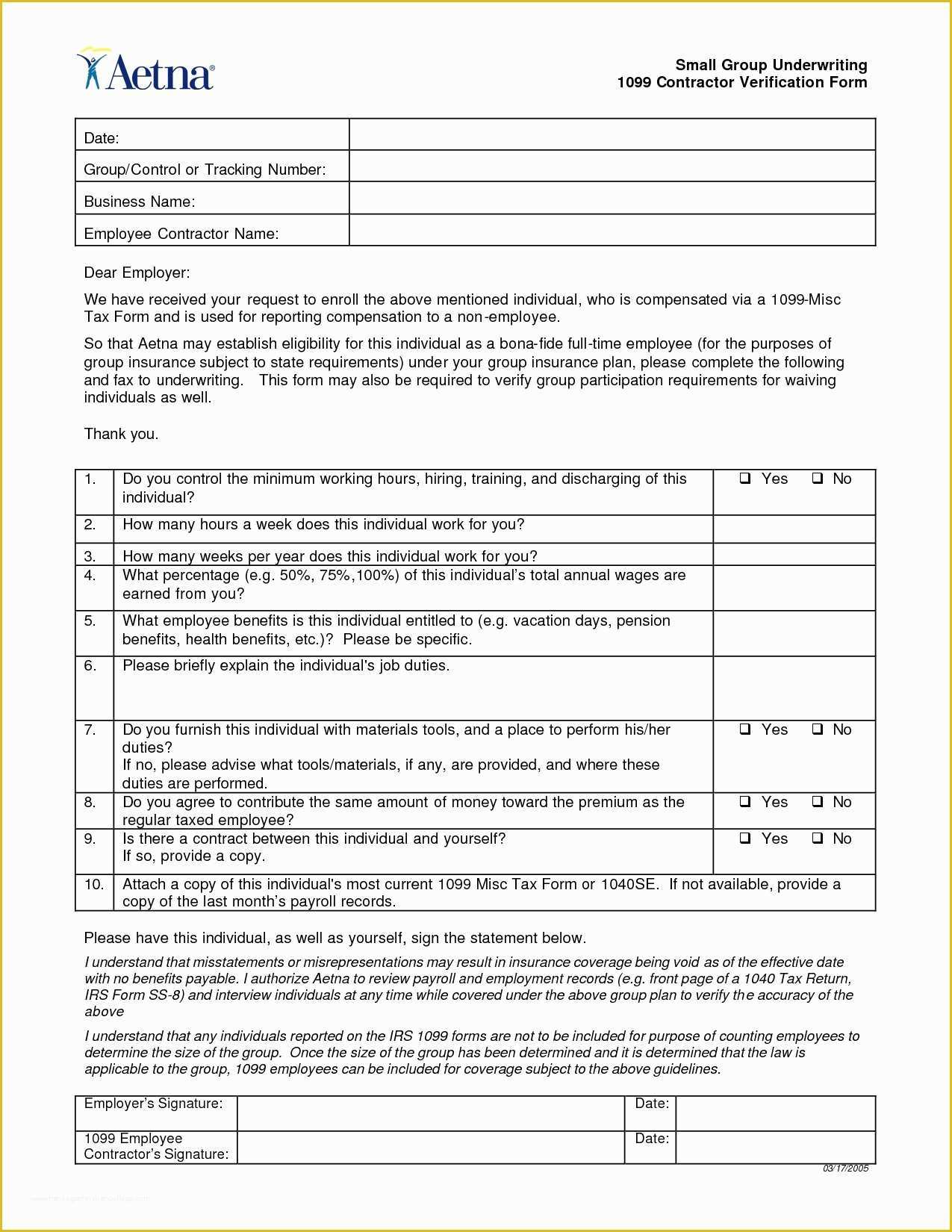

1099 Employee Contract Template

1099 Employee Contract Template - For your protection, this form may show only the last four digits of your social security number. Ad over 15,000 companies use deel to help them hire employees all over the world. Ad accurate & dependable 1099 right to your email quickly and easily. What is a 1099 employee? Report the employee's income and social security taxes withheld and other information. Web report wages, tips, and other compensation paid to an employee. Both the w2 and the 1099 report income from the current tax year. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Web instructions for recipient recipient’s taxpayer identification number (tin). Deel empowers companies to hire remote contractors and employees from 150 countries.

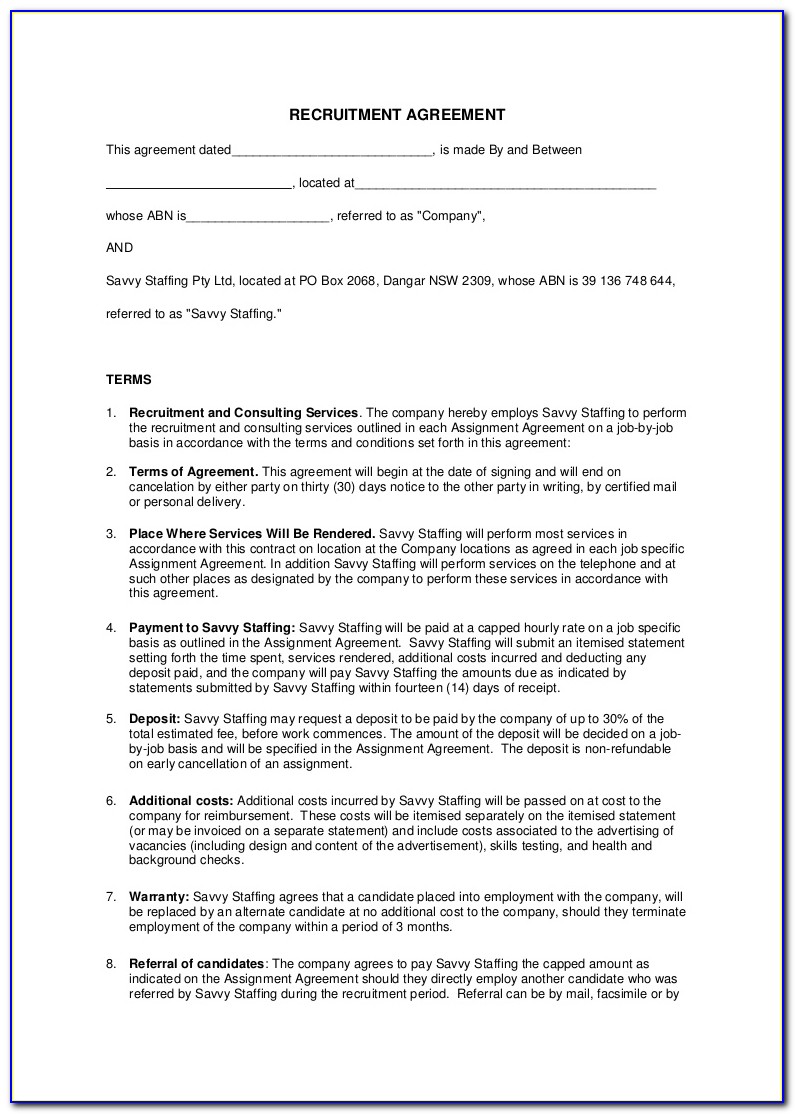

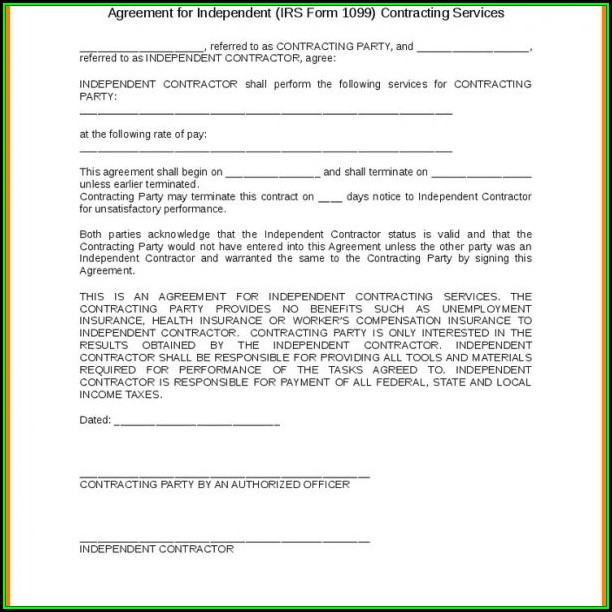

1099 Employee Contract Agreement

Deel empowers companies to hire remote contractors and employees from 150 countries. Create a service agreement to protect your rights and ensure your compensation. Salespersons paid solely on commission (except. Download this 2022 excel template. Web instructions for recipient recipient’s taxpayer identification number (tin).

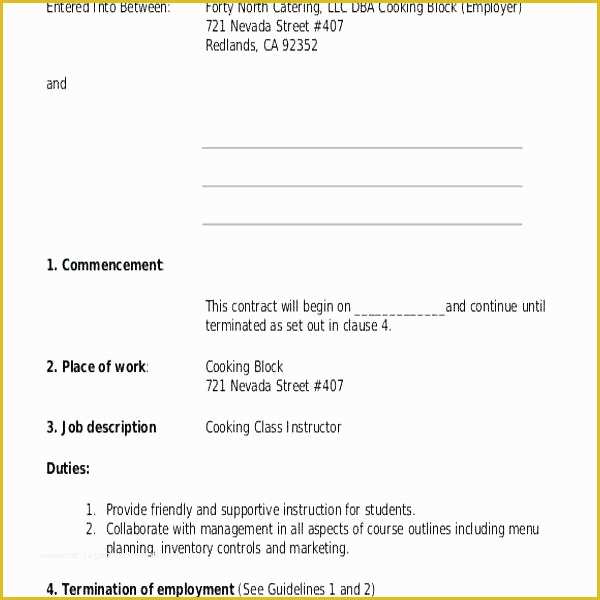

1099 Employee form Printable New 1099 Employee Contract form Templates

Report the employee's income and social security taxes withheld and other information. Know exactly what you'll pay each month. Ad pandadoc makes contract management easy. Free quick & easy templates online. Web updated june 25, 2020:

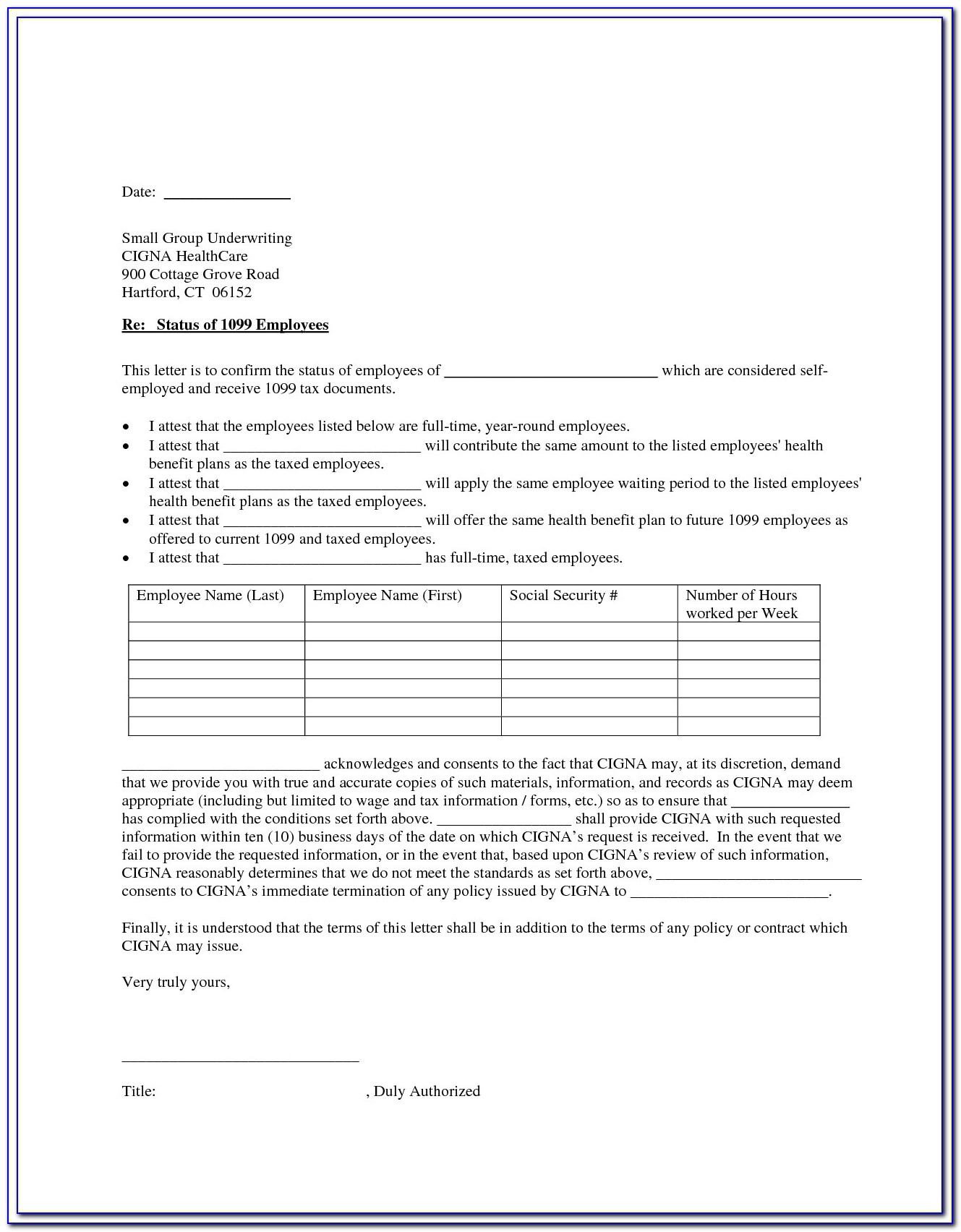

52 1099 Agreement Template Free Heritagechristiancollege

May control their work attire; Ad start setting up gusto for free and don't pay a cent until you're ready to run payroll. Create a service agreement to protect your rights and ensure your compensation. 1779, independent contractor or employee. Web understanding the differences between contract w2 vs 1099.

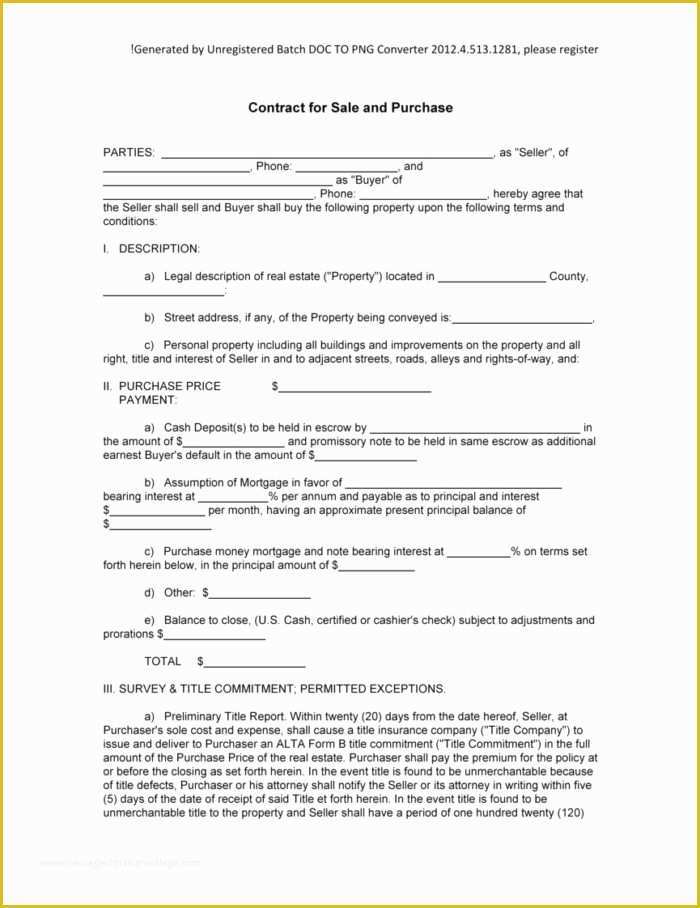

1099 Agreement Template Free Of Blank Sales Contract Template Templates

A 1099 employee is one that doesn't fall under normal employment classification rules. Ad pandadoc makes contract management easy. For your protection, this form may show only the last four digits of your social security number. Able to control how their services are completed; Web create document updated july 19, 2023 an independent contractor (1099) offer letter is between a.

1099 Agreement Template Free Of 1099 Employee Contract Template

Free quick & easy templates online. Ad accurate & dependable 1099 right to your email quickly and easily. Download this 2022 excel template. Ad start setting up gusto for free and don't pay a cent until you're ready to run payroll. May control their work attire;

Basic Independent Contractor Agreement Template Template 2 Resume

Web instructions for recipient recipient’s taxpayer identification number (tin). Remove the headaches of proposals & contracts. Report the employee's income and social security taxes withheld and other information. Download this 2022 excel template. Ad accurate & dependable 1099 right to your email quickly and easily.

Best Of 1099 Employee Contract form Templates Resume Examples in 2020

Know exactly what you'll pay each month. Web when hiring a 1099 employee, companies often negotiate a contract outlining the project's terms and payment for completing the assignment. Salespersons paid solely on commission (except. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. In a.

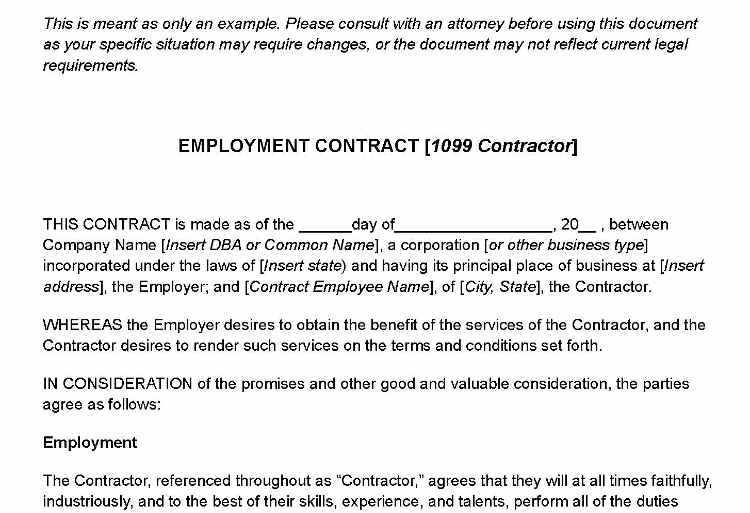

Employment Contract Template, Definition & What to Include

Deel empowers companies to hire remote contractors and employees from 150 countries. Web understanding the differences between contract w2 vs 1099. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Ad over 15,000 companies use deel to help them hire employees all over the world..

52 1099 Agreement Template Free Heritagechristiancollege

Web instructions for recipient recipient’s taxpayer identification number (tin). Answer simple questions to make an employment contract on any device in minutes. Web 1099 contractor agreement agreement made as of _________________, between eastmark consulting, inc., a massachusetts corporation with its principal office. Pay as you go, cancel any time. Report the employee's income and social security taxes withheld and other.

1099 Contract Employee Tax Form

May control their work attire; Web updated june 25, 2020: Free quick & easy templates online. Web to calculate and print to irs 1099 forms with their unconventional spacing. Web a 1099 employee is a term for an independent contractor.

Businesses use w2s for employees since the. Know exactly what you'll pay each month. Free quick & easy templates online. Create, track & esign online. Ad over 15,000 companies use deel to help them hire employees all over the world. Web when hiring a 1099 employee, companies often negotiate a contract outlining the project's terms and payment for completing the assignment. What is a 1099 employee? Web report wages, tips, and other compensation paid to an employee. Web 1099 contractor agreement agreement made as of _________________, between eastmark consulting, inc., a massachusetts corporation with its principal office. Remove the headaches of proposals & contracts. Deel empowers companies to hire remote contractors and employees from 150 countries. Ad pandadoc makes contract management easy. Ad accurate & dependable 1099 right to your email quickly and easily. Deel empowers companies to hire remote contractors and employees from 150 countries. Customize to fit your needs. Able to control how their services are completed; Download this 2022 excel template. Web understanding the differences between contract w2 vs 1099. Web updated june 25, 2020: Salespersons paid solely on commission (except.

Create, Track & Esign Online.

Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Able to control how their services are completed; Get access to professional contracts for all of your unique legal needs. Web if you hire 1099 workers directly, rather than through an employment agency, you will need to set up the following irs paperwork:

Ad Pandadoc Makes Contract Management Easy.

Create a service agreement to protect your rights and ensure your compensation. Web understanding the differences between contract w2 vs 1099. Businesses use w2s for employees since the. A 1099 employee is one that doesn't fall under normal employment classification rules.

Download This 2022 Excel Template.

For your protection, this form may show only the last four digits of your social security number. Deel empowers companies to hire remote contractors and employees from 150 countries. Both the w2 and the 1099 report income from the current tax year. Answer simple questions to make an employment contract on any device in minutes.

Able To Work Their Own Schedule And Hours;

May control their work attire; Web 1099 contractor agreement agreement made as of _________________, between eastmark consulting, inc., a massachusetts corporation with its principal office. Ad start setting up gusto for free and don't pay a cent until you're ready to run payroll. Web you need to hire an independent contractor (they work for you but you are not responsible for any tax withholdings and or insurance )this independent contractor contract.