Depreciation Spreadsheet Template

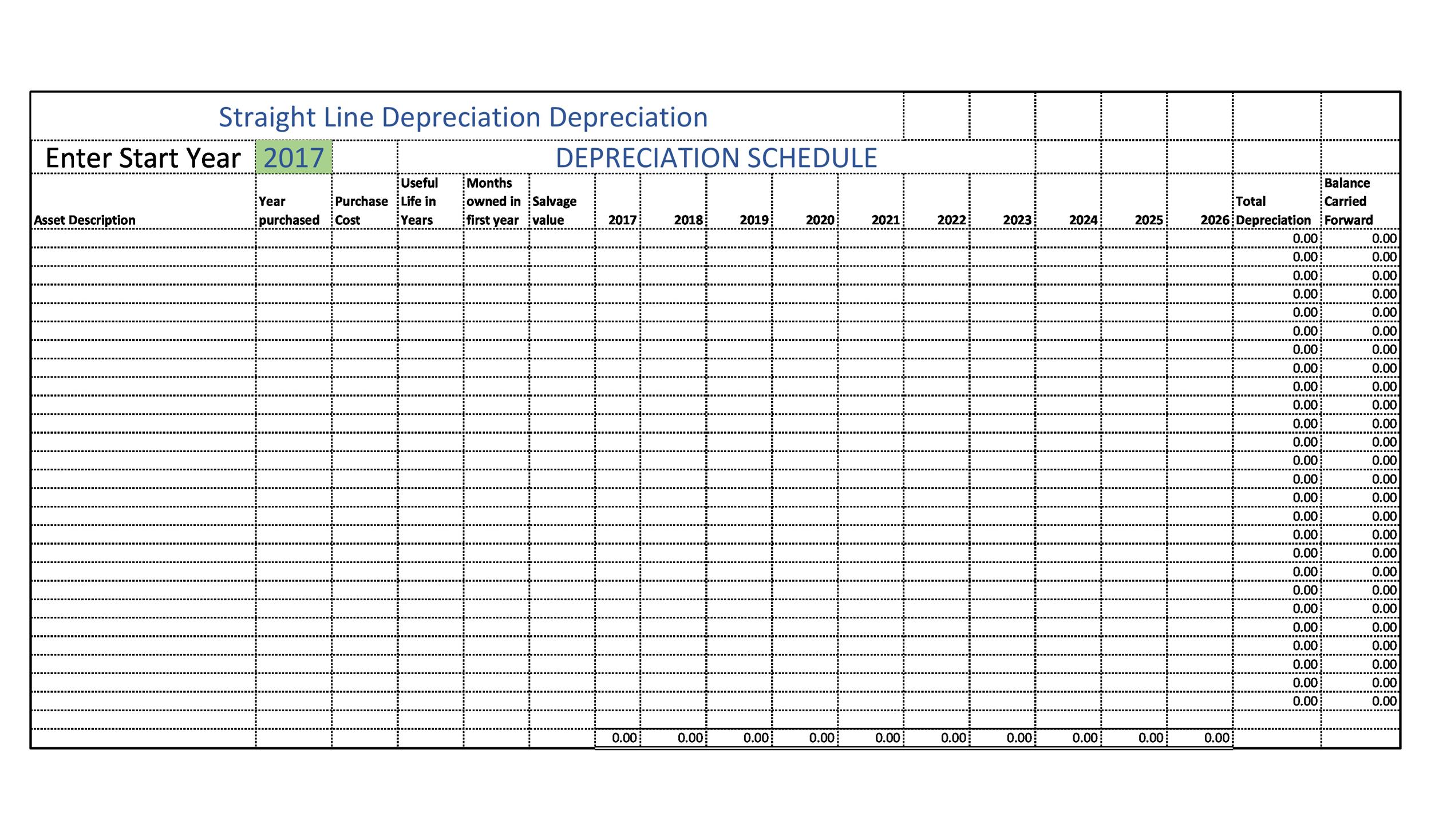

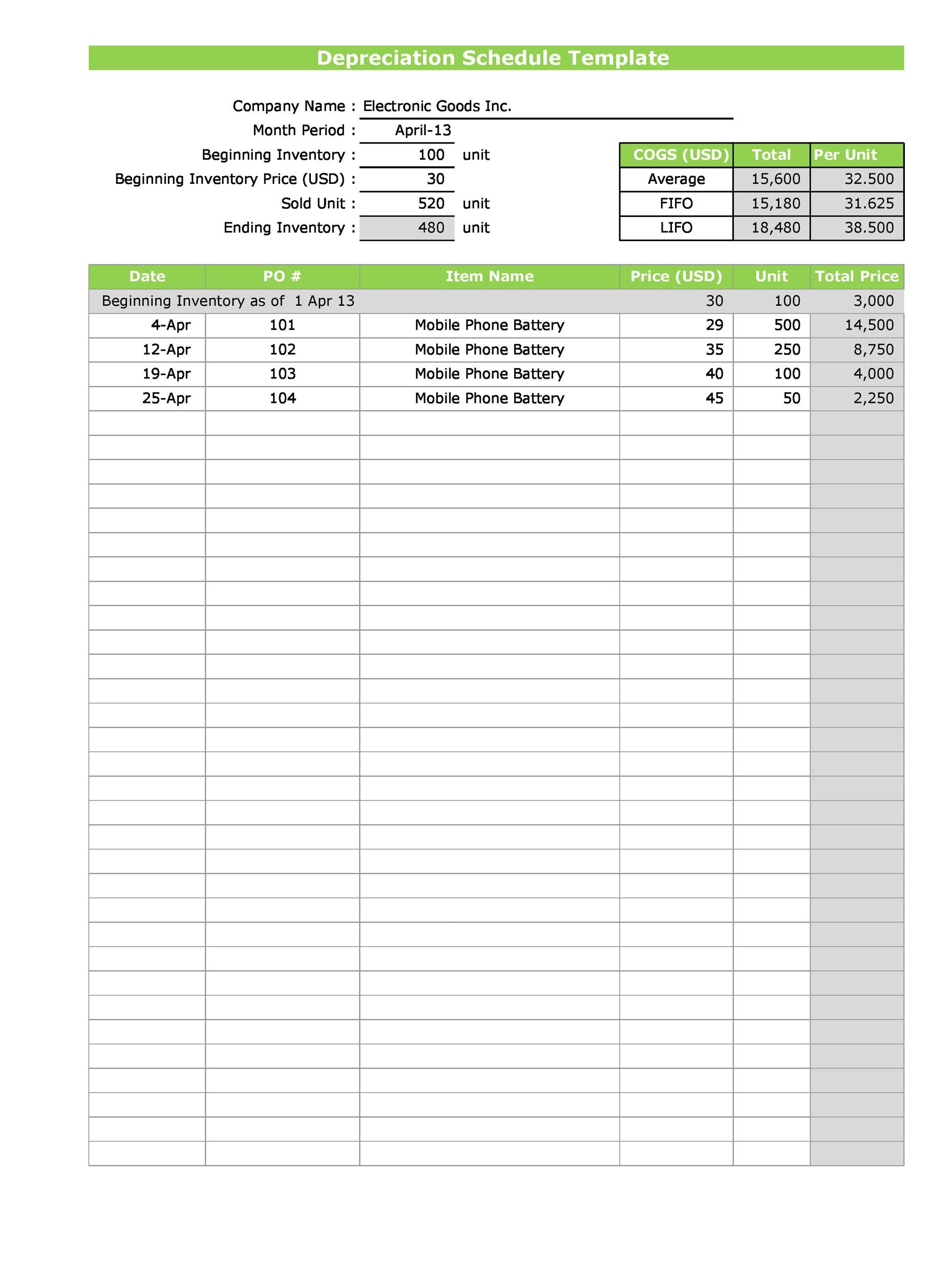

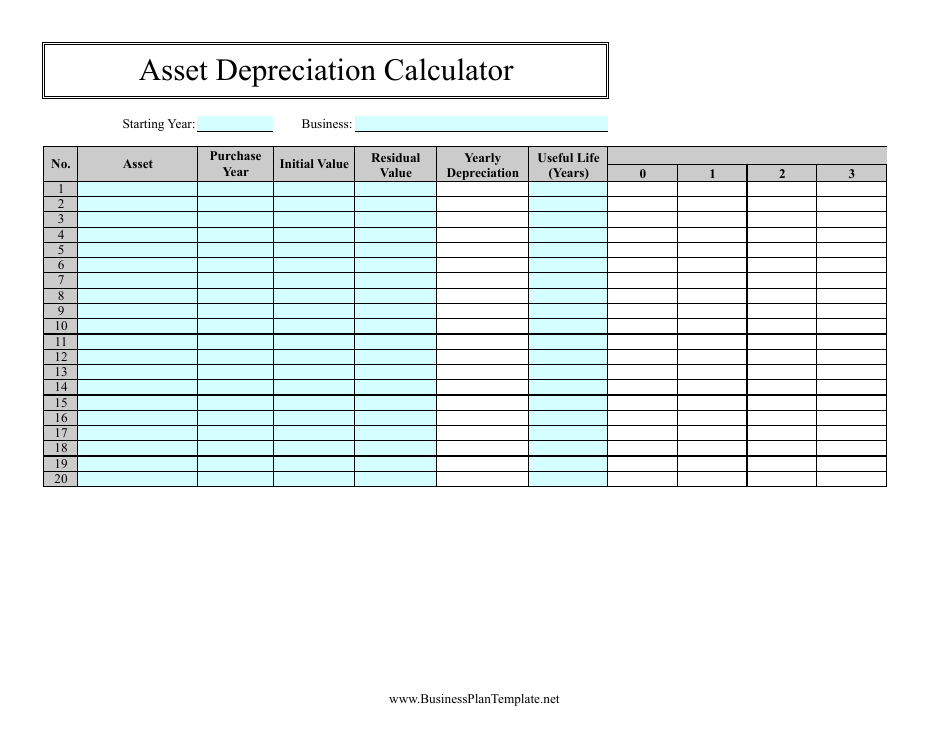

Depreciation Spreadsheet Template - Given that it is used for tangible assets, examples of the assets. Depreciation is the reduction in the value of an asset due to usage, passage of time,. Web excel supports various methods and formulas to calculate depreciation. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). Stay on track for your personal and business goals by evaluating your income and expenses. Stop losing receipts and have employees upload them directly into your expenses app. Web the annual straight line depreciation would be $2,000 ($10,000 / 5 years). Ad easily manage employee expenses. Web download practice workbook what is a depreciation schedule? Centralize key asset details, like vendor contracts, while reducing potential breakdowns with automated alerts.

Depreciation Schedule Template Excel Free Printable Templates

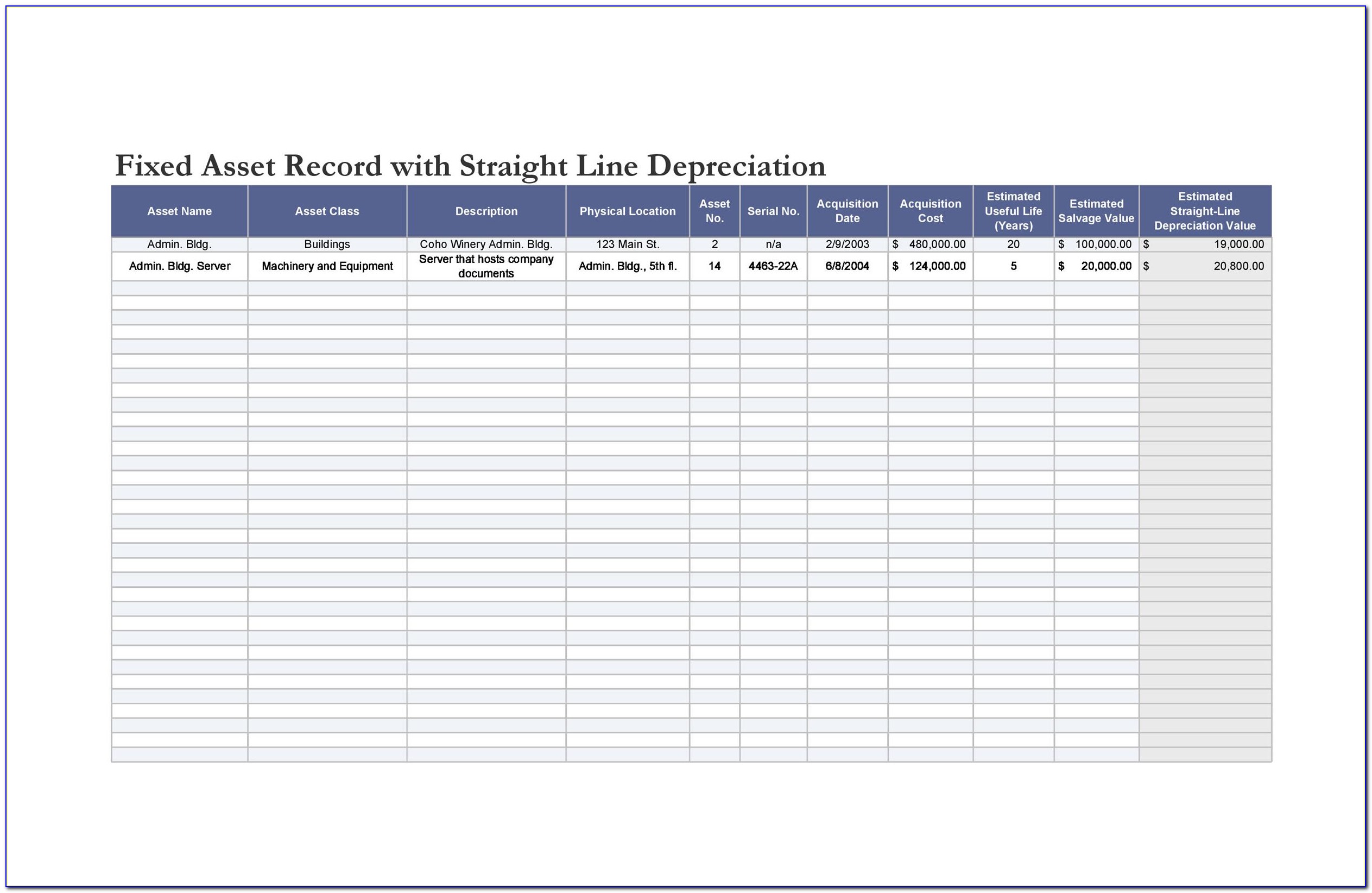

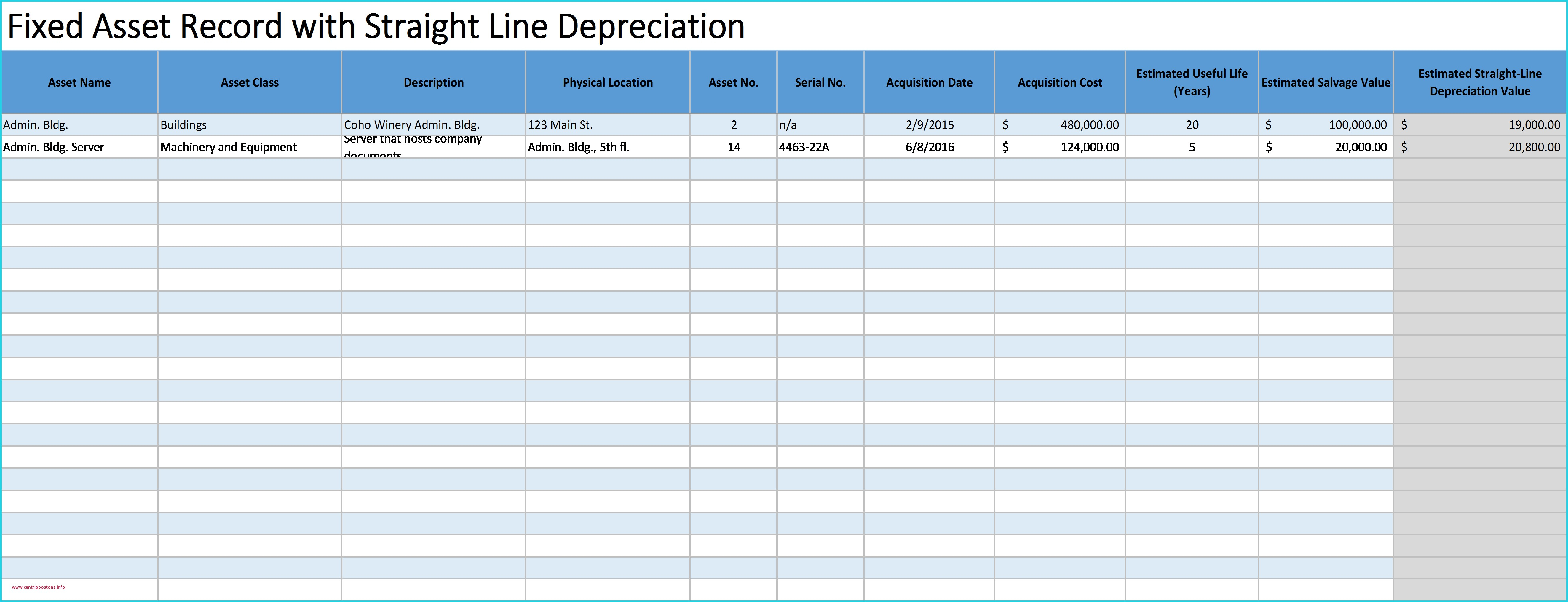

Use the template to list all of your. Centralize key asset details, like vendor contracts, while reducing potential breakdowns with automated alerts. Given that it is used for tangible assets, examples of the assets. Web this depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple assets. Web asset manager with depreciation template.

Schedule Of Real Estate Owned Excel Sample Excel Templates

Web excel offers five different depreciation functions. Web excel supports various methods and formulas to calculate depreciation. Use these templates to add in pie. Centralize key asset details, like vendor contracts, while reducing potential breakdowns with automated alerts. Ad easily manage employee expenses.

Depreciation Schedule Template Excel Free Printable Templates

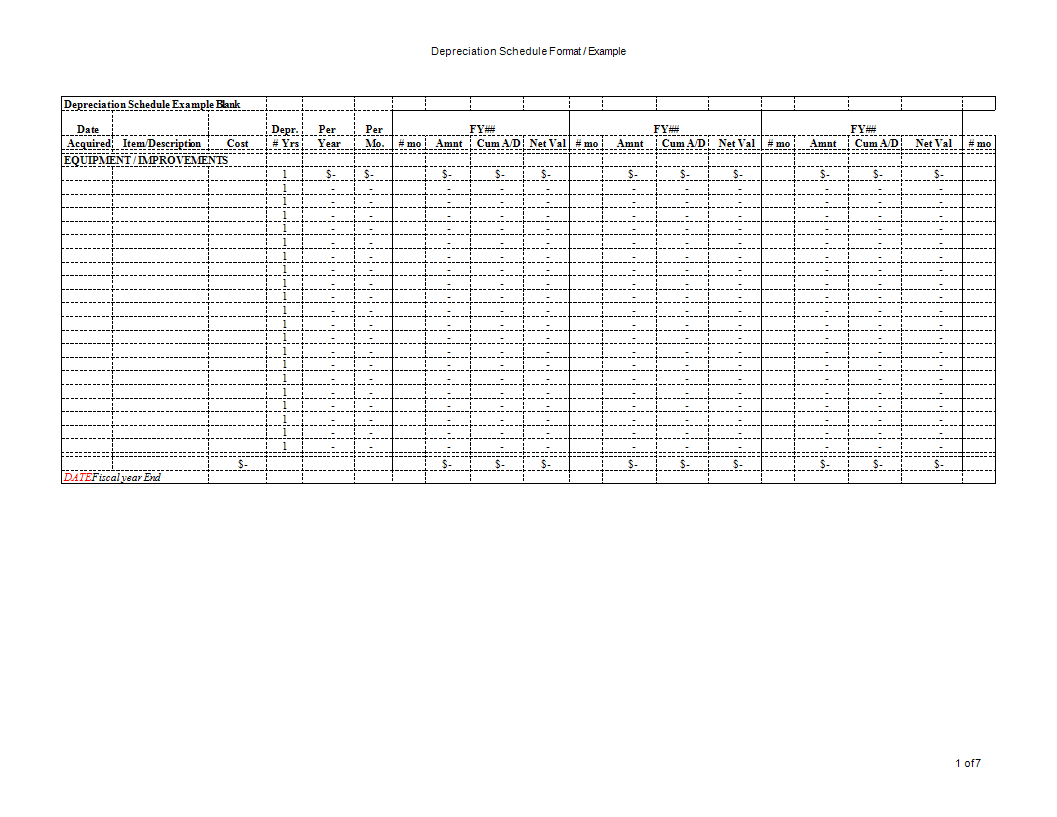

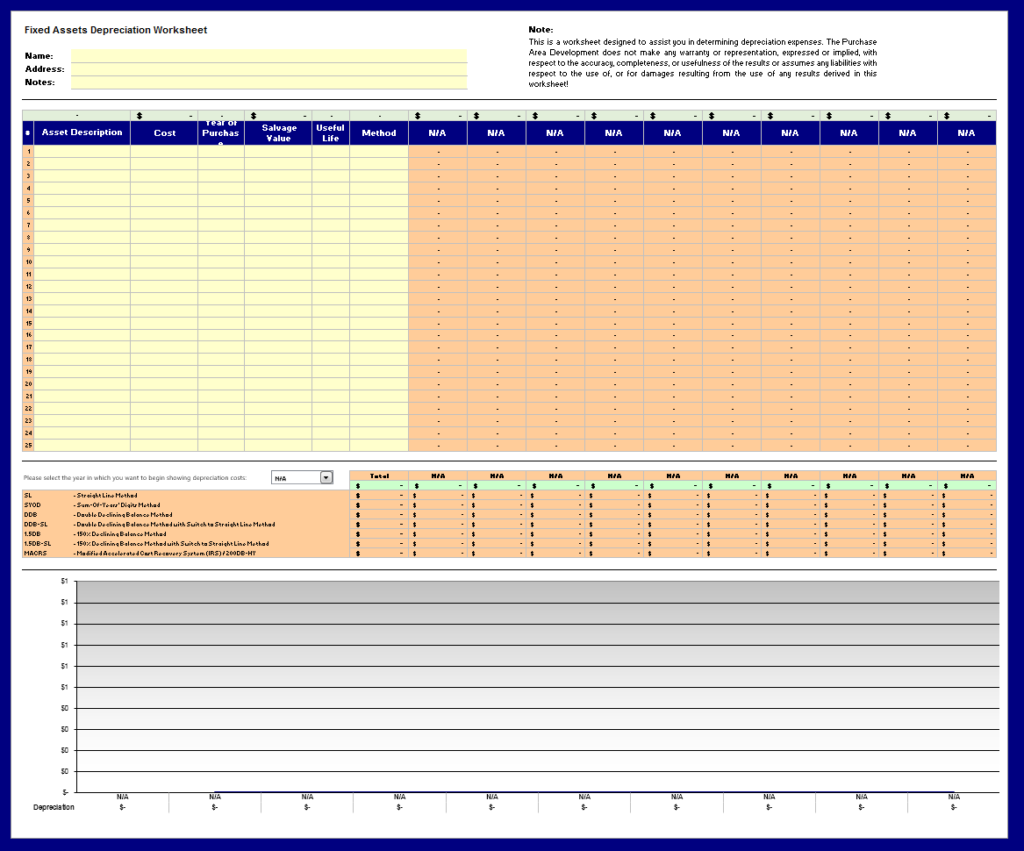

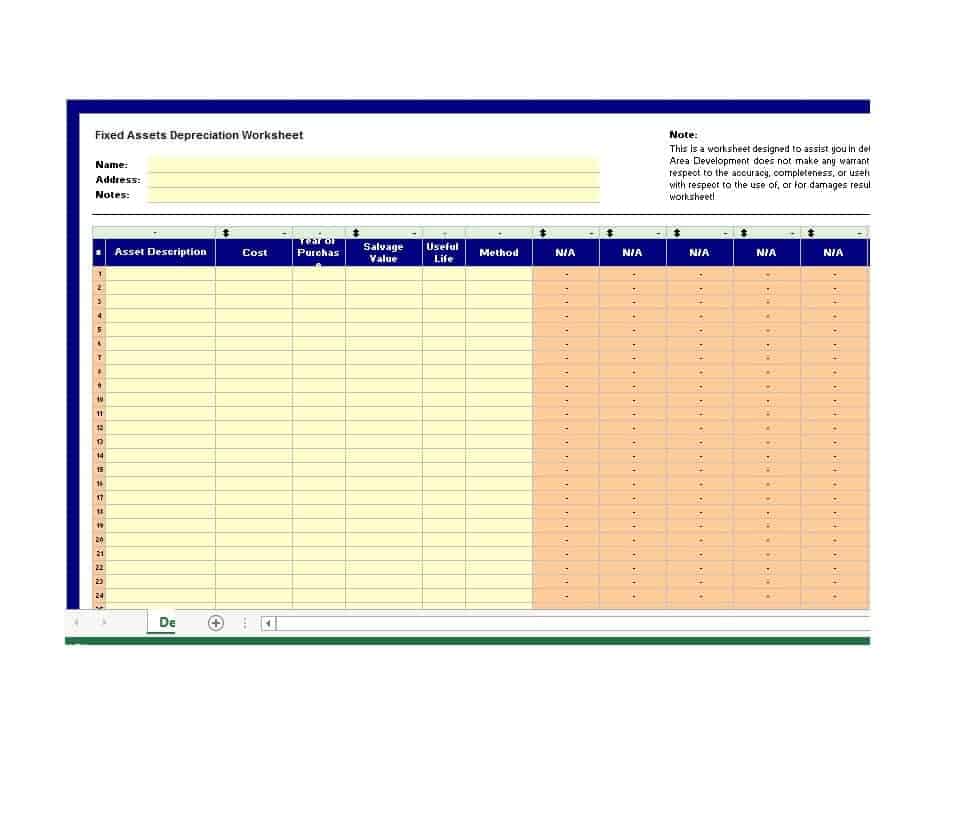

This is an easy to use depreciation calculator template that can give you the annual depreciation rates and book values using straight. Get support for this template. Download this template for free. Web 1.00 factors macrsyears methods methods noswitch fixed assets depreciation worksheet check max min selection asset description cost year of purchase salvage. Stay on track for your personal.

Depreciation Excel Template Database

Web depreciation methods template download the free template. Web 1.00 factors macrsyears methods methods noswitch fixed assets depreciation worksheet check max min selection asset description cost year of purchase salvage. Using data validation tool to. Centralize key asset details, like vendor contracts, while reducing potential breakdowns with automated alerts. This is an easy to use depreciation calculator template that can.

Depreciation schedule Excel format Templates at

Enter your name and email in the form below and download the free template now! Web excel offers five different depreciation functions. This is an easy to use depreciation calculator template that can give you the annual depreciation rates and book values using straight. Use the template to list all of your. Centralize key asset details, like vendor contracts, while.

Asset Depreciation Calculator Spreadsheet Template Download Printable

Web download practice workbook what is a depreciation schedule? This double declining balance depreciation template will help you find depreciation expense using one of the. Get support for this template. Fully integrated w/ employees, invoicing, project & more. Web double declining balance depreciation template.

Fixed Asset Depreciation Excel Spreadsheet —

Use these templates to add in pie. Web asset manager with depreciation template. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. Straight line depreciation schedule 2. Get support for this template.

20+ Free Depreciation Schedule Templates MS Excel & MS Word

Web excel offers five different depreciation functions. Web manage your finances using excel templates. Web excel supports various methods and formulas to calculate depreciation. Web double declining balance depreciation template. This is an easy to use depreciation calculator template that can give you the annual depreciation rates and book values using straight.

Depreciation Schedule Template Excel Free Printable Templates

Depreciation is the reduction in the value of an asset due to usage, passage of time,. Ad easily manage employee expenses. Use these templates to add in pie. Stop losing receipts and have employees upload them directly into your expenses app. Web the annual straight line depreciation would be $2,000 ($10,000 / 5 years).

20+ Free Depreciation Schedule Templates MS Excel & MS Word

The straight line rate is 20% ($2,000 annual depreciation / $10,000 depreciable value),. This double declining balance depreciation template will help you find depreciation expense using one of the. Web excel offers five different depreciation functions. Sum of years’ digit 3. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn.

Depreciation is the reduction in the value of an asset due to usage, passage of time,. Using data validation tool to. Download this template for free. Given that it is used for tangible assets, examples of the assets. Web 1.00 factors macrsyears methods methods noswitch fixed assets depreciation worksheet check max min selection asset description cost year of purchase salvage. Web excel offers five different depreciation functions. Web double declining balance depreciation template. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). Web asset manager with depreciation template. Web download practice workbook 8 methods to prepare depreciation schedule in excel 1. Stop losing receipts and have employees upload them directly into your expenses app. Fully integrated w/ employees, invoicing, project & more. Web download practice workbook what is a depreciation schedule? Straight line depreciation schedule 2. Get support for this template. Web manage your finances using excel templates. Ad easily manage employee expenses. Use the template to list all of your. Enter your name and email in the form below and download the free template now! Web the annual straight line depreciation would be $2,000 ($10,000 / 5 years).

Stay On Track For Your Personal And Business Goals By Evaluating Your Income And Expenses.

Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. Centralize key asset details, like vendor contracts, while reducing potential breakdowns with automated alerts. Ad easily manage employee expenses. Fully integrated w/ employees, invoicing, project & more.

This Double Declining Balance Depreciation Template Will Help You Find Depreciation Expense Using One Of The.

Using data validation tool to. Use these templates to add in pie. Web 1.00 factors macrsyears methods methods noswitch fixed assets depreciation worksheet check max min selection asset description cost year of purchase salvage. This is an easy to use depreciation calculator template that can give you the annual depreciation rates and book values using straight.

Use The Template To List All Of Your.

The straight line rate is 20% ($2,000 annual depreciation / $10,000 depreciable value),. Get support for this template. Sum of years’ digit 3. Enter your name and email in the form below and download the free template now!

Web Asset Manager With Depreciation Template.

Web depreciation methods template download the free template. Download this template for free. Web double declining balance depreciation template. Web excel offers five different depreciation functions.