Cash On Cash Return Excel Template

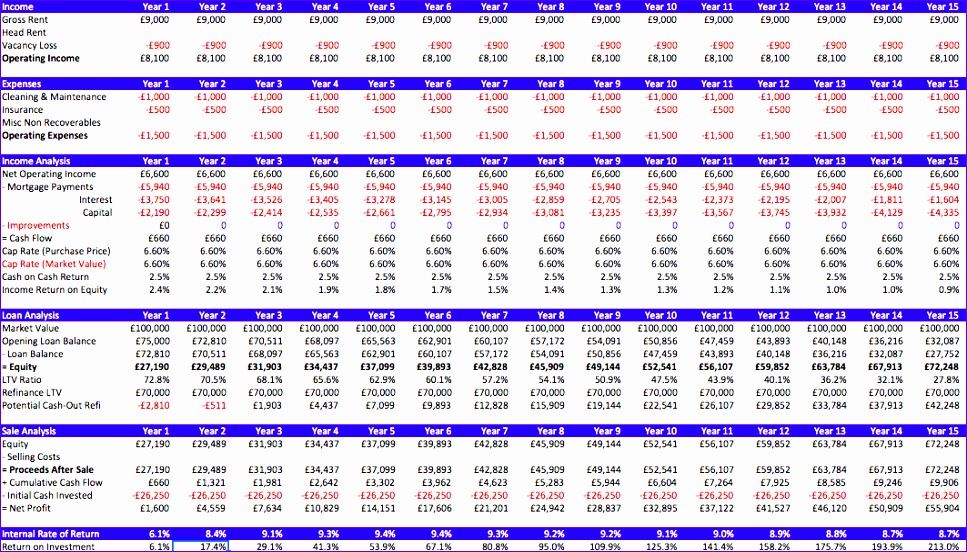

Cash On Cash Return Excel Template - Web cash return on assets (cash roa) example [+ excel template] what is the cash return on assets (cash roa)? Cash on cash return = (net operating income / cash invested) x 100. How to calculate it with the right formula? Price reviews downloads publication date last updated by profit vision. Returns the modified internal rate of return for a series of periodic cash flows. Web choose from wide array of financial model excel templates that provides for calculation of this metric. Mirr considers both the cost of the investment and the interest received on. Cash on cash= annual net cash flow/invested capital. The problem is that the. Web the cash on cash return formula is as follows:

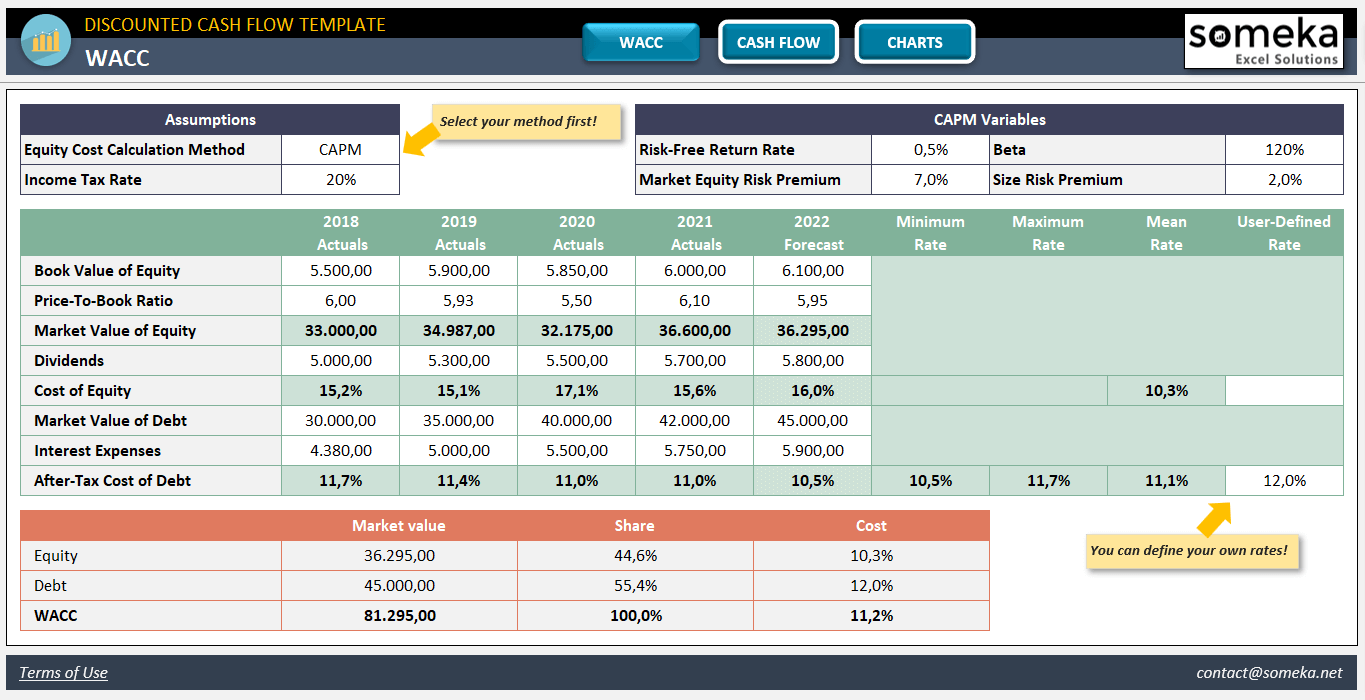

5 Discounted Cash Flow Excel Template Excel Templates Excel Templates

Web how can i calculate cash on cash return on an investment (how many months it takes to recoup a cash investment) from a stream of income payments? We want the result in the form of a percentage. How to calculate it with the right formula? Web the bottom line: Web mashvisor tools analyzing atlanta investment properties:

Discounted Cash Flow Excel Template DCF Valuation Template

These are assets not expected to be. Web it cash flow forecast template. How to calculate it with the right formula? Returns the modified internal rate of return for a series of periodic cash flows. Price reviews downloads publication date last updated by profit vision.

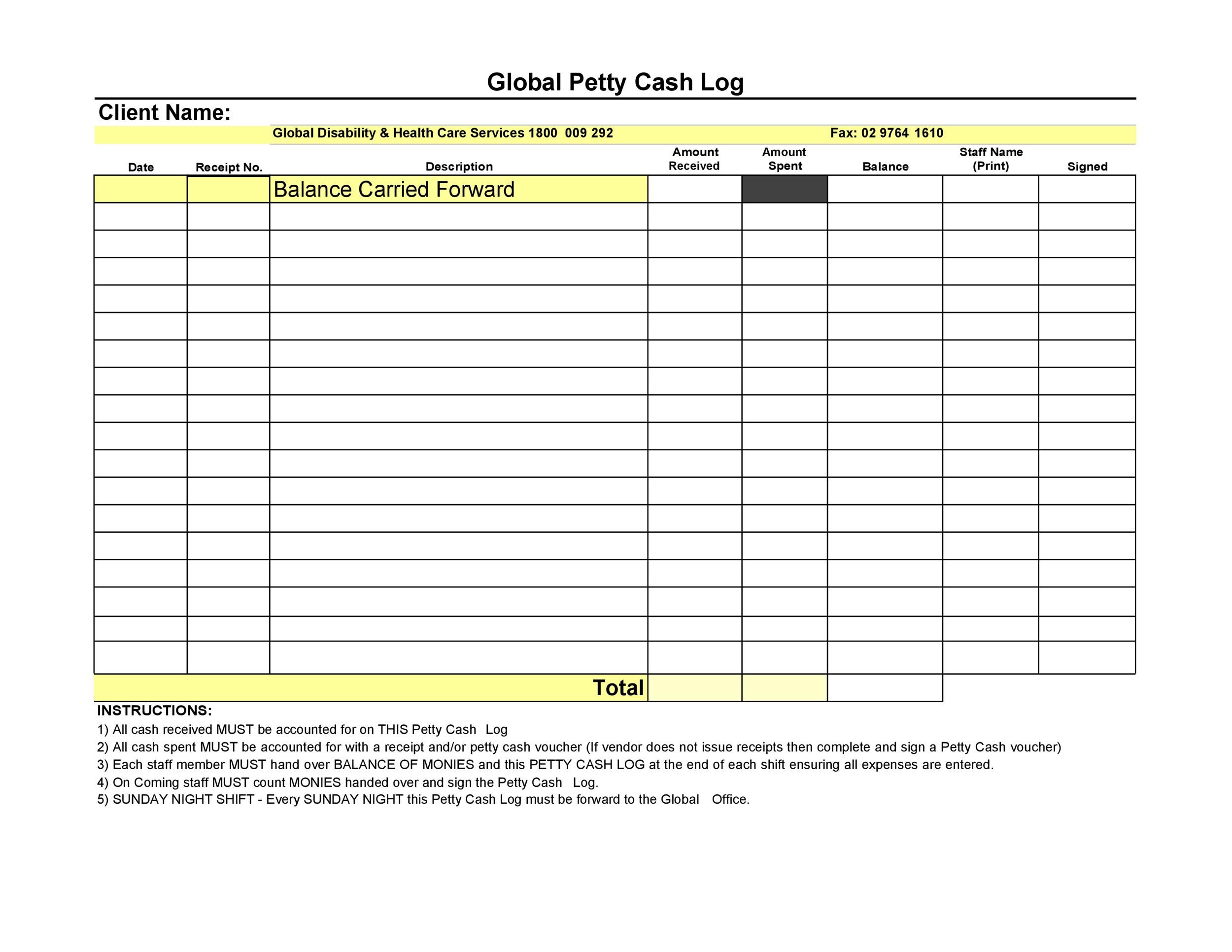

7+ Petty Cash Reconciliation Sheet Sample Templates

Web mashvisor tools analyzing atlanta investment properties: Web it cash flow forecast template. Web the cash on cash return formula is as follows: Fast track your financial management efforts. In this template, you will enter the following variables:

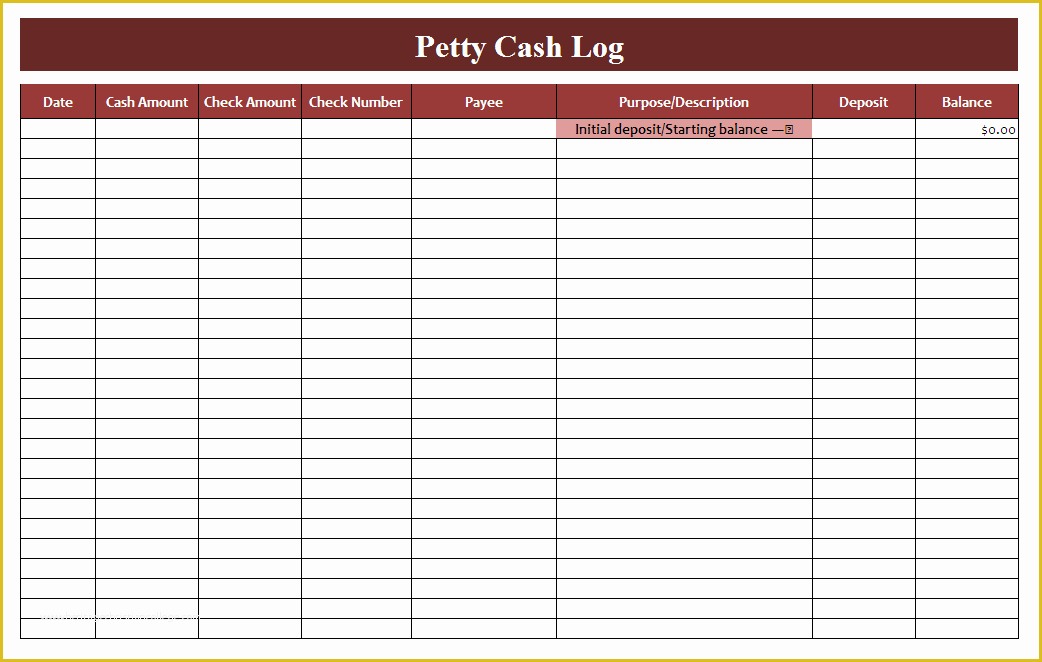

Cash Sheet Template Free Of 4 Petty Cash Log Templates Excel Xlts

Web download this cash flow calculator template design in excel, google sheets format. Knowing the two values mentioned above is enough, and dividing them by each other to obtain the result. Web how can i calculate cash on cash return on an investment (how many months it takes to recoup a cash investment) from a stream of income payments? Web.

What is Cash on Cash Return? Formula + Calculator

We want the result in the form of a percentage. Web cash return on assets (cash roa) example [+ excel template] what is the cash return on assets (cash roa)? Web the bottom line: Web how can i calculate cash on cash return on an investment (how many months it takes to recoup a cash investment) from a stream of.

Petty cash receipt template excel lanbda

Price reviews downloads publication date last updated by profit vision. Web the bottom line: Web a cask book excel template is a simple format that is designed to record all the cash transactions done by a company on every day basis. How to calculate it with the right formula? Web determine the net present value using cash flows that occur.

Excel Petty Cash Template Collection

Web updated december 13, 2022 what is cash on cash return? Web determine the net present value using cash flows that occur at irregular intervals. Mirr considers both the cost of the investment and the interest received on. These are assets not expected to be. Web mashvisor tools analyzing atlanta investment properties:

Petty Cash Statement Excel Excel Templates

Fast track your financial management efforts. Cash on cash return is a rate of return ratio that calculates the total cash earned on the total cash. Price reviews downloads publication date last updated by profit vision. Both metrics discussed are essential for. Web download this cash flow calculator template design in excel, google sheets format.

Petty Cash Statement Excel Excel Templates

As stated above, it is a fairly simple formula and is expressed as follows: Fast track your financial management efforts. Web the cash on cash return formula is as follows: Download this it cash flow forecast template design in excel, google sheets format. Both metrics discussed are essential for.

Free cashbook as Excel template Excel Templates for every purpose

Each cash flow, specified as a value, occurs at a scheduled payment date. In this template, you will enter the following variables: Web determine the net present value using cash flows that occur at irregular intervals. Both metrics discussed are essential for. Web cash return on assets (cash roa) example [+ excel template] what is the cash return on assets.

Cash on cash= annual net cash flow/invested capital. The problem is that the. As stated above, it is a fairly simple formula and is expressed as follows: Each cash flow, specified as a value, occurs at a scheduled payment date. Returns the modified internal rate of return for a series of periodic cash flows. Web the bottom line: Web updated december 13, 2022 what is cash on cash return? Web choose from wide array of financial model excel templates that provides for calculation of this metric. How to calculate it with the right formula? Web how can i calculate cash on cash return on an investment (how many months it takes to recoup a cash investment) from a stream of income payments? Web a cask book excel template is a simple format that is designed to record all the cash transactions done by a company on every day basis. Knowing the two values mentioned above is enough, and dividing them by each other to obtain the result. These are assets not expected to be. In this template, you will enter the following variables: Web determine the net present value using cash flows that occur at irregular intervals. Web the cash on cash return formula is as follows: Web mashvisor tools analyzing atlanta investment properties: Price reviews downloads publication date last updated by profit vision. Mirr considers both the cost of the investment and the interest received on. Download this it cash flow forecast template design in excel, google sheets format.

Web Updated December 13, 2022 What Is Cash On Cash Return?

In this template, you will enter the following variables: We want the result in the form of a percentage. Fast track your financial management efforts. Web the bottom line:

Cash On Cash Return = (Net Operating Income / Cash Invested) X 100.

As stated above, it is a fairly simple formula and is expressed as follows: Web how can i calculate cash on cash return on an investment (how many months it takes to recoup a cash investment) from a stream of income payments? By kabue muriithi published march 8, 2023. Web mashvisor tools analyzing atlanta investment properties:

Download This It Cash Flow Forecast Template Design In Excel, Google Sheets Format.

Web cash return on assets (cash roa) example [+ excel template] what is the cash return on assets (cash roa)? Web choose from wide array of financial model excel templates that provides for calculation of this metric. Web download this cash flow calculator template design in excel, google sheets format. Web yield on cost (yoc) cash on cash return development spread development yield loss to lease (ltl) equity multiple rental yield gross rental yield levered irr.

Cash On Cash= Annual Net Cash Flow/Invested Capital.

Web the cash on cash return formula is as follows: Web determine the net present value using cash flows that occur at irregular intervals. Each cash flow, specified as a value, occurs at a scheduled payment date. How to calculate it with the right formula?