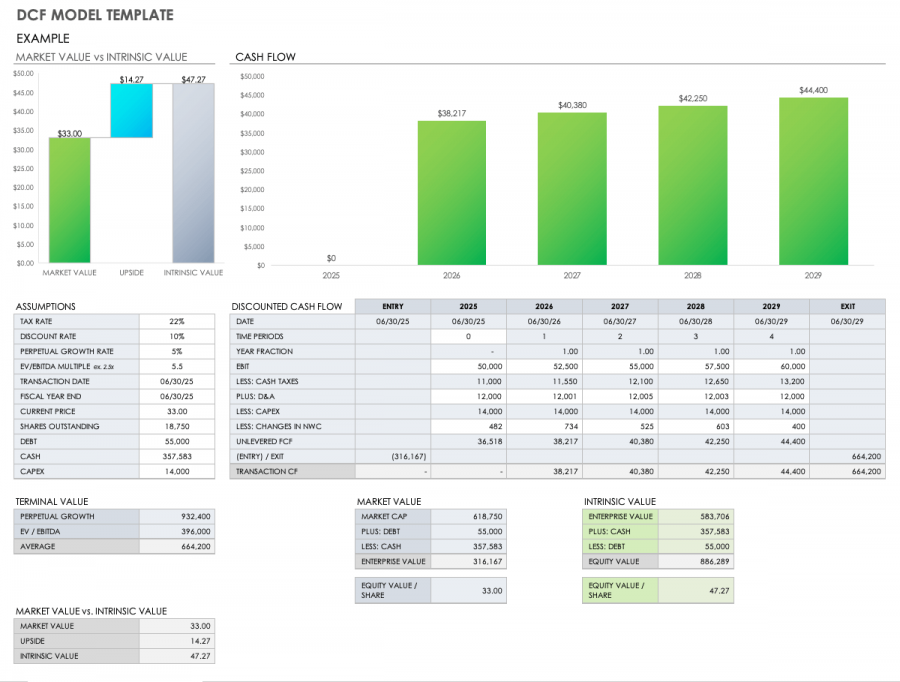

Discounted Cash Flow Model Template

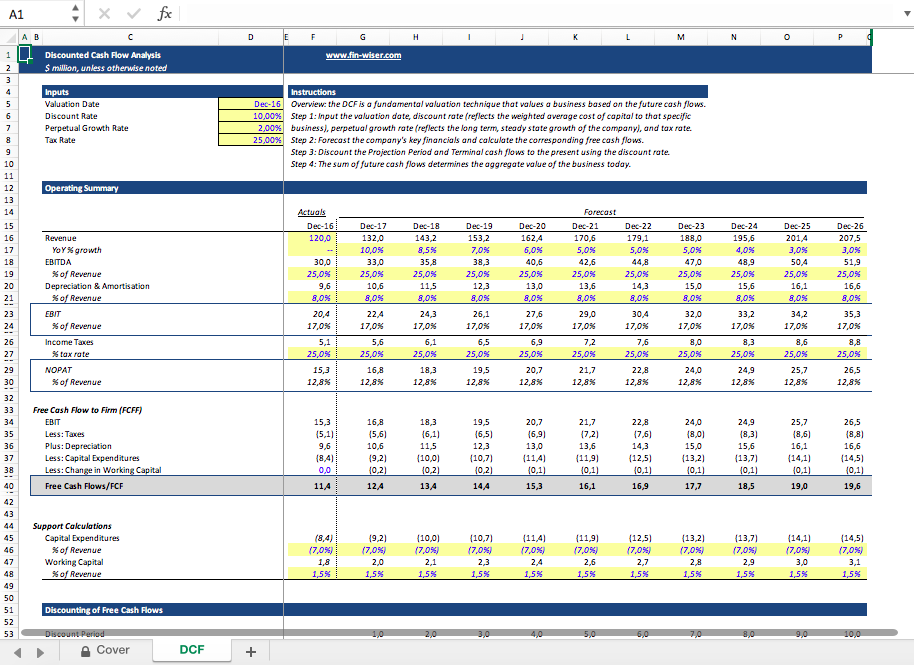

Discounted Cash Flow Model Template - Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is. Web discounted cash flow model template; Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web basic discounted cash flow formula: Ad get 3 cash flow strategies to stop leaking, overpaying and wasting your money. Web january 31, 2022. Book a playbook demo to explore — schedule a call with us and. This template allows you to build your own discounted cash flow. Web discounted cash flow model.

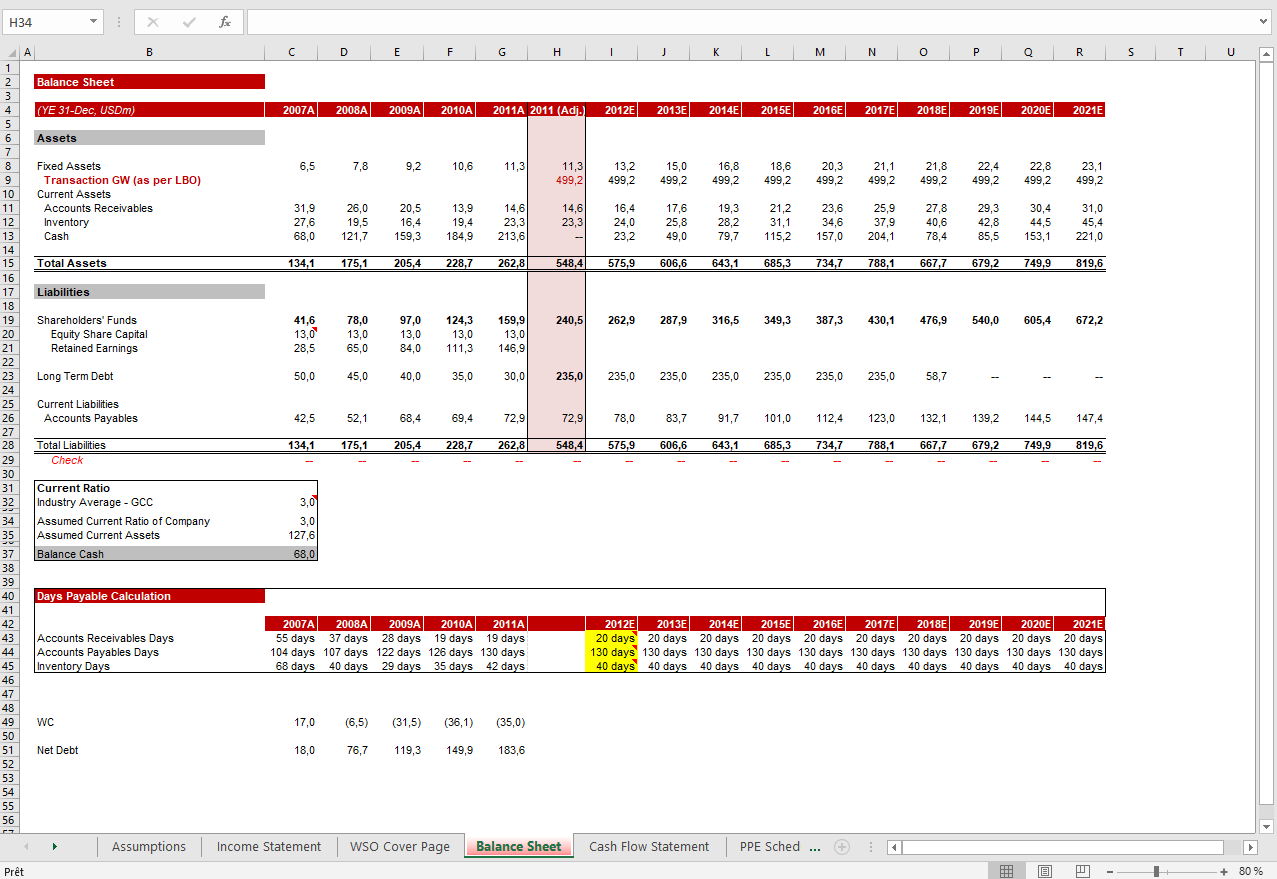

Discounted Cash Flow (DCF) Excel Model Template Eloquens

This template allows you to build your own discounted cash flow. Discounted cash flow analysis template; Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its.

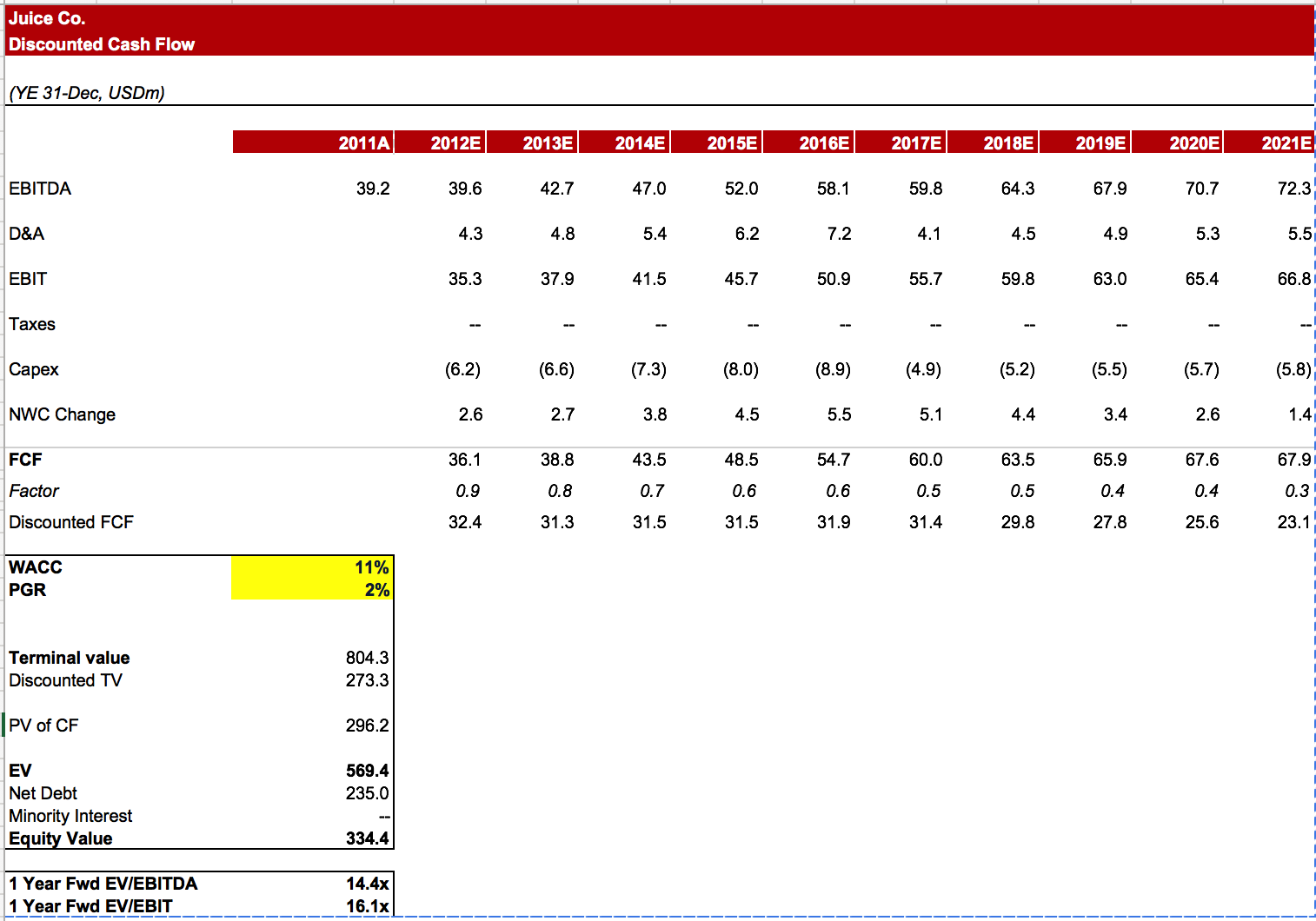

DCF Discounted Cash Flow Model Excel Template Eloquens

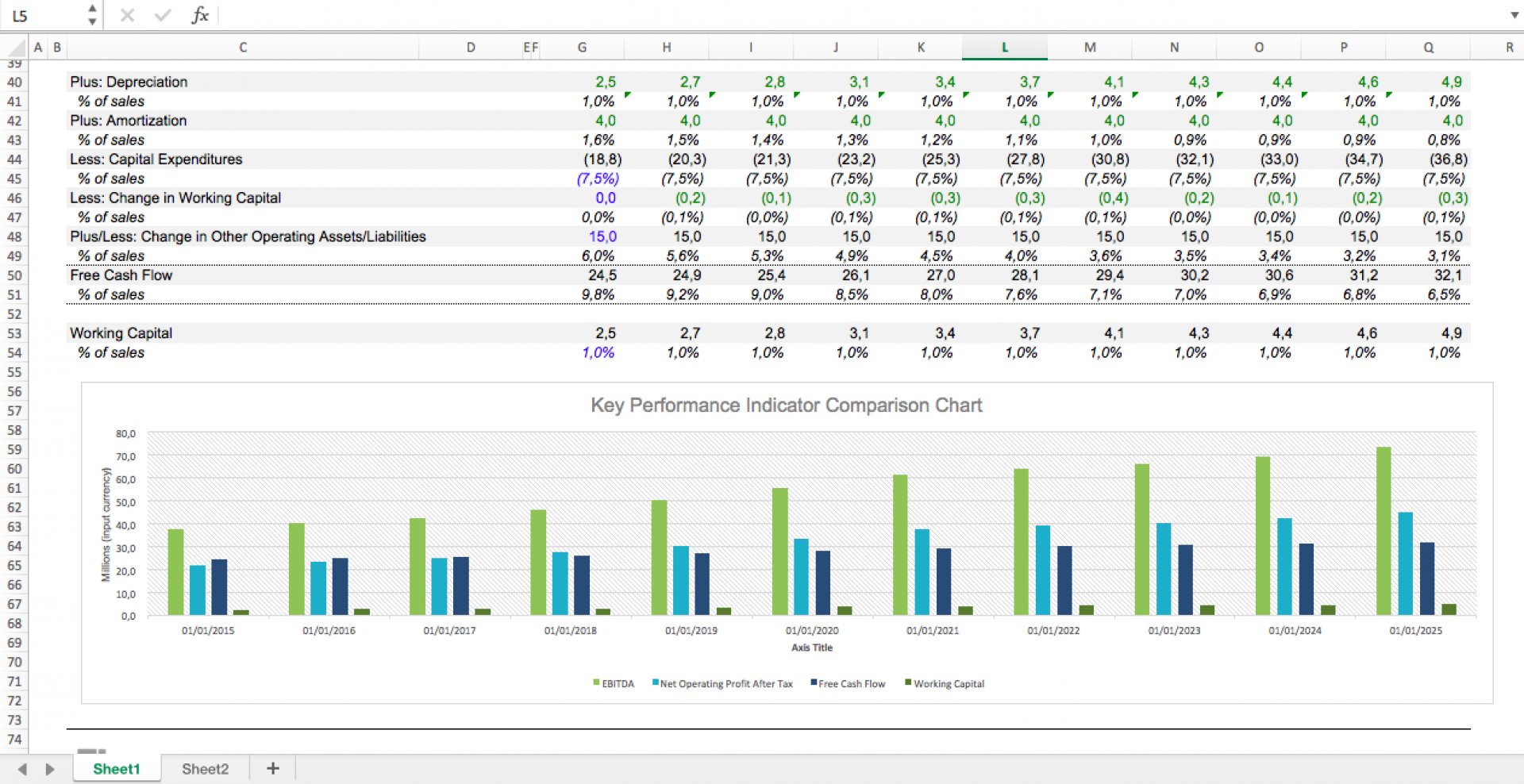

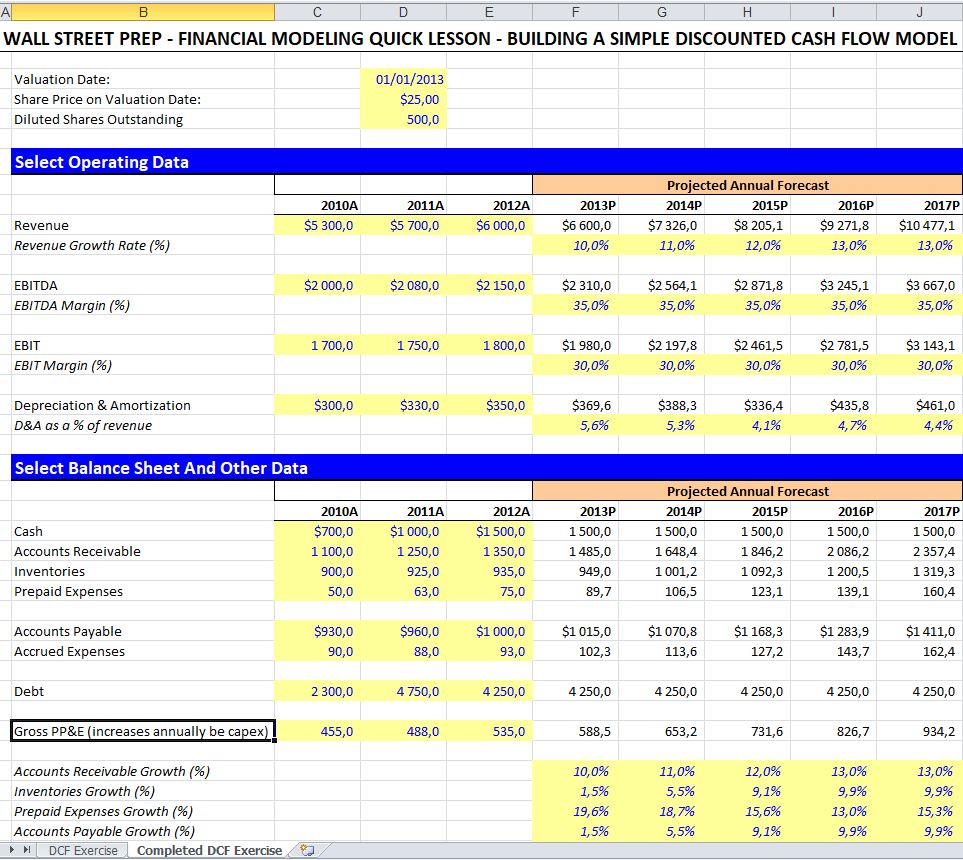

Web january 31, 2022. Building a discounted cash flow model (dcf) model introduces some of the most critical aspects of finance including the time. It computes the perpetuity growth rate. In the template below you can see the same projected cash flow for each. Ad get 3 cash flow strategies to stop leaking, overpaying and wasting your money.

Discounted Cash Flow (DCF) Model Template Wall Street Oasis

Web discounted cash flow (dcf) is a method of valuing a project, company, or asset using the present value of future cash flows. This template allows you to build your own discounted cash flow. Web discounted cash flow (dcf) excel model template. It computes the perpetuity growth rate. 3 ways to create a cash flow surge in your business

Free Discounted Cash Flow Templates Smartsheet

Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Web table of contents faqs discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web discounted cash flow model. Download wso's free discounted cash flow (dcf) model template below!.

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Web to aid your understanding of how to create and interpret a dcf model, we will go through the wso discounted cash flow template below. Web discounted cash flow (dcf) is a method of valuing a project, company, or asset using the present value of future cash flows. Web what is a dcf model? Web the discounted cash flow (dcf).

Free Discounted Cash Flow Templates Smartsheet

Ad get 3 cash flow strategies to stop leaking, overpaying and wasting your money. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Web a basic dcf model involves projecting future cash flows and discounting them.

DCF Discounted Cash Flow Model Excel Template Eloquens

Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. The dcf formula allows you to determine the. The purpose of the discounted free cash flow financial model template is to provide the user with a. Ad get 3 cash flow strategies to stop leaking, overpaying and wasting your.

Discounted Cash Flow (DCF) Model Template + Instructions Eloquens

Web what is a dcf model? Web to aid your understanding of how to create and interpret a dcf model, we will go through the wso discounted cash flow template below. Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. Web basic discounted cash flow formula: Building a discounted cash flow model.

7 Cash Flow Analysis Template Excel Excel Templates

Discounted cash flow valuation template ; Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Book a playbook demo to explore — schedule a call with us and. The purpose of the discounted free cash flow financial model template is to provide the user with a. We have ten.

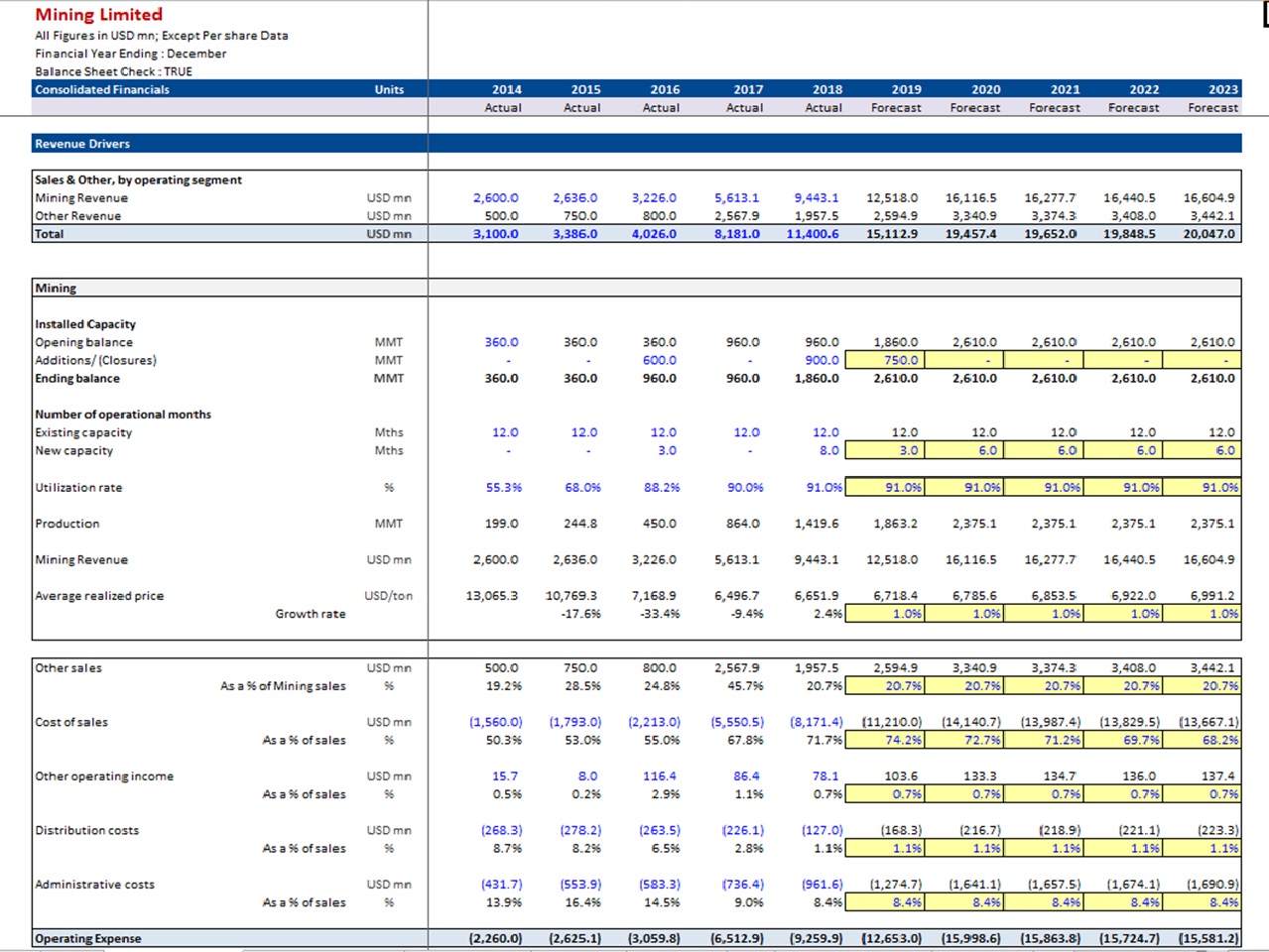

Discounted Cash Flow DCF Valuation Model Template (Mining Company

Web basic discounted cash flow formula: Download wso's free discounted cash flow (dcf) model template below! Building a discounted cash flow model (dcf) model introduces some of the most critical aspects of finance including the time. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Web.

Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web what is a dcf model? Web basic discounted cash flow formula: Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web discounted cash flow (dcf) excel model template. Discounted cash flow valuation template ; Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. The purpose of the discounted free cash flow financial model template is to provide the user with a. We have ten years of. Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n cf = the cash flow in a given year (cf1 is year one. Web while unrealistic, it makes it easier to see the effect that time has on the value of projected cash flows. Web table of contents faqs discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting. Discounted cash flow analysis template; Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Web a basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is. Web discounted cash flow model template; It computes the perpetuity growth rate.

Web A Basic Dcf Model Involves Projecting Future Cash Flows And Discounting Them Back To The Present Using A Discount Rate That Reflects The Riskiness Of The Capital.

This template allows you to build your own discounted cash flow. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Web table of contents faqs discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Discounted cash flow analysis template;

This Technique Discounts Future Cash Flows Back To.

The purpose of the discounted free cash flow financial model template is to provide the user with a. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting. The dcf formula allows you to determine the. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows.

Web Discounted Cash Flow (Dcf) Valuation Model Is A Way To Value A Company/Project Based On Its Future Cash Flows.

It computes the perpetuity growth rate. Download wso's free discounted cash flow (dcf) model template below! Web discounted cash flow (dcf) is a method of valuing a project, company, or asset using the present value of future cash flows. Web what is a dcf model?

Web Discounted Cash Flow (Dcf) Excel Model Template.

Web discounted cash flow model. Web january 31, 2022. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow.