1099 B Notice Template

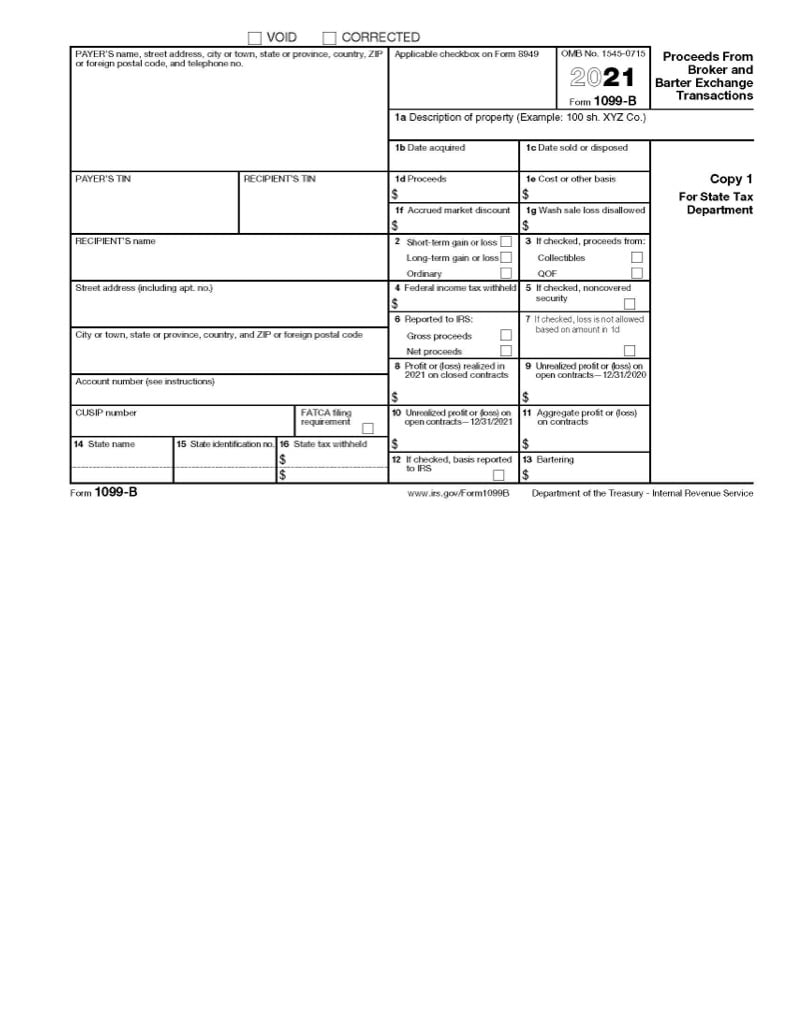

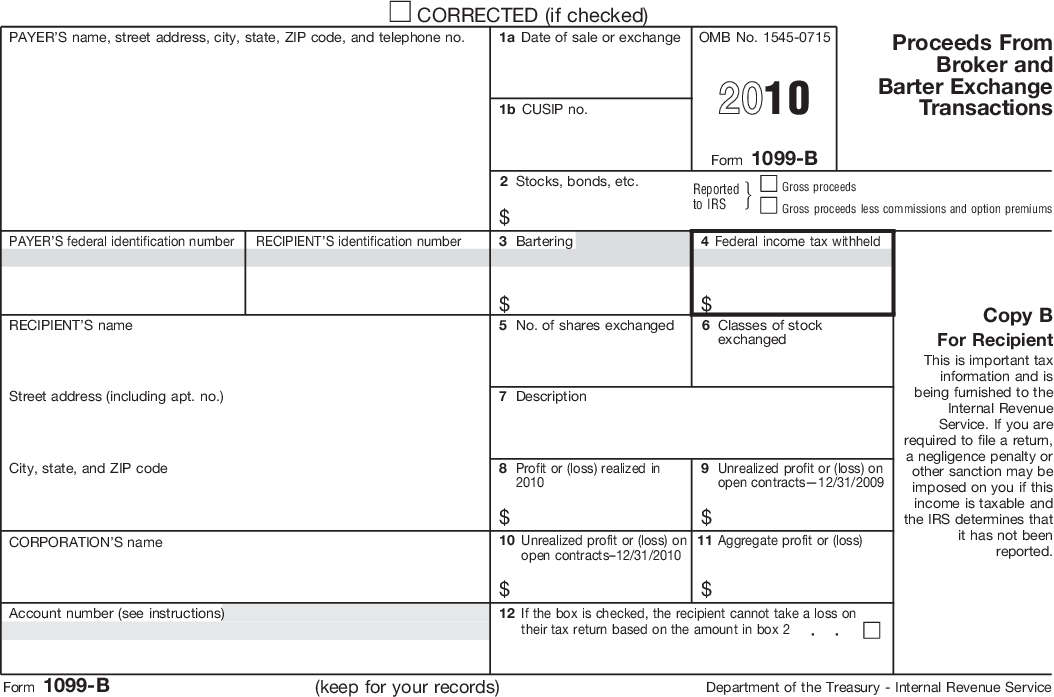

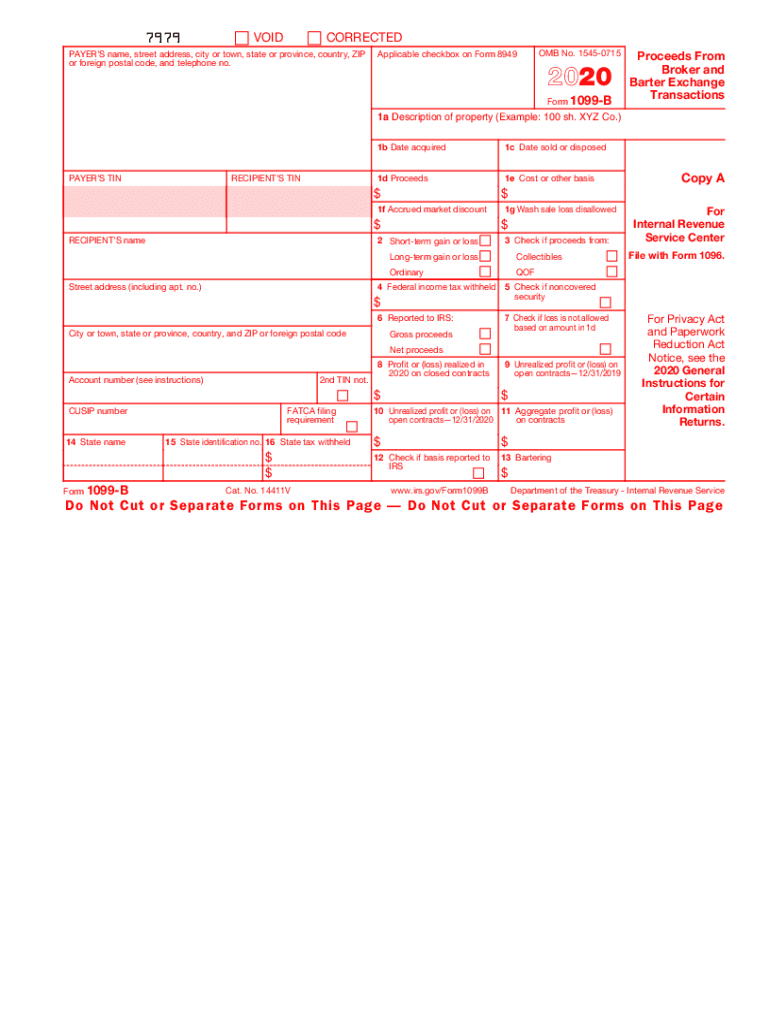

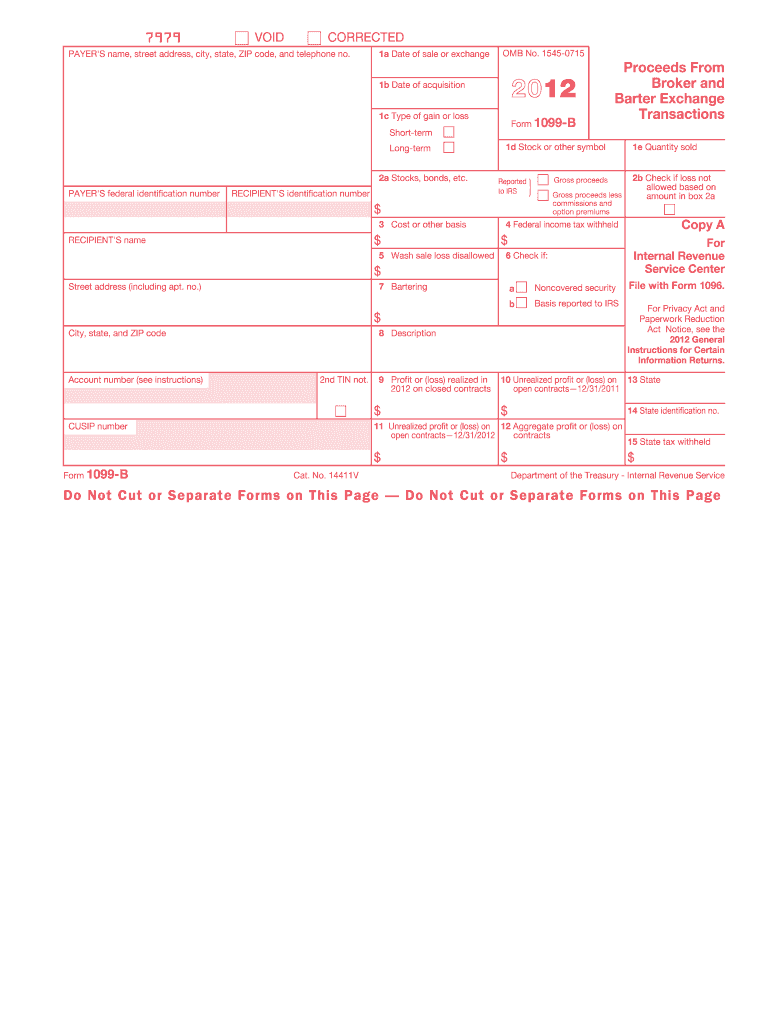

1099 B Notice Template - For whom the broker has sold (including short sales) stocks, commodities,. Web the notice will include a list of payees whose tins (on form 1099 filed by, or on behalf of, the agency/department) are missing, incorrect, or not issued. Web if the tin information is not corrected by the payee within 30 days of receiving the “b” notice, payers must begin backup withholding at the 28% rate. Web use a 1099 b 2021 template to make your document workflow more streamlined. Get ready for tax season deadlines by completing any required tax forms today. Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t match the irs database and need correction. Proceeds from broker and barter exchange transactions is an internal revenue service (irs) tax form that is issued by brokers or barter exchanges. If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. Ad download or email more irs fillable forms, try for free now!

Irs First B Notice Fillable Form Printable Forms Free Online

If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. Web second “b” notice. Web if the tin information is not corrected by the payee within 30 days of receiving the “b” notice, payers must begin backup withholding at the 28% rate. How it works browse.

1099 B Form Fill Out and Sign Printable PDF Template signNow

See the instructions for form. Reporting is also required when your. Show details this website is not affiliated with irs. For whom the broker has sold (including short sales) stocks, commodities,. If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the.

How To Read A 1099b Form Armando Friend's Template

Create an account with taxbandits. Reporting is also required when your. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer. Web if the tin information is not corrected by the payee within 30 days of receiving the “b” notice, payers must begin.

1099 Products Page 2 Tax Form Depot

You also may have a filing requirement. Reporting is also required when your. Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer. Show details.

Formulaire 1099B Définition du produit d'une bourse de courtage et

For whom, they sold stocks,. Web use a 1099 b 2021 template to make your document workflow more streamlined. A broker or barter exchange must file this form for each person: Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t match the irs database and need.

How To Read A 1099b Form Armando Friend's Template

Web the notice will include a list of payees whose tins (on form 1099 filed by, or on behalf of, the agency/department) are missing, incorrect, or not issued. Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t match the irs database and need correction. Create an.

Form 1099B Proceeds from Brokered and Bartered Transactions Jackson

For whom, they sold stocks,. For whom the broker has sold (including short sales) stocks, commodities,. See the instructions for form. Web second “b” notice. Proceeds from broker and barter exchange transactions is an internal revenue service (irs) tax form that is issued by brokers or barter exchanges.

Form 1099B Proceeds from Broker and Barter Exchange Transactions

If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. Get ready for tax season deadlines by completing any required tax forms today. Notifies individuals and organizations that the name and tax identification number submitted on irs form 1099 do not match irs records. See the.

IRS Form 1099B.

Web if the tin information is not corrected by the payee within 30 days of receiving the “b” notice, payers must begin backup withholding at the 28% rate. Web second “b” notice. Proceeds from broker and barter exchange transactions is an internal revenue service (irs) tax form that is issued by brokers or barter exchanges. For whom the broker has.

2020 Form IRS 1099B Fill Online, Printable, Fillable, Blank pdfFiller

Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t match the irs database and need correction. Reporting is also required when your. Get ready for tax season deadlines by completing any required tax forms today. Web second “b” notice. See the instructions for form.

Web the notice will include a list of payees whose tins (on form 1099 filed by, or on behalf of, the agency/department) are missing, incorrect, or not issued. For whom, they sold stocks,. Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t match the irs database and need correction. Show details this website is not affiliated with irs. For whom the broker has sold (including short sales) stocks, commodities,. Web if the tin information is not corrected by the payee within 30 days of receiving the “b” notice, payers must begin backup withholding at the 28% rate. Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. Proceeds from broker and barter exchange transactions is an internal revenue service (irs) tax form that is issued by brokers or barter exchanges. Notifies individuals and organizations that the name and tax identification number submitted on irs form 1099 do not match irs records. Create an account with taxbandits. Ad download or email more irs fillable forms, try for free now! A broker or barter exchange must file this form for each person: If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer. How it works browse for the 1099b. See the instructions for form. Complete, edit or print tax forms instantly. You also may have a filing requirement. Web second “b” notice. Get ready for tax season deadlines by completing any required tax forms today.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web if the tin information is not corrected by the payee within 30 days of receiving the “b” notice, payers must begin backup withholding at the 28% rate. Web second “b” notice. Web use a 1099 b 2021 template to make your document workflow more streamlined. See the instructions for form.

Proceeds From Broker And Barter Exchange Transactions Is An Internal Revenue Service (Irs) Tax Form That Is Issued By Brokers Or Barter Exchanges.

Web checked, the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. How it works browse for the 1099b. Reporting is also required when your. For whom, they sold stocks,.

Notifies Individuals And Organizations That The Name And Tax Identification Number Submitted On Irs Form 1099 Do Not Match Irs Records.

Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer. Create an account with taxbandits. Complete, edit or print tax forms instantly. If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the.

A Broker Or Barter Exchange Must File This Form For Each Person:

Web the notice will include a list of payees whose tins (on form 1099 filed by, or on behalf of, the agency/department) are missing, incorrect, or not issued. Show details this website is not affiliated with irs. Reporting is also required when your. You also may have a filing requirement.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at10.53.11AM-3e34b458ed634edf8d428777afabc1d3.png)