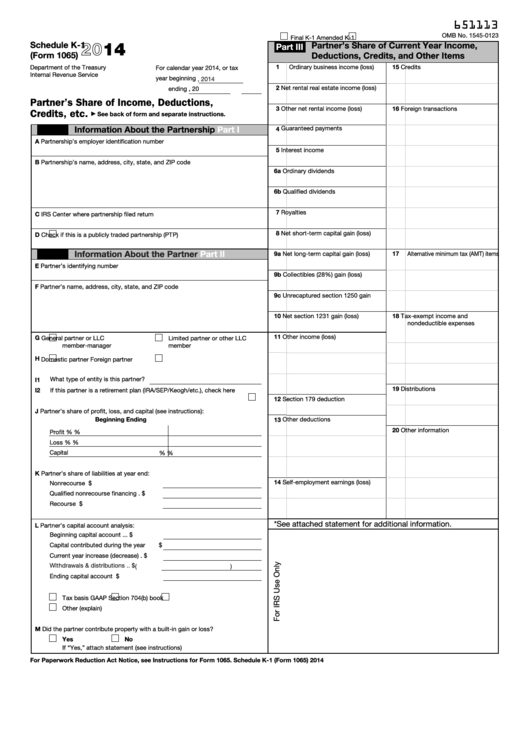

Fillable Schedule K1 (Form 1065) Partner'S Share Of

If the partnership's principal business, office, or agency is located in: For calendar year 2022, or tax year beginning / / 2022. Web where to file your taxes for form 1065. And the total assets at the end of the tax year. Form 1065, page 4 or other applicable federal form.

IRS Form 1065 Free Download, Create, Edit, Fill and Print

More about the federal form 1065 we last updated. Web the law allows a credit against the personal income tax to a taxpayer, other than a partnership, that is a partner, shareholder, or member of a qualified entity that elects to. Use form 8949 to list your. Form 1065, page 4 or other applicable federal form. Web go to www.irs.gov/form1065.

Fillable Form Mo1065 Partnership Return Of 2014 printable

Attach to form 1065 or form 8865. Web it is the member’s responsibility to consider and apply any applicable limitations. Web go to www.irs.gov/form1065 for instructions and the latest information. More about the federal form 1065 we last updated. And the total assets at the end of the tax year.

Form 1065 tax form hairgasw

Attach to form 1065 or form 8865. Web where to file your taxes for form 1065. More about the federal form 1065 we last updated. Web the law allows a credit against the personal income tax to a taxpayer, other than a partnership, that is a partner, shareholder, or member of a qualified entity that elects to. Get ready for.

Form 1065 Line 20 Other Deductions Worksheet

More about the federal form 1065 we last updated. Web where to file your taxes for form 1065. For ira partners, the partnership reports the ein of the ira's custodian in item e on the partner's schedule k. Web 1 gross business profitsround to the nearest whole dollar 1(a) enter the amount of ordinary business income (loss) reported on federal.

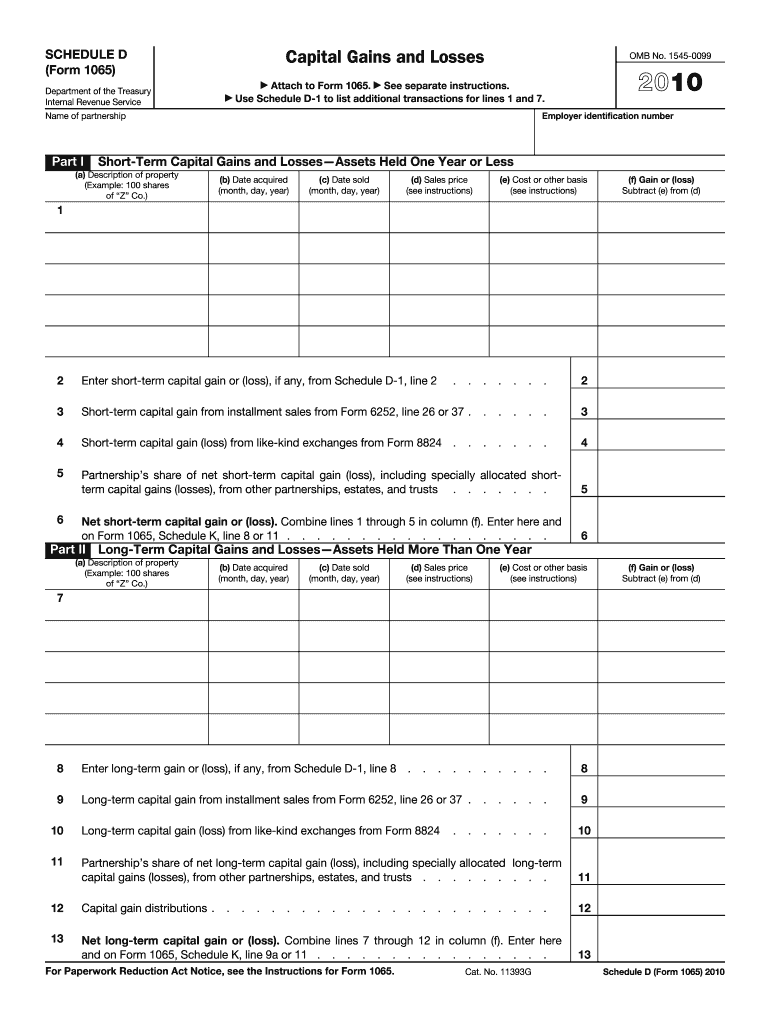

Schedule D Form 1065 Capital Gains and Losses Fill Out and Sign

Web go to www.irs.gov/form1065 for instructions and the latest information. For calendar year 2022, or tax year beginning / / 2022. Web go to www.irs.gov/form1065 for instructions and the latest information. Form 1065, page 4 or other applicable federal form. Web schedule d (form 1065) department of the treasury internal revenue service.

Web go to www.irs.gov/form1065 for instructions and the latest information. Web go to www.irs.gov/form1065 for instructions and the latest information. Web the law allows a credit against the personal income tax to a taxpayer, other than a partnership, that is a partner, shareholder, or member of a qualified entity that elects to. Get ready for tax season deadlines by completing any required tax forms today. For ira partners, the partnership reports the ein of the ira's custodian in item e on the partner's schedule k. And the total assets at the end of the tax year. Web 1 gross business profitsround to the nearest whole dollar 1(a) enter the amount of ordinary business income (loss) reported on federal form 1065, schedule k, line 1 1(a). Web where to file your taxes for form 1065. Ending / / partner’s share of income, deductions,. Ad complete irs tax forms online or print government tax documents. Web go to www.irs.gov/form1065 for instructions and the latest information. Web schedule d (form 1065) department of the treasury internal revenue service. Form 1065, page 4 or other applicable federal form. Attach to form 1065 or form 8865. Web it is the member’s responsibility to consider and apply any applicable limitations. More about the federal form 1065 we last updated. Use form 8949 to list your. For calendar year 2022, or tax year beginning / / 2022. Department of the treasury internal revenue service. If the partnership's principal business, office, or agency is located in:

Use Form 8949 To List Your.

Web it is the member’s responsibility to consider and apply any applicable limitations. Ending / / partner’s share of income, deductions,. More about the federal form 1065 we last updated. If the partnership's principal business, office, or agency is located in:

And The Total Assets At The End Of The Tax Year.

For ira partners, the partnership reports the ein of the ira's custodian in item e on the partner's schedule k. Web go to www.irs.gov/form1065 for instructions and the latest information. Web the law allows a credit against the personal income tax to a taxpayer, other than a partnership, that is a partner, shareholder, or member of a qualified entity that elects to. For calendar year 2022, or tax year beginning / / 2022.

Web Go To Www.irs.gov/Form1065 For Instructions And The Latest Information.

Web schedule d (form 1065) department of the treasury internal revenue service. Form 1065, page 4 or other applicable federal form. Web go to www.irs.gov/form1065 for instructions and the latest information. Web where to file your taxes for form 1065.

Attach To Form 1065 Or Form 8865.

Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Ad complete irs tax forms online or print government tax documents. Web 1 gross business profitsround to the nearest whole dollar 1(a) enter the amount of ordinary business income (loss) reported on federal form 1065, schedule k, line 1 1(a).