501 C 3 Bylaws Template

501 C 3 Bylaws Template - Easily customize your corporate bylaws. Get form templates for any purpose! Written conflict of interest policy (part vi, section b, line 12). Ad fill out legal templates written by professionals. Web it is intended that the organization described in this paragraph c shall be entitled to exemption from federal income tax under section 501(c)(3) of the internal. Web according to the irs' compliance guide for 501(c)(3) nonprofits, an exempt organization that is required to file an annual return must report name, address, and structural and. Web this corporation is organized exclusively for charitable, religious, educational and scientific purposes, including, for such purposes, the making of distributions to. This means, among other things, that. Web like the constitution, your bylaws should deal with only the highest level of governing issues such as: Web there are five governance policies that the irs form 990 asks whether a charitable nonprofit has adopted:

501c3 Form Sample Form Resume Examples wRYPBlP24a

Written conflict of interest policy (part vi, section b, line 12). Web this corporation is organized exclusively for charitable, religious, educational and scientific purposes, including, for such purposes, the making of distributions to. Organizational purpose, board structure, officer position. Ad fill out legal templates written by professionals. It is more challenging to change your nonprofit's mission than to make other.

501c3 Bylaws Template Resume Examples

Get form templates for any purpose! (“corporation”) may have offices, either within or without the district of columbia, as the. Web to qualify for exemption under section 501 (c) (3) of the internal revenue code, a foundation’s organizing documents must contain certain provisions. How many board members need to say “yes” to. Written conflict of interest policy (part vi, section.

Sample 501c3 Bylaws Board Of Directors Indemnity

(“corporation”) may have offices, either within or without the district of columbia, as the. Web it is intended that the organization described in this paragraph c shall be entitled to exemption from federal income tax under section 501(c)(3) of the internal. Organizational purpose, board structure, officer position. Protect the environment now education fund. Web to qualify for exemption under section.

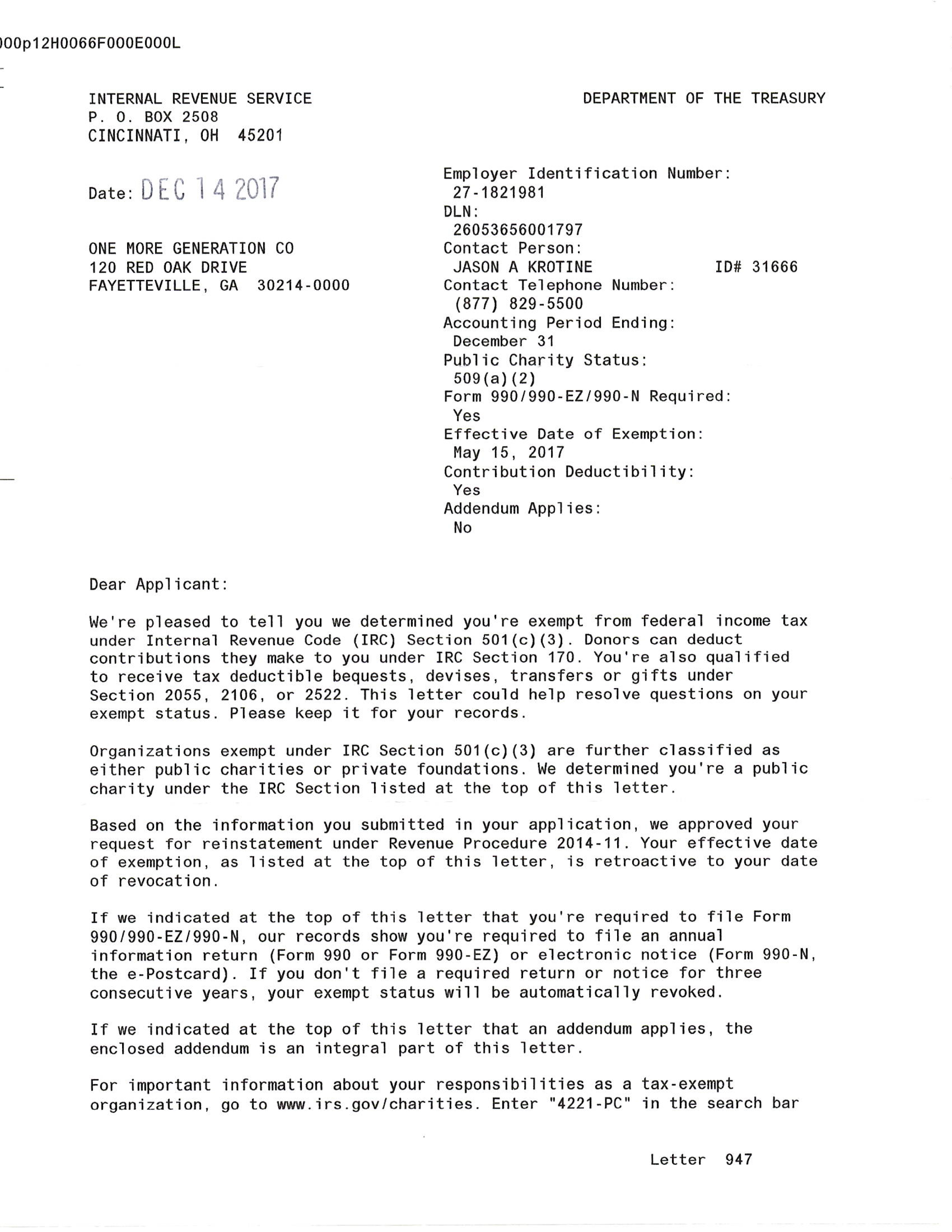

501c3 Certificate One More Generation

Web like the constitution, your bylaws should deal with only the highest level of governing issues such as: Web up to 25% cash back changing your nonprofit's mission. Protect the environment now education fund. Web it is intended that the organization described in this paragraph c shall be entitled to exemption from federal income tax under section 501(c)(3) of the.

501c3 Bylaws Template Resume Examples

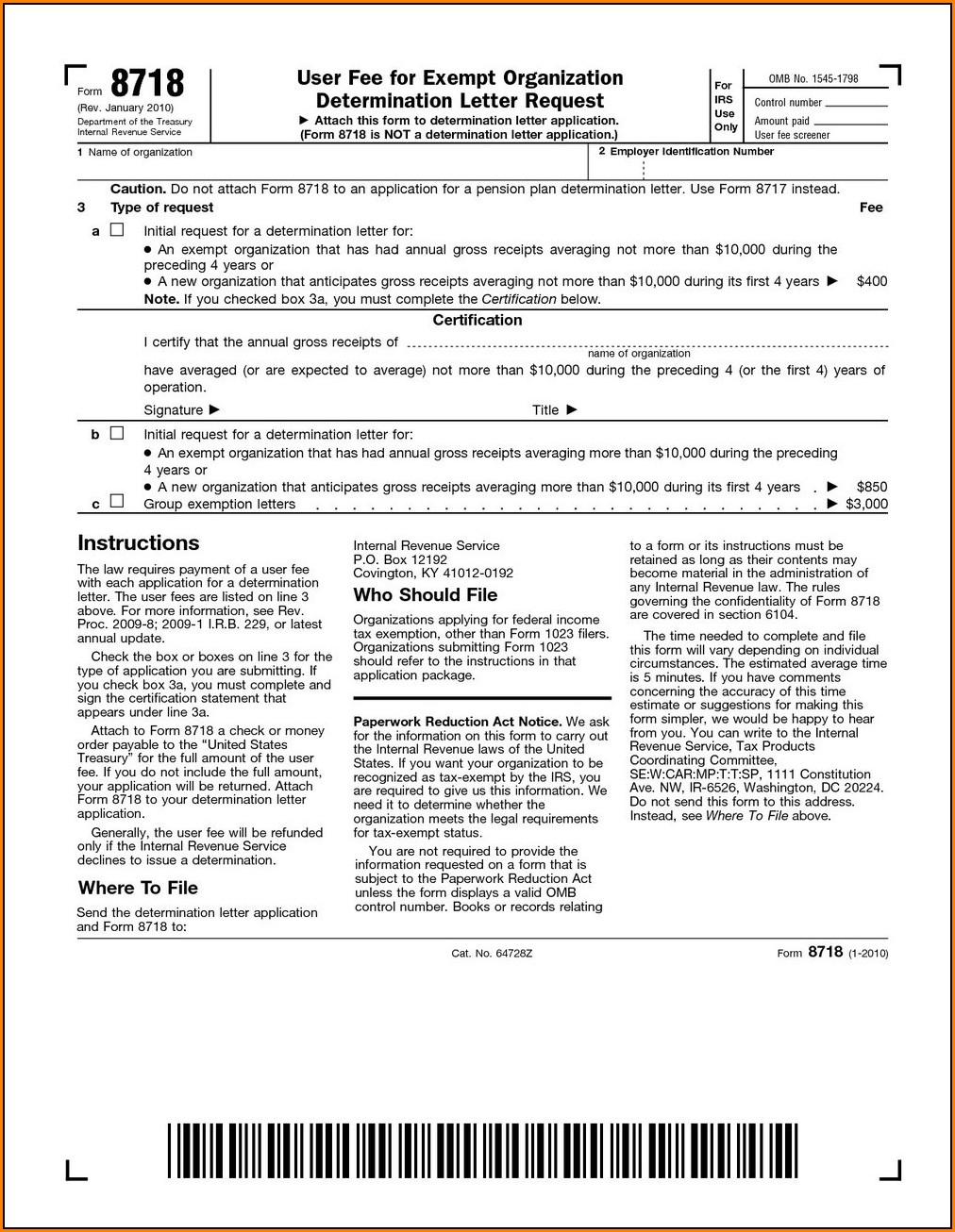

Ad fill out legal templates written by professionals. Web intervention.13 organizations under section 501(c)(3) are permitted to lobby for or against legislation, but section 501(c)(3) and section 501(h) restrict the amount of. Web electronically submit your form 8976, notice of intent to operate under section 501(c)(4) solicitation notice; Web this corporation is organized exclusively for charitable, religious, educational and scientific.

501c3 Form Sample Form Resume Examples wRYPBlP24a

How many board members need to say “yes” to. What if i need to fire a board member? (“corporation”) may have offices, either within or without the district of columbia, as the. Web american college of cardiology 501(c)(6) bylaws. Web to qualify for exemption under section 501 (c) (3) of the internal revenue code, a foundation’s organizing documents must contain.

Irs Form 501c3 Ez Universal Network

Web nonprofit bylaws template how long can someone serve on our board? Web to qualify for exemption under section 501 (c) (3) of the internal revenue code, a foundation’s organizing documents must contain certain provisions. Web they put up these free sample articles of incorporation templates to either sell you a book, take a course, sell you their “services”, or.

how to write articles of incorporation

Web american college of cardiology 501(c)(6) bylaws. Written conflict of interest policy (part vi, section b, line 12). Ad fill out legal templates written by professionals. Web like the constitution, your bylaws should deal with only the highest level of governing issues such as: Web there are five governance policies that the irs form 990 asks whether a charitable nonprofit.

Unique 501c3 Purpose Statement Examples Preparing Cash Flow Indirect Method

Web according to the irs' compliance guide for 501(c)(3) nonprofits, an exempt organization that is required to file an annual return must report name, address, and structural and. How many board members need to say “yes” to. American college of cardiology foundation (501(c)(3) bylaws. Easily customize your corporate bylaws. Get form templates for any purpose!

PPT A StepByStep Reference Guide To Creating A 501(C)3 PowerPoint

Web electronically submit your form 8976, notice of intent to operate under section 501(c)(4) solicitation notice; Web it is intended that the organization described in this paragraph c shall be entitled to exemption from federal income tax under section 501(c)(3) of the internal. Written conflict of interest policy (part vi, section b, line 12). Protect the environment now education fund..

Get form templates for any purpose! Web to qualify for exemption under section 501 (c) (3) of the internal revenue code, a foundation’s organizing documents must contain certain provisions. It is more challenging to change your nonprofit's mission than to make other amendments to your bylaws. Web up to 25% cash back changing your nonprofit's mission. Web like the constitution, your bylaws should deal with only the highest level of governing issues such as: Easily customize your corporate bylaws. Organizational purpose, board structure, officer position. Web according to the irs' compliance guide for 501(c)(3) nonprofits, an exempt organization that is required to file an annual return must report name, address, and structural and. How many board members need to say “yes” to. Web a charity's organizing document must limit the organization's purposes to exempt purposes set forth in section 501 (c) (3) and must not expressly empower it to. Protect the environment now education fund. (“corporation”) may have offices, either within or without the district of columbia, as the. Web they put up these free sample articles of incorporation templates to either sell you a book, take a course, sell you their “services”, or simply for attracting traffic to their site for paid. Web it is intended that the organization described in this paragraph c shall be entitled to exemption from federal income tax under section 501(c)(3) of the internal. This means, among other things, that. Web electronically submit your form 8976, notice of intent to operate under section 501(c)(4) solicitation notice; Web intervention.13 organizations under section 501(c)(3) are permitted to lobby for or against legislation, but section 501(c)(3) and section 501(h) restrict the amount of. Web american college of cardiology 501(c)(6) bylaws. Web up to 25% cash back irc section 501(c)(3) purposes this corporation is organized exclusively for one or more of the purposes as specified in section 501(c)(3) of the internal. Web to qualify for exemption under section 501 (c) (3), an organization must be organized exclusively for purposes described in that section.

Web To Qualify For Exemption Under Section 501 (C) (3) Of The Internal Revenue Code, A Foundation’s Organizing Documents Must Contain Certain Provisions.

Web according to the irs' compliance guide for 501(c)(3) nonprofits, an exempt organization that is required to file an annual return must report name, address, and structural and. This means, among other things, that. Get form templates for any purpose! Web this corporation is organized exclusively for charitable, religious, educational and scientific purposes, including, for such purposes, the making of distributions to.

How Many Board Members Need To Say “Yes” To.

American college of cardiology foundation (501(c)(3) bylaws. Web american college of cardiology 501(c)(6) bylaws. Written conflict of interest policy (part vi, section b, line 12). Web it is intended that the organization described in this paragraph c shall be entitled to exemption from federal income tax under section 501(c)(3) of the internal.

Web Intervention.13 Organizations Under Section 501(C)(3) Are Permitted To Lobby For Or Against Legislation, But Section 501(C)(3) And Section 501(H) Restrict The Amount Of.

Web up to 25% cash back irc section 501(c)(3) purposes this corporation is organized exclusively for one or more of the purposes as specified in section 501(c)(3) of the internal. Web they put up these free sample articles of incorporation templates to either sell you a book, take a course, sell you their “services”, or simply for attracting traffic to their site for paid. Protect the environment now education fund. Web like the constitution, your bylaws should deal with only the highest level of governing issues such as:

What If I Need To Fire A Board Member?

(“corporation”) may have offices, either within or without the district of columbia, as the. Web a charity's organizing document must limit the organization's purposes to exempt purposes set forth in section 501 (c) (3) and must not expressly empower it to. Easily customize your corporate bylaws. Web electronically submit your form 8976, notice of intent to operate under section 501(c)(4) solicitation notice;