50-30-20 Budget Template

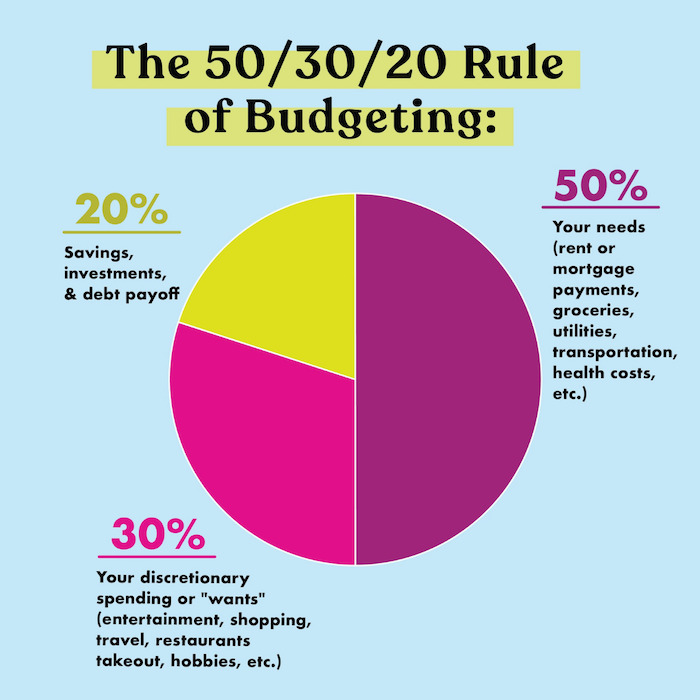

50-30-20 Budget Template - Get the app and start saving today. With everydollar, your budget goes with you. Consider an individual who takes home $5,000 a month. Web about this template a straightforward financial planning system for those who just want an easy way to plan and keep track of their budget and finances. Savings and debts may include: Lower bills, manage budgets, and start saving today. Web 50 30 20 budget template related tags sample budget download this 50 30 20 budget template design in excel, google sheets format. One of the primary attractions of the 50/30/20 budget rule is its simplicity. Ad everydollar puts you in control of your money (not the other way around). 50% for needs, 30% for wants, 20% for savings and debt.

50/30/20 Budget Worksheet Fillable PDF Etsy Budgeting worksheets

Compute expenses in 3 different categories step 04: 50% for your needs, 30% for your wants and 20% for your savings. 50% for needs, 30% for wants, 20% for savings and debt. Consider an individual who takes home $5,000 a month. Web about this template a straightforward financial planning system for those who just want an easy way to plan.

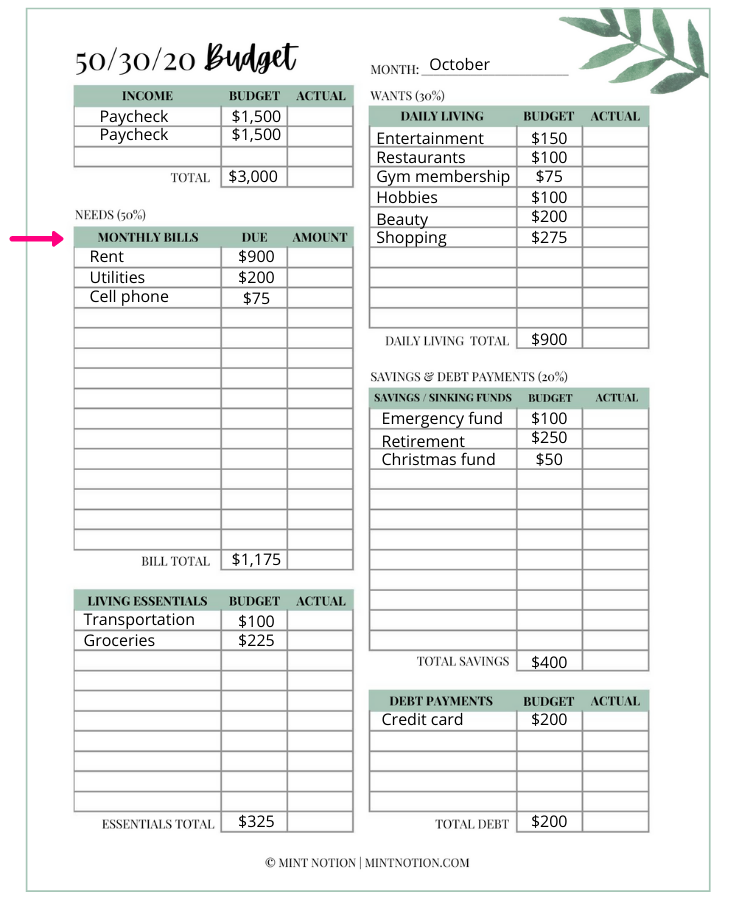

What is the 50/30/20 Budget Rule and How it Works Mint Notion

Lower bills, manage budgets, and start saving today. 50% for needs, 30% for wants, 20% for savings and debt. Keep tabs on your spending on mobile or web. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Web what is the 50/30/20 budget rule?

Monthly 50/30/20 Budget Worksheet in 2021 Budgeting, Budgeting

Ad find hidden costs and cut them. The most difficult part of having a budget is trying to stick to it, but it is possible if you are. 30% of your income on wants and. Web 50 30 20 budget template related tags sample budget download this 50 30 20 budget template design in excel, google sheets format. One of.

The 50/30/20 Budget Rule A Simple StepbyStep Guide Money In Your Tea

Web about this template a straightforward financial planning system for those who just want an easy way to plan and keep track of their budget and finances. Rocket money helps 3.4+ million members save hundreds. The 50/30/20 budget rule is a fast way to see how much you can afford to spend and save each month. Web the 50/30/20 budget.

Free Printable 50 30 20 Budget Spreadsheet Template Printable Templates

Consider an individual who takes home $5,000 a month. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Lower bills, manage budgets, and start saving today. Web the 50/30/20 budget in a nutshell. Savings and debts may include:

The 50/30/20 Budget What It Is & Why You Need To Start Using It ASAP

50% on needs, 30% on wants, and 20% on savings. Web the 50/30/20 budget in a nutshell. Web crunching the numbers. Consider an individual who takes home $5,000 a month. Web what is the 50/30/20 budget rule?

The 50/30/20 rule to budgeting and saving Locke Digital

30% of your income on wants and. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: 50% on needs, 30% on wants, and 20% on savings. Web the 50 30 20 budget template can get you started on the right track. Web crunching the numbers.

How the 50/30/20 Rule Can Catapult Your Budget to Success helpmeimpoor

Web the 50 30 20 budget template can get you started on the right track. 50% for your needs, 30% for your wants and 20% for your savings. 50% of your income on living expenses (rent, mortgage, groceries, bills transportation, etc.). Rocket money helps 3.4+ million members save hundreds. With everydollar, your budget goes with you.

Monthly Budget Planner 50/30/20 Rule & Expense Money Etsy in

With everydollar, your budget goes with you. Compute expenses in 3 different categories step 04: 30% of your income on wants and. Savings and debts may include: Web crunching the numbers.

Free 50/30/20 Budget Calculator for Your Foundation Template

Lower bills, manage budgets, and start saving today. 50% for your needs, 30% for your wants and 20% for your savings. Web the 50 30 20 budget template can get you started on the right track. Consider an individual who takes home $5,000 a month. The most difficult part of having a budget is trying to stick to it, but.

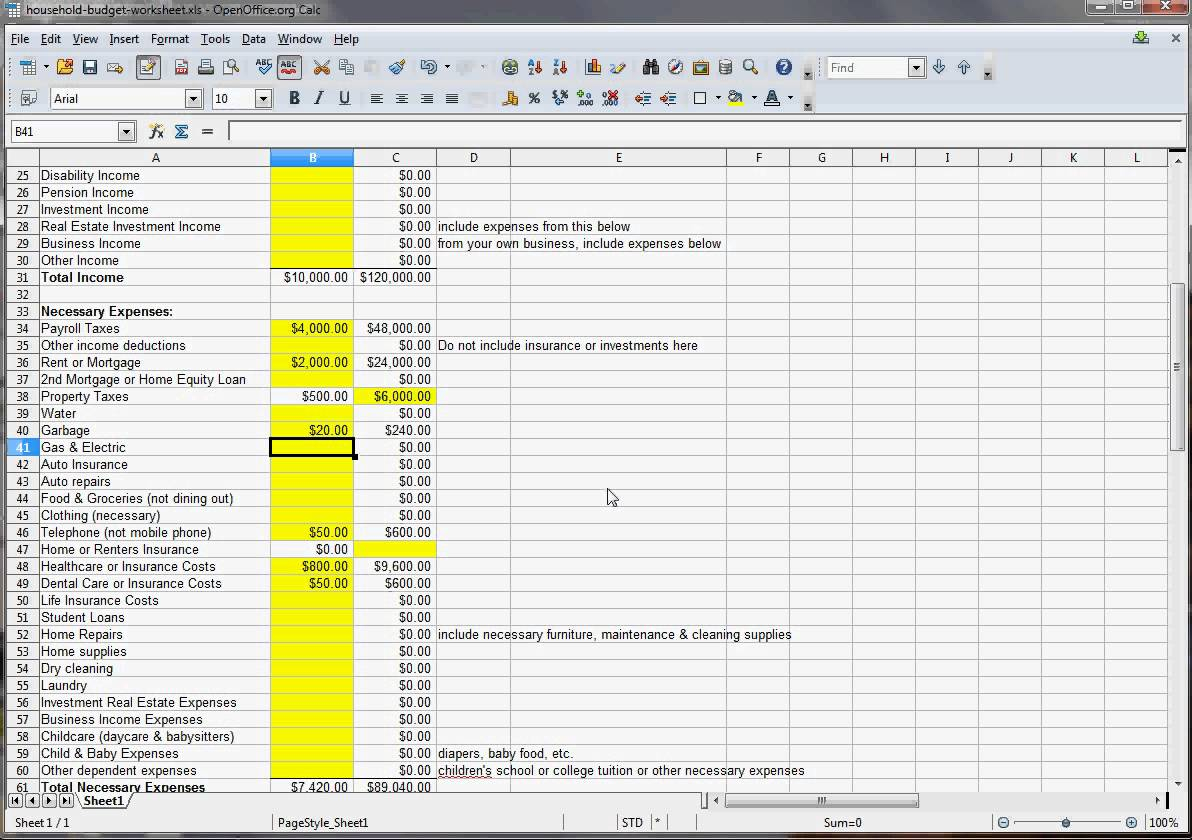

Web the 50/30/20 budget template is a simple budgeting rule for anyone to start a budget. One of the primary attractions of the 50/30/20 budget rule is its simplicity. The 50/30/20 budget rule is a fast way to see how much you can afford to spend and save each month. 50% of your income on living expenses (rent, mortgage, groceries, bills transportation, etc.). 50% on needs, 30% on wants, and 20% on savings. Ad everydollar puts you in control of your money (not the other way around). Compute expenses in 3 different categories step 04: Web crunching the numbers. 50% for needs, 30% for wants, 20% for savings and debt. With everydollar, your budget goes with you. Ad find hidden costs and cut them. Savings and debts may include: Get the app and start saving today. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: 50% for your needs, 30% for your wants and 20% for your savings. Keep tabs on your spending on mobile or web. Web 20% savings and debt the savings and debts category is meant for setting money aside for the future and paying off any loans or debts owed. Web the 50 30 20 budget template can get you started on the right track. Web the 50/30/20 budget in a nutshell. Calculate monthly income step 02:

Consider An Individual Who Takes Home $5,000 A Month.

Web the 50/30/20 budget template is a simple budgeting rule for anyone to start a budget. 50% of your income on living expenses (rent, mortgage, groceries, bills transportation, etc.). Web crunching the numbers. Web 50 30 20 budget template related tags sample budget download this 50 30 20 budget template design in excel, google sheets format.

Web The 50 30 20 Budget Template Can Get You Started On The Right Track.

50% for your needs, 30% for your wants and 20% for your savings. Keep tabs on your spending on mobile or web. Savings and debts may include: 50% on needs, 30% on wants, and 20% on savings.

Rocket Money Helps 3.4+ Million Members Save Hundreds.

Ad find hidden costs and cut them. With everydollar, your budget goes with you. Ad everydollar puts you in control of your money (not the other way around). The most difficult part of having a budget is trying to stick to it, but it is possible if you are.

It’s Easy To Use, Enter Your Monthly Income And The Sheet Will Calculate Your Outgoing Targets For Needs, Wants And Savings.

Compute expenses in 3 different categories step 04: The 50/30/20 budget rule is a fast way to see how much you can afford to spend and save each month. Get the app and start saving today. Web about this template a straightforward financial planning system for those who just want an easy way to plan and keep track of their budget and finances.